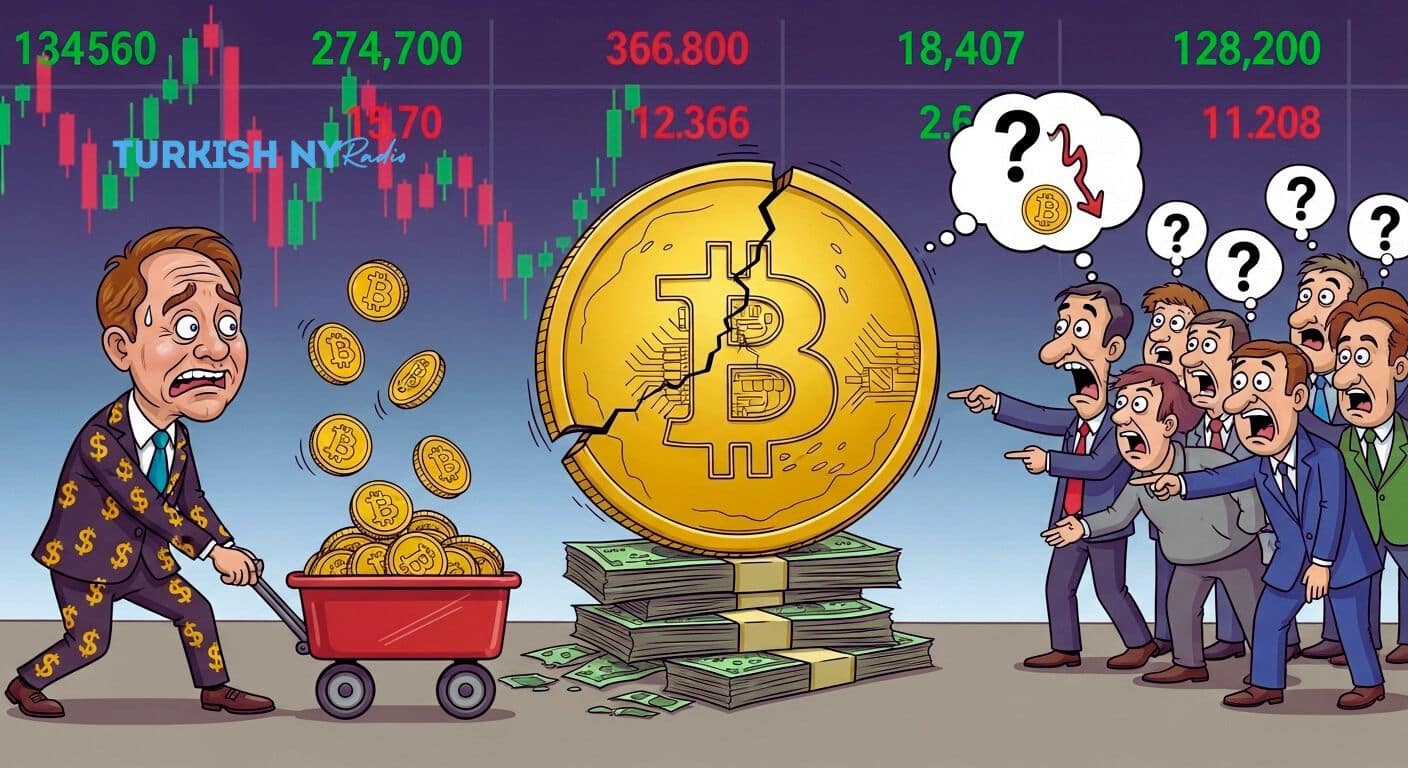

Investor and author Robert Kiyosaki has announced the sale of approximately $2.25 million worth of Bitcoin (BTC). This move, aimed at acquiring more precious metals, suggests a potential shift in his immediate bullish stance on Bitcoin at current price levels compared to earlier this year.

Kiyosaki stated that he had acquired the Bitcoin position years ago when a single unit was valued at around $6,000. He sold this portion of his holdings at approximately the $90,000 level. The proceeds from this sale are being reinvested into a surgery center and billboard business plan, which is projected to generate about $27,500 per month in tax-free income by early 2026.

Despite the sale, Kiyosaki expressed continued optimism for Bitcoin.

“I remain extremely bullish and optimistic about Bitcoin and will continue investing more of my surplus $ to be disposed of as cash flow.”

He reiterated his earlier prediction that BTC will reach $250,000 within the next five years, a thesis he bases on Bitcoin's scarcity and digital asset utility.

Factors Influencing Bitcoin's Price Prediction

Bitcoin is currently trading between $84,000 and $87,000, a significant decrease from its October peak of over $126,000, representing a fall of more than 30%. On-chain data and sentiment indexes indicate elevated market stress and substantial drawdowns, which have led to margin liquidations and institutional outflows. The Crypto Fear & Greed Index has dropped to single digits, signaling extreme investor apprehension.

In contrast, veteran trader Peter Brandt has offered a more conservative timeline for Bitcoin's ascent. Brandt predicts that BTC will take 10 years to reach $200,000, specifically forecasting that this target will not be achieved until Q3 of 2029.

