Sei Network’s native token, SEI, made its debut on the Robinhood trading platform this week, representing a significant development for one of the rapidly expanding Layer-1 blockchains. This listing provides SEI with increased exposure to Robinhood's substantial user base of 25 million retail investors and its considerable monthly cryptocurrency trading volume, exceeding $13 billion, thereby enhancing its presence within the U.S. market.

