Crypto revenue for the trading platform Robinhood Markets soared over 300% in the third quarter, but the company has stated it is not rushing to become a digital asset treasury (DAT) firm.

Robinhood’s crypto-trading revenue reached $268 million, as announced by CEO Vlad Tenev during the firm’s third-quarter earnings call. Overall, transaction-based revenues increased 129% from the same period last year, totaling $730 million.

The company’s earnings per share rose 259% to 61 cents, surpassing analyst expectations of 51 cents.

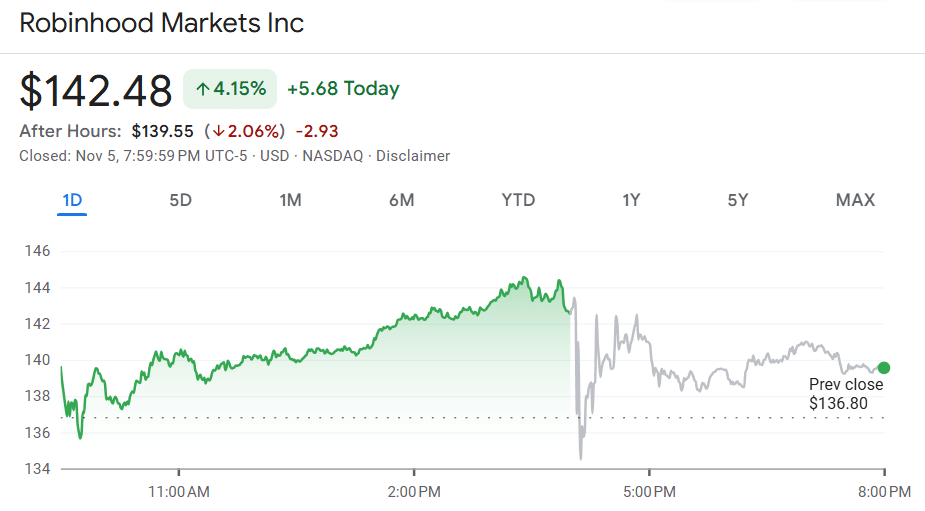

Robinhood shares closed the previous day up more than 4%, although they saw a decline of over 2% in after-hours trading, according to Google Finance.

Robinhood Expands Its Presence in the Crypto Market

Robinhood, historically recognized for its stock trading platform, has been implementing strategic initiatives to attract both institutional and retail crypto users. This expansion follows its acquisition of crypto exchange Bitstamp earlier this year.

The company has also introduced tokenized stocks and prediction markets.

The substantial increase in Robinhood’s crypto trading business is attributed to these strategic moves. During the earnings call, CFO Jason Warnick noted that Robinhood’s Bitstamp and prediction markets businesses are generating approximately $100 million or more in annualized revenues.

Tenev indicated that the company has no plans to halt its expansion efforts.

“Prediction Markets are growing rapidly, Robinhood Banking is starting to roll out, and Robinhood Ventures is coming,” he stated.

Robinhood Expresses Caution Regarding the Digital Asset Treasury Trend

However, the company is hesitant to add cryptocurrencies to its balance sheet. Incoming CFO Shiv Verma, who is set to succeed Warnick in the first quarter of 2026, mentioned that Robinhood’s finance team is still evaluating whether incorporating digital assets onto the company’s balance sheet represents the most effective use of capital for investors.

Verma explained that while holding crypto tokens on the company’s balance sheet might appeal to users, it would tie up capital that could be allocated to other opportunities.

He also highlighted that shareholders can directly purchase Bitcoin on Robinhood, granting them direct exposure rather than relying on Robinhood’s shares as a proxy for BTC exposure.

“We have this debate constantly, and I think the short answer is we’re still thinking about it,” Verma commented. “There’s pros and cons to both of it. It’s one that we’re going to keep actively looking at.”

Stock Performance of Digital Asset Treasury Firms Declines

The enthusiasm surrounding crypto treasury firms has diminished in recent months, coinciding with a sharp decline in their share prices.

Strategy's MSTR stock has dropped over 29% in the past month. Similarly, Japan-based Metaplanet has seen its stock slump 28%, and BitMine Immersion Technologies, a prominent Ethereum treasury firm, experienced a decline of more than 34%.

Despite this trend, market leader Strategy has continued to acquire more Bitcoin.

Its most recent purchase was disclosed earlier this week, when the company announced it had bought 397 BTC for approximately $45.6 million.

Strategy has acquired 397 BTC for ~$45.6 million at ~$114,771 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/2/2025, we hodl 641,205 $BTC acquired for ~$47.49 billion at ~$74,057 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/yJfoyeNzCm

— Strategy (@Strategy) November 3, 2025