Introduction to Project Crypto

The U.S. Securities and Exchange Commission (SEC) enters a pivotal period as Chairman Paul Atkins leads new regulatory initiatives for cryptocurrency starting November 2025 in Washington.

This shift signals potential changes in crypto regulations, affecting market structures, and attracting institutional interest. Industry experts anticipate increased activity in tokenized securities amid evolving compliance standards.

SEC's Strategic Shift in Crypto Regulation

The U.S. Securities and Exchange Commission (SEC), led by Chairman Paul Atkins, initiates a pivotal regulatory phase in the cryptocurrency sector with the introduction of "Project Crypto".

Atkins's agenda aims to transition from enforcement to rulemaking, focusing on structured crypto regulations over the coming months. This marks a significant shift from prior SEC enforcement practices, emphasizing clear guidelines for digital assets.

"The United States must lead in the digital finance revolution by updating our rules to support responsible innovation and investor protection," said Atkins, highlighting the strategic vision for U.S. leadership in global crypto markets.

Industry leaders express hope for more investor protection alongside innovation support under Project Crypto.

Historical Context and Market Data on Crypto Regulations

Did you know? The SEC's pivot from enforcement to rulemaking mirrors the regulatory shift seen in 2017, when initial asset guidelines sparked substantial institutional crypto adoption.

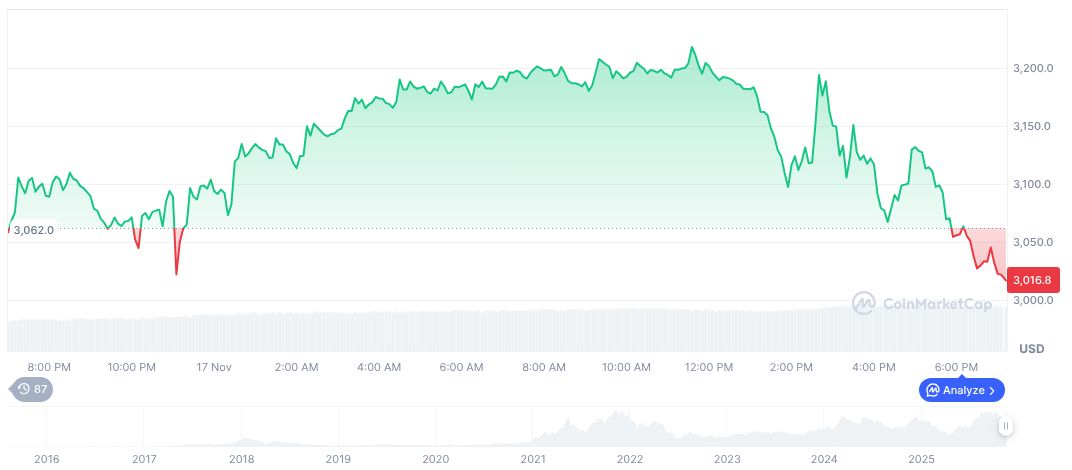

Ethereum (ETH), as per CoinMarketCap, is currently priced at $3,026.25, with a market cap of $365.26 billion. The recent 24-hour trading volume hit $38.39 billion, marking a 45.62% change. Recent declines include 14.68% over the last 7 days, and 34.37% in the last 60 days.

The Coincu research team suggests that Project Crypto could enhance regulatory clarity, leading to increased institutional investment in tokenized equities and cryptocurrencies. They see potential growth in crypto exchanges aligning with new compliance norms, leveraging this market transition to boost liquidity and investor confidence.