The U.S. Securities and Exchange Commission (SEC) has announced a delay in the decision for the BlackRock Bitcoin Premium Income ETF. This postponement is attributed to the commission operating with a reduced staff due to the ongoing government shutdown.

Concurrently, the broader cryptocurrency market is experiencing a significant downturn, with the price of Bitcoin falling below $100,000 amidst substantial selling pressure.

BlackRock Bitcoin Premium Income ETF Among Filings Postponed by the US SEC

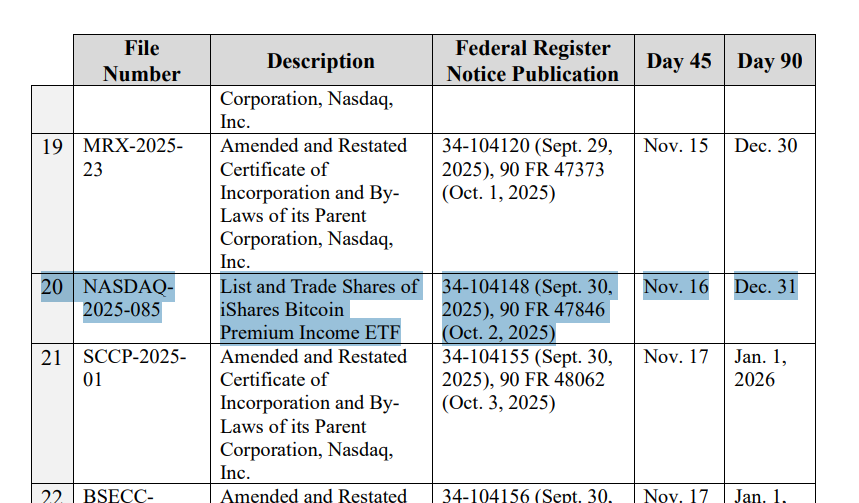

According to the latest release from the US SEC, the commission has delayed the review of all Exchange-Traded Products (ETPs) and proposed rule changes that were filed just before the government shutdown commenced. These filings include those whose 45th day of review falls within November.

The BlackRock iShares Bitcoin Premium Income ETF filing is among those that have been postponed by the US SEC. Its 45th day of review was scheduled for November 16.

The commission has postponed the decision to the 90th day, extending beyond the 75-day deadline stipulated under the Generic listing standards. The SEC will now make a decision on the BlackRock Bitcoin Premium Income ETF on December 31, citing the government shutdown as the reason for the delay.

No Auto-Approval for BlackRock iShares Bitcoin Premium Income ETF?

BlackRock submitted its filing for the iShares Bitcoin Premium Income ETF following the U.S. SEC's adoption of Generic Listing Guidelines for crypto ETPs. This particular product is an actively-managed exchange-traded product.

The filing by Nasdaq to list and trade the BlackRock Bitcoin Premium Income ETF was made under the commodity-based trust rule 5711(d). Notably, the SEC has previously approved amendments to Rule 5711(d) to establish generic listing standards for commodity-based trust shares.

These Generic listing standards are applicable to passively managed commodity-based trust shares. As the ETF in question meets all other requirements outlined in the Generic listing standards, Nasdaq is seeking approval under the 5711(d) rule.

The ETF is designed to generate income by selling BTC call options. Its investment strategy primarily involves holding spot Bitcoin and the iShares Bitcoin Trust (IBIT), along with cash, while simultaneously writing options on IBIT or indices that track spot Bitcoin ETPs.

Bitcoin Price Plunges Below $100K

Bulls were unable to sustain Bitcoin's price above the $100,000 mark, with the cryptocurrency trading at $99,431 at the time of reporting. The 24-hour trading range saw a low of $99,257 and a high of $103,557.

Trading volume experienced a 40% increase as investors engaged in selling their holdings, while some took advantage of the dip to buy. This decline appears to be primarily linked to the expiration of crypto options occurring today.

Data from CoinGlass indicates mixed sentiment within the derivatives market. The total Bitcoin futures open interest rose by 0.55% to $69.52 billion over the last 24 hours.

Specifically, BTC futures open interest on CME saw a decrease of over 2%, while on Binance, it climbed by 2%. Analysts suggest that Bitcoin needs to hold the $98,000 level to avert a more significant price fall.