Robinhood Prediction Markets just crossed 4 billion event contracts traded all-time, with over 2 billion in Q3 alone. And we’re just getting started. pic.twitter.com/13LxjqWaNt

— Vlad Tenev (@vladtenev) September 29, 2025

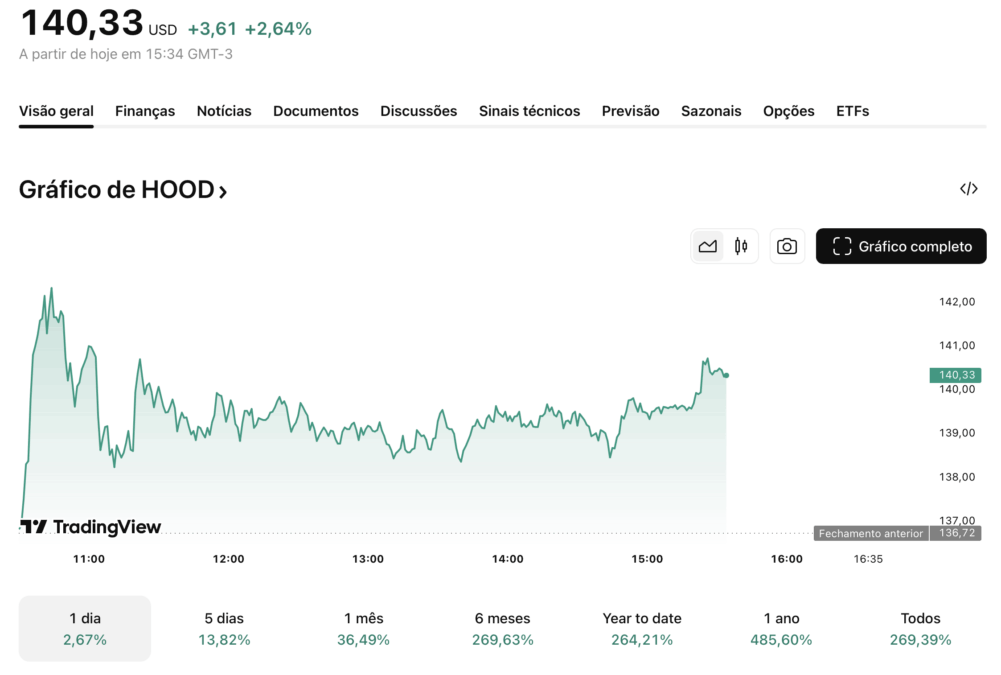

Robinhood’s move into prediction markets aligns with its user base’s appetite for risk, extending beyond meme stocks and crypto into event-driven speculation. Financially, the strategy appears to be working: Q2 net revenue surged 45 % to $989 million, with operating costs rising just 12 %, leading to $386 million in net income and fueling a 275 % year-to-date rally in HOOD stock.

Robinhood eyes retail access to private equity deals

Meanwhile, Robinhood is also waiting on a regulatory green light from the U.S. Securities and Exchange Commission (SEC) to launch its Robinhood Ventures Fund I, a retail‑accessible product offering exposure to private, pre‑IPO companies. If approved, the fund would trade under the ticker ‘RVI’ on the NYSE and invest in high‑growth firms through their IPO phases and beyond.

Previously, the company unveiled tokenized stock products in Europe, giving users access to firms like OpenAI and SpaceX. Ventures Fund I would extend this access into the U.S., challenging long‑standing restrictions that favor institutions.

Taken together, the prediction market expansion and the SEC fund application reflect Robinhood’s dual push: one outward, toward new global markets and asset types, and one inward, to democratize traditionally off‑limits financial instruments.