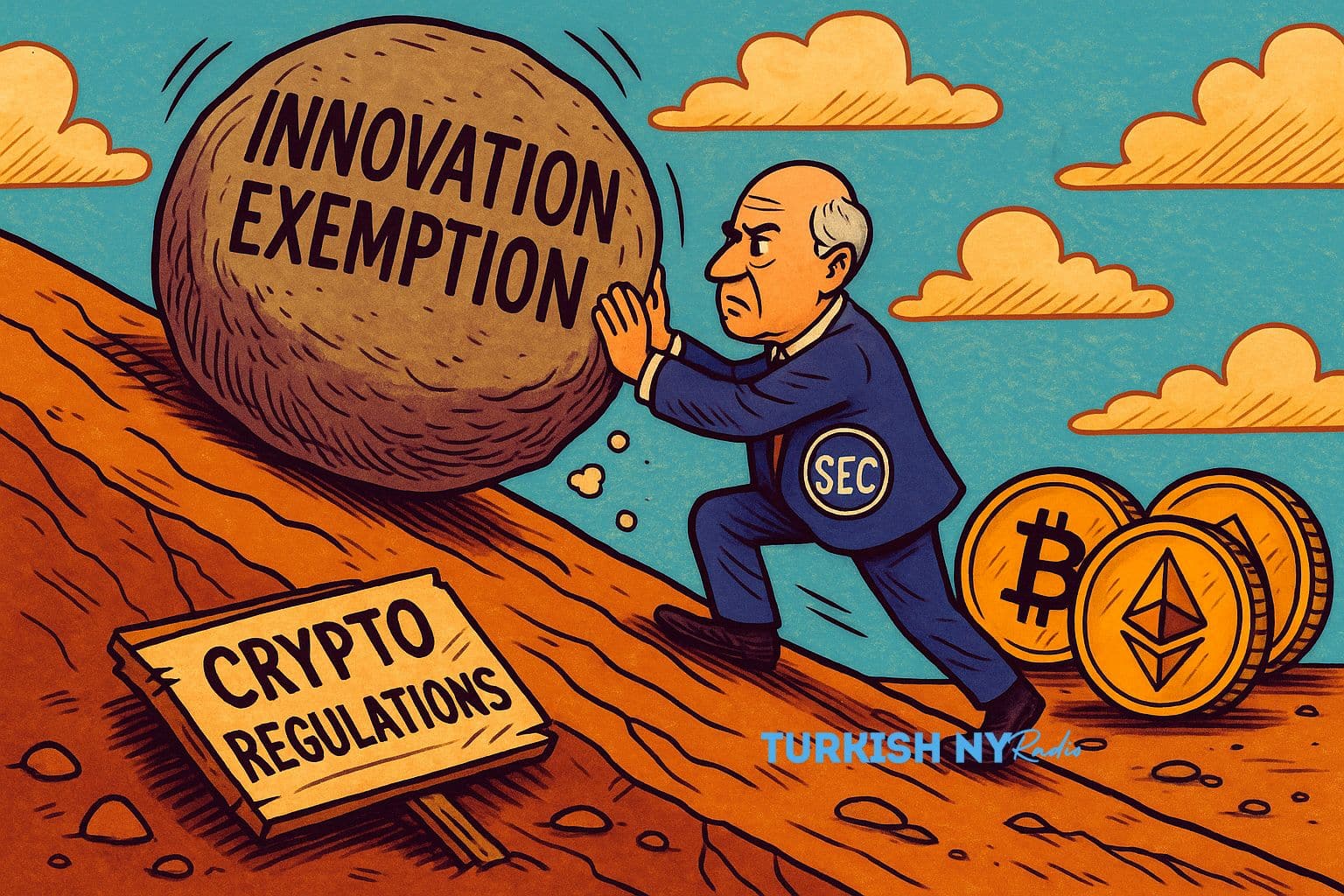

The SEC’s leadership has since placed the innovation exemption at the center stage of their proposed reforms. The idea is to allow crypto and digital‑asset companies to stage certain offerings under lighter, provisional scrutiny as opposed to having them face a heavy regulatory burden from the get‑go.

The invention exception has received extensive scrutiny in media and industry commentary. SEC Chairman Paul Atkins said in an interview on Fox Business that the rulemaking process would take place in the coming months. Among other components, that process will involve preparing the innovation exemption by the end of this year.

The innovation exemption is not presented as a remedial bridging step but as ground‑laying regarding how the United States will regulate digital assets.

Rule clarity is also reliant on coordination between the SEC and CFTC. Confusion over which agency should be supervising novel instruments like tokenized derivatives or single‑stock crypto futures doomed many past launches. They may be smoothed out by the innovation exemption.

A cross‑market roundtable to be held on Sept. 29 will examine jurisdictional overlaps, collateral frameworks, and trading rules that overlap between crypto and traditional markets. That forum is expected to reveal how the innovation exemption might work in practice.

From Gensler’s Cop to Contemporary Rulemaking

The changing currents on crypto regulation are clear. Gary Gensler’s animus often regarded many tokens as unregistered securities through enforcement actions. The current approach is from reactive enforcement to proactive rule development. The innovation exception is one piece of that realignment.