Brandt also cautioned that a potential retracement to $81,000 or even $58,000 could occur before the next significant upward movement.

Kiyosaki vs. Analysts: Bitcoin Price Forecast Comparison

| Predictor | Year | Target Price | Notes |

|---|---|---|---|

| Robert Kiyosaki | 2026 | $250,000 | Maintains bullish stance after recent sale |

| Peter Brandt | 2029 | $200,000 | Suggests longer-term horizon and a potential decline before rise |

| Market Consensus (via ETFs & On-chain) | 2025 | $60,000-$90,000 | Suggests short-term support rather than immediate surge |

Market Dynamics and Bitcoin's Current Role

The price of Bitcoin significantly influences how market participants assess opportunity and risk within the cryptocurrency space. Kiyosaki's recent action exemplifies a dual strategy: taking profits from a high entry point and reinvesting in assets that generate cash flow, while retaining a generally favorable skepticism towards Bitcoin.

If Brandt's projection proves accurate, it could indicate that the broader market may need to undergo a period of consolidation or further correction before Bitcoin experiences another substantial upward trend.

Institutional flows provide additional context. Data suggests a surge in redemptions from spot Bitcoin ETFs, coupled with an increase in long-term holder supply on-chain. This combination points to short-term market stress, even if fundamental conviction remains intact.

Analysts characterize these outflows as tactical rather than structural, though they do contribute to increased volatility.

Key Indicators for Bitcoin's Price Movement

Support Zones: Bitcoin's trading activity within the $80,000 to $85,000 range is noteworthy. A breach below this level could signal further declines.

Institutional Investment: A resumption of inflows or accumulation by large holders could help stabilize Bitcoin's price.

Macroeconomic Factors: Central bank policies and liquidity conditions continue to be primary drivers for high-beta assets like Bitcoin.

Social Signals: Historically, sentiment extremes have preceded turning points in Bitcoin's price. Analysts suggest that social-sentiment models have proven to be useful leading indicators of shifts in market sentiment.

Concluding Thoughts on Bitcoin's Trajectory

Bitcoin's price is currently under significant pressure but remains well above most previous cycle lows. The contrast between Kiyosaki's optimistic $250,000 target for 2026 and Brandt's more conservative $200,000 target for 2029 highlights a growing divergence between ambitious projections and pragmatic timelines.

For short-term Bitcoin watchers, the focus may need to shift towards preservation and strategic repositioning rather than anticipating an immediate rally.

Summary

Robert Kiyosaki has divested $2.25 million worth of Bitcoin, acquired at approximately $6,000 per unit, and has reallocated these profits into other cash-generating businesses. He maintains his long-term bullish outlook on Bitcoin.

Bitcoin's recent fall into the mid-$80,000s, combined with extreme fear readings and outflows from Bitcoin ETFs, has contributed to market uncertainty.

Analysts remain divided on Bitcoin's future price trajectory, with Kiyosaki forecasting $250,000 by 2026 and Peter Brandt predicting $200,000 by 2029. The current market signals short-term stress rather than a fundamental collapse.

Glossary of Key Terms

Long-Term Holder Supply: Refers to the supply of Bitcoin held by individuals or entities who have held their assets for an extended period. A decrease might indicate profit-taking, while an increase suggests strong conviction and potentially poor market liquidity.

ETF Outflows: The redemption of shares in Bitcoin Exchange-Traded Funds (ETFs) by institutional or retail investors. Outflows generally signal lower short-term confidence and can impact liquidity and price stability.

On-Chain Data: Transaction data recorded on the blockchain, including volume, wallet activity, and supply distribution. Analysts use this data to understand real market dynamics beyond price fluctuations.

Crypto Fear & Greed Index: An indicator that gauges market sentiment by analyzing volatility, volume, social media discussions, and other factors. A low reading suggests fear and potential capitulation among investors.

Cash-Flowing Assets: Investments such as real estate, businesses, or royalties that generate regular income. Kiyosaki prioritizes purchasing these assets to ensure consistent monthly revenue.

FAQs About Bitcoin Price Prediction

Why did Robert Kiyosaki dump some of his Bitcoin?

Kiyosaki sold a portion of his Bitcoin holdings to realize profits, which he then reinvested into cash-flowing businesses. He continues to hold a long-term bullish sentiment towards digital assets.

What impact will this sale have on the short-term Bitcoin price forecast?

The sale contributes to market uncertainty. However, analysts suggest that Bitcoin's pullback is a reaction to short-term stress rather than a decline in fundamentals, and long-term price predictions are expected to remain on track.

What worries are investors expressing about market volatility and security?

Investors are concerned about increasing volatility, outflows from ETFs, and record-high fear readings. Nevertheless, blockchain transaction data indicates stable network activity and strong, secure participation from long-term holders.

Do analysts share Kiyosaki’s Bitcoin optimism for its future growth?

Analysts are divided. Kiyosaki is targeting $250,000 by 2026, while other forecasters anticipate slower growth, influenced by broader economic conditions and institutional behavior.