Michael Saylor Denies Strategy Dumping Bitcoin

Michael Saylor, executive chair of Strategy, has denied reports that the company was offloading some of its Bitcoin amid a flash crash in the cryptocurrency's price. In a Friday X post, Saylor stated that there was no truth to a report claiming Strategy had reduced its overall Bitcoin holdings by approximately 47,000 BTC, or $4.6 billion at the time of publication. Saylor added that the company was continuing to buy Bitcoin as the price dropped by more than 4% in less than 24 hours, from over $100,000 to under $95,000.

"I think the volatility comes with the territory," Saylor said in a Friday CNBC interview. "If you're going to be a Bitcoin investor, you need a four-year time horizon and you need to be prepared to handle the volatility in this market."

Uniswap Revives ICO-Style Token Launches with New On-Chain Auction System

Decentralized finance heavyweight Uniswap has introduced Continuous Clearing Auctions (CCA), a new protocol designed to facilitate token offerings through its infrastructure. According to a Thursday announcement, Uniswap's CCA helps teams bootstrap liquidity on Uniswap v4 and discover the market price for new and low-liquidity tokens. The company indicated that this is the first of several tools it is developing to assist projects in launching and deepening token liquidity on the platform.

The announcement coincided with preparations for the first CCA-enabled sale. The privacy-focused Aztec Network opened its community-only AZTEC token sale on Thursday, with a public phase scheduled for December 2. The Aztec team claimed to have enhanced the community access that characterized the 2017 ICO era. The team reportedly collaborated with Uniswap to develop the new protocol, prioritizing fair access, permissionless, on-chain access for community members and the general public before the launch. The team stated that the AZTEC token will be 100% community-owned once tokens unlock.

Cathie Wood's ARK Buys $46 Million of Circle Stock Amid Price Dip

Cathie Wood's investment company, ARK Invest, has resumed buying shares of USDC issuer Circle as the stock price falls below $90. ARK purchased a total of 542,269 Circle (CRCL) shares over the past two trading days, investing approximately $46 million, according to the firm's daily trading disclosures. The two acquisitions, a $30.4 million purchase on Wednesday and a $15.5 million buy on Thursday, occurred amidst a decline in CRCL shares, which closed at $86 and $82.30, respectively.

These recent purchases mark ARK's first CRCL transactions since the firm divested approximately 1.7 million Circle shares across four sales in June, at an average closing price of $200, generating $352 million.

XRP ETF Debut Outshines All 2025 Launches with $250 Million Inflows

The debut of the Canary Capital XRP exchange-traded fund (ETF) is signaling renewed demand for altcoins, following the fund's record-breaking first-day performance among over 900 ETFs launched in 2025. Canary Capital's XRP ETF closed its first day with $58 million in trading volume, marking the most successful ETF debut of 2025 across both crypto and traditional ETFs, according to Bloomberg ETF analyst Eric Balchunas in a Thursday X post. The new fund garnered over $250 million in inflows during its first trading day, surpassing the recent inflows of all other crypto ETFs.

Part of the reason behind the successful launch was the ETF's in-kind creation model, according to ETF analyst and president of NovaDius Wealth Management, Nate Geraci.

Bitcoin ETFs See $866 Million Outflows, Second Worst Day on Record

Demand for Bitcoin and crypto-linked investment funds continued to decline on Thursday, despite the long-awaited end of the 43-day US government shutdown. US spot Bitcoin exchange-traded funds (ETFs) experienced $866 million in net outflows on Thursday, marking their second-worst day on record after the $1.14 billion daily outflows recorded on February 25, 2025, according to Farside Investors. This marks the second consecutive day of outflows for the Bitcoin ETFs, as the conclusion of the 43-day US government shutdown failed to reignite investor appetite.

The $866 million in outflows occurred one day after President Donald Trump signed a government funding bill on Wednesday. The bill provides funding until January 30, 2026.

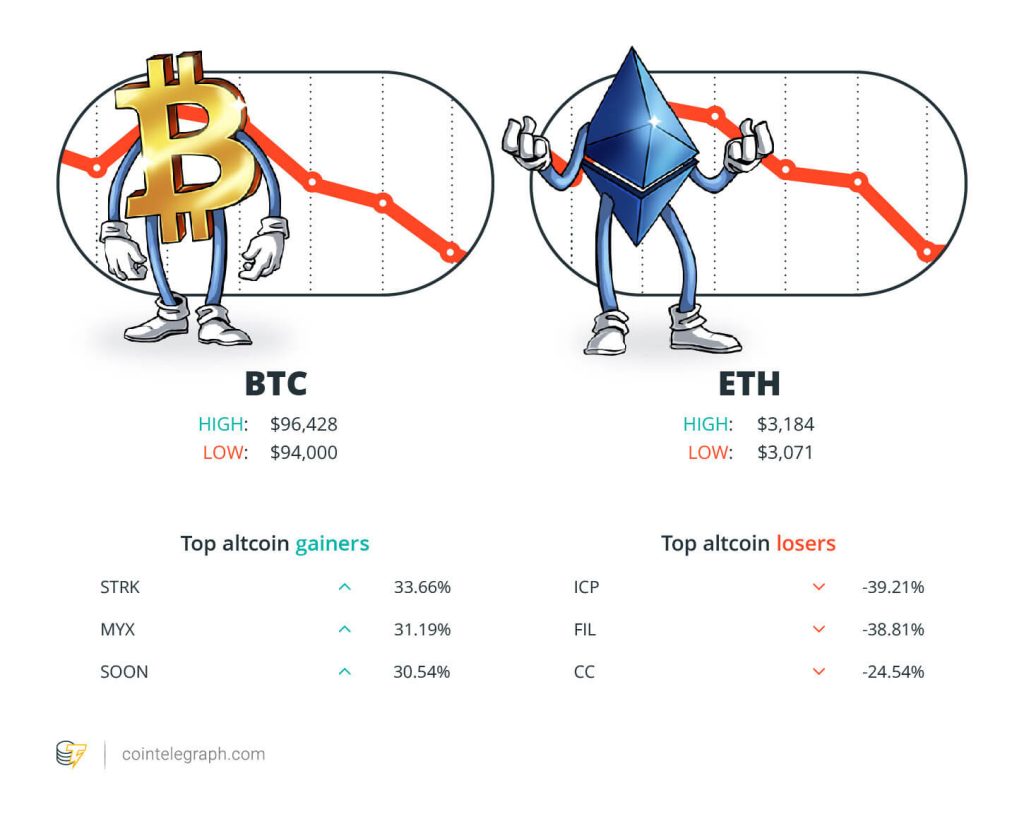

Winners and Losers in the Crypto Market

At the end of the week, Bitcoin (BTC) is trading at $96,428, Ether (ETH) at $3,184, and XRP at $2.29. The total market capitalization stands at $3.27 trillion, according to CoinMarketCap. Among the top 100 cryptocurrencies, the leading altcoin gainers of the week include Starknet (STRK) at 33.66%, MYX Finance (MYX) at 31.19%, and SOON (SOON) at 30.54%.

The top three altcoin losers of the week are Internet Computer (ICP) at 39.21%, Filecoin (FIL) at 38.81%, and Canton (CC) at 24.54%. For further details on crypto prices, readers are encouraged to consult Cointelegraph's market analysis.

Probability of December Interest Rate Cut Falls Below 50%

Only 45.9% of investors anticipate an interest rate cut at the next US Federal Open Market Committee meeting in December, amid declining market sentiment and a downturn in the cryptocurrency market. The odds of a 25 basis point (BPS) interest rate cut in December were nearly 67% on November 7, according to data from the Chicago Mercantile Exchange Group. In September, several banking institutions had forecast at least two interest rate cuts in 2025, with market analysts at Goldman Sachs and Citigroup each projecting three 25 BPS cuts in 2025.

Bitfarms Plunges 18% After Plan to Wind Down Bitcoin Mining Operations

Bitfarms stock has experienced an 18% decline following the company's announcement that it intends to shutter its Bitcoin mining operations over the next two years and convert them into artificial intelligence and high-compute data centers. The company stated on Thursday that its 18-megawatt Bitcoin mining site in Washington state will be the first to be fully converted to support AI and high-performance computing, with completion expected in December 2026.

"Despite being less than 1% of our total developable portfolio, we believe that the conversion of just our Washington site to GPU-as-a-Service could potentially produce more net operating income than we have ever generated with Bitcoin mining," said Bitfarms CEO Ben Gagnon. He added that the conversion would assist the company as it winds down its Bitcoin mining business in 2026 and 2027.

Risk Managers Could Turn Bitcoin's Institutional Boom into a Bust, CEO Warns

The significant wave of institutional buying that propelled Bitcoin higher since early 2024 could also amplify a market correction if fatigue persists, according to Markus Thielen, CEO of 10x Research and a former portfolio manager. In an interview with Bloomberg, Thielen noted that the crypto market, and Bitcoin in particular, is showing signs of fatigue after a challenging October marked by the industry's largest liquidation event on record. He pointed out that these losses have compounded underlying macroeconomic risks that Bitcoin has increasingly mirrored.

Given that institutional inflows, particularly from spot Bitcoin exchange-traded funds, have been a primary driver of the 2024 rally, Thielen cautioned that the same investor base could accelerate downside pressure if activity continues to slow.

Kraken Co-CEO Criticizes UK Rules for Harming Users

Arjun Sethi, the co-CEO of major crypto exchange Kraken, has criticized the United Kingdom's crypto regulations, asserting that they hinder services for customers. In an interview with the Financial Times, Sethi stated that in the UK today, users encounter disclaimers on crypto websites, including Kraken's, that he likened to cigarette box warnings. He suggested that these disclaimers significantly impact the customer experience.

Sethi proposed that these disclosures slow users down and, given the importance of speed in crypto trading, are detrimental to customers. He concluded that while disclosures are important, having "14 steps" makes the experience worse. The UK Financial Conduct Authority's updated financial promotion regime, which came into effect in October 2023, introduced a cooling-off period for first-time crypto investors and required firms to assess users' knowledge and experience before allowing them to trade.

Top Magazine Stories of the Week

2026: The Year of Pragmatic Privacy in Crypto

After years of emphasizing transparency, 2026 is poised to be the year privacy takes flight in the crypto space, driven by contributions from Canton, Zcash, the Ethereum Foundation, and others.

Taiwan Considers Bitcoin Reserve; Sony's Ethereum L2 Super App Featured

Taiwan is set to formally assess the possibility of holding Bitcoin in its reserves. Sony's Ethereum L2 Soneium is launching a DeFi super app, among other developments in Asia.

Did a Time-Traveling AI Invent Bitcoin?

A speculative question arises: Did an artificial intelligence travel to the past to create Bitcoin as the perfect decentralized network, thereby preventing humans from ever switching the AI off? Some theories suggest this possibility.