Chair Atkins in July brought Project Crypto, a proposal to update securities laws so that the innovation exemption can plug into existing regulatory infrastructure rather than bypassing it.

Atkins is also suggesting that intermediaries could have the option of rolling trading, staking, and lending into a single license rather than three separate ones. That perspective mirrors the innovation exemption philosophy of allowing more flexible business models.

Market Pulse & Community Reaction

On cryptocurrency forums, members have largely debated whether the innovation exemption can actually provide meaningful regulatory relief. To some traders and developers, the innovation exemption is a long overdue practical way to resume product introduction in the United States.

The devil will be in the details, others cautioned. The public mind veered back to the question of which tokens are eligible. The social media reaction echoes some of the same themes.

On X, analysts discuss custody, staking, derivatives, and token standards, which will be treated under the innovation exemption. Others stress that the innovation exemption needs to balance investor protection with market opportunity.

Bitcoin Scenario Table

| Timeframe | Status Quo | Favorable Innovation Exemption | Delayed/Restrictive Version |

|---|---|---|---|

| End 2025 | $100K–$120K | $120K–$135K | $90K–$110K |

| Mid-2026 | $110K–$140K | $140K–$165K | $80K–$115K |

These forecasts are hypothetical models and not financial advice. The innovation exemption’s drafting and implementation will influence momentum.

Key Indicators to Monitor

Publication of the innovation exemption proposal (including deadlines for comments).

Level of CFTC enforceability regarding wrapped debt tokens, perps, and derivs.

Language in SEC Crypto Task Force memos detailing how tokens, staking, and distributed models will be classified under new rules.

Legislative responses by Congress do not duplicate companion provisions/legislation, which could codify parts of the innovation exemption.

Conclusion

With innovation exemption as its headline driver, the S.E.C. seems to be poised for a reset on how crypto will be regulated. The innovation waiver would offer a bridge for up‑and‑coming initiatives.

But the success will hinge on doctrine, agency alignment, and legal clarity. The inventiveness exception crops up time and again as the linchpin of reform to come, and its drafting efforts will be closely watched in departments right across.

The innovation exception is more than just a slogan. It might form the fulcrum between deadlocked regulatory paralysis and resurgent growth of U.S. digital finance.

Summary

The SEC is proposing an innovation exemption to enable the innovation of crypto and give U.S. businesses a clear path forward.

The FRA said in a press release that Capitol Hill consensus has been reached on the legislation, and Chairman Paul Atkins also indicated that it will be completed by year‑end as the commission works with the CFTC to allocate oversight roles.

The exemption would open the door for crypto firms to roll out products on easier terms, limiting uncertainty. By contrast with the enforcement‑driven approach of the past, this evolution is intended to enhance U.S. competitiveness while providing stable market access for digital assets and investors.

Glossary of Key Terms

SEC (Securities and Exchange Commission)

A United States government agency that writes and enforces rules for financial markets. Think of it as the referee ensuring fair play in investing.

CFTC (Commodity Futures Trading Commission)

Another American agency that is ultimately responsible for trading in commodities and derivatives. Think of it as the guard dog for futures markets, which would include some crypto products.

Innovation Exemption

A proposed rule that would enable crypto companies to develop and release products with less oversight. It is a “trial license” before the full rules kick in.

Regulatory Clarity

Concrete guidance from regulators that tells companies what is acceptable. It’s like having an instruction manual for a vehicle you just purchased; the manual functions as road signs on a highway, and it makes projects move forward instead of constantly guessing what to do next.

Digital Assets

Anything of value you keep in the cloud, including cryptocurrencies and tokens (no matter how many wheels the Lambo on its website has). Consider them digital money or ultra‑secure collectibles.

Tokenized Securities

Old‑school investments like stock made available on the blockchain. Like owning a share of a company, but it’s recorded digitally and moves in the virtual marketplace far more quickly than shares on Wall Street.

Staking

It’s locking up cryptocurrency to help a network run and get rewards. You can think of it as if you were socking away money in a savings account that earned interest.

ETF (Exchange‑Traded Fund)

An asset basket (of Bitcoins or Ether, for example) traded on stock exchanges. Like purchasing a package deal versus an individual item.

Frequently Asked Questions About Innovation Exemption

Q1: What are the innovation exemptions in the SEC’s Crypto Regulation?

The innovation exemption is a new rule the CSA is floating that would enable crypto firms to release products under fewer rules so as not to freeze innovation. It lowers transactional uncertainties but provides investor protection through oversight. The opposite of paralysis by analysis.

Q2: What are the possible implications of the innovation exemption for crypto prices and market access?

It could expand access to services such as staking and ETFs, spur new listings, and serve to stabilize prices by laying down clearer rules for exchanges and investors.

Q3: What are the business and developer benefits of the innovation exemption?

The exemption includes accelerated product launches, reduced upfront costs of compliance, and clear information about SEC‑CFTC jurisdiction to support the project in expansive growth without concerns over regulatory risk.

Q4: What potential risks or issues are associated with the innovation concept “exemption” approach?

Yes, but challenges such as uneven enforcement practice (across industries and cross‑border), varying interpretations of what constitutes a security in various jurisdictions, and potential setbacks in the implementation of regulation will require that firms need to monitor developments closely and align their strategy accordingly.