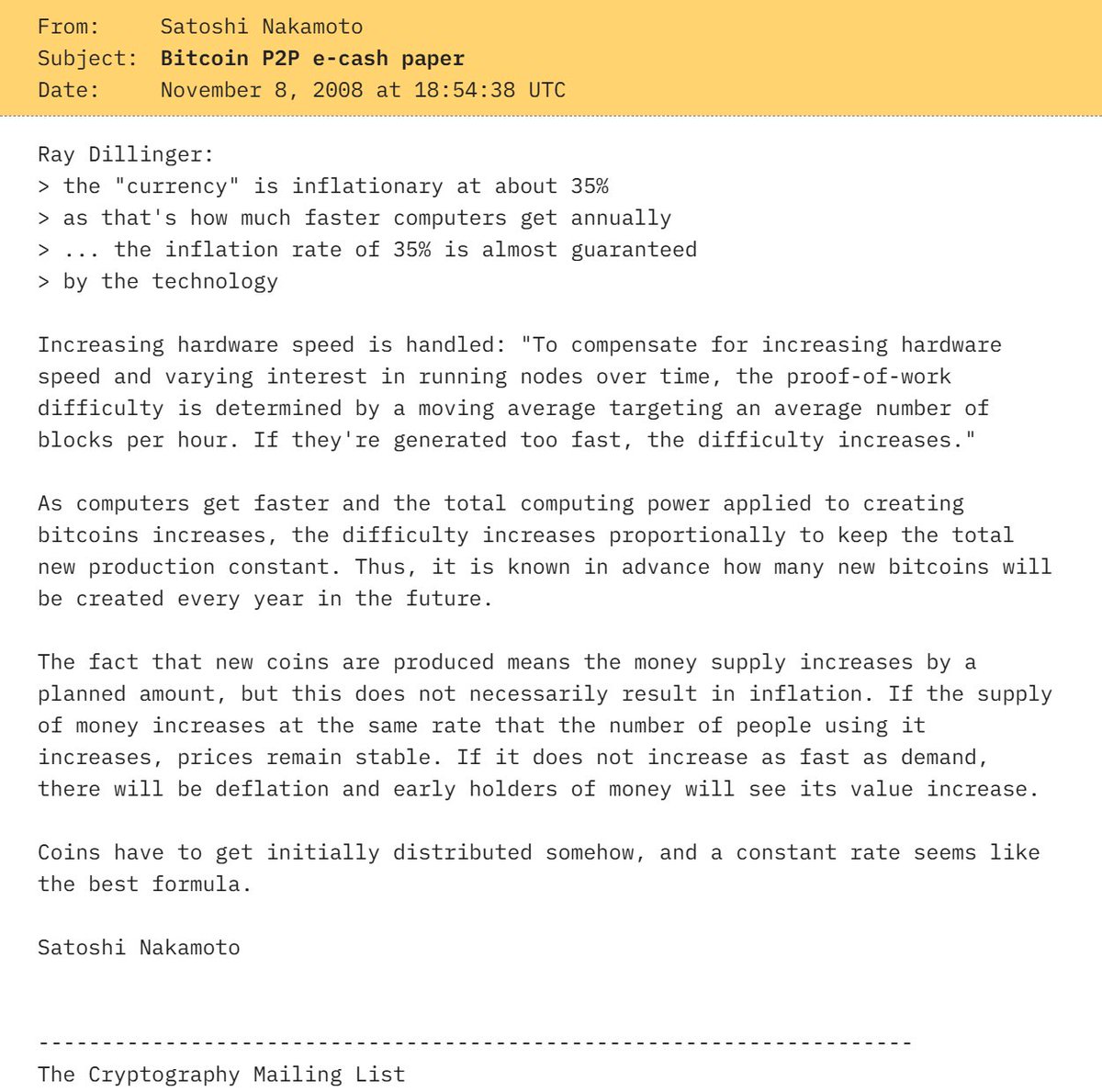

A historical email from November 8, 2008, shared by Documenting Bitcoin, offers rare insight into Satoshi Nakamoto’s thinking just weeks before Bitcoin’s whitepaper went public. In his correspondence with cryptographer Ray Dillinger, Satoshi described how Bitcoin’s proof-of-work system dynamically adjusts mining difficulty to maintain a predictable issuance rate, one of the most critical innovations that separates Bitcoin from traditional money systems.

Satoshi wrote:

As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new bitcoins will be created every year in the future.

This mechanism ensures Bitcoin’s supply cannot be artificially inflated by technological advancements, an idea that has kept Bitcoin’s monetary policy transparent, algorithmic, and incorruptible for over 15 years.

Why Difficulty Adjustment Matters

The “difficulty adjustment” is what prevents faster computers or large mining pools from disrupting Bitcoin’s issuance schedule. Every 2,016 blocks (roughly every two weeks), the network automatically adjusts the difficulty to maintain an average of one block every 10 minutes.

By doing so, Satoshi ensured that Bitcoin remains scarce and predictable, independent of human control. Even if thousands of miners suddenly join the network, the algorithm rebalances itself, keeping inflation in check.

This innovation contrasts sharply with fiat systems where money supply can expand at will, one of the core reasons Bitcoin’s supporters view it as “sound money.”

A Timeless Concept Ahead of Its Era

Satoshi’s 2008 message also addressed concerns about inflation. He explained that a predictable, capped supply would naturally balance with demand, maintaining price stability over time. This economic foresight has proven prescient, as Bitcoin’s fixed 21 million cap and regular halving cycles have made it the most deflationary major asset in modern history.

Today, as global markets face monetary expansion and inflationary risks, this old email reads less like a technical note and more like a manifesto for monetary independence — one that continues to define Bitcoin’s enduring appeal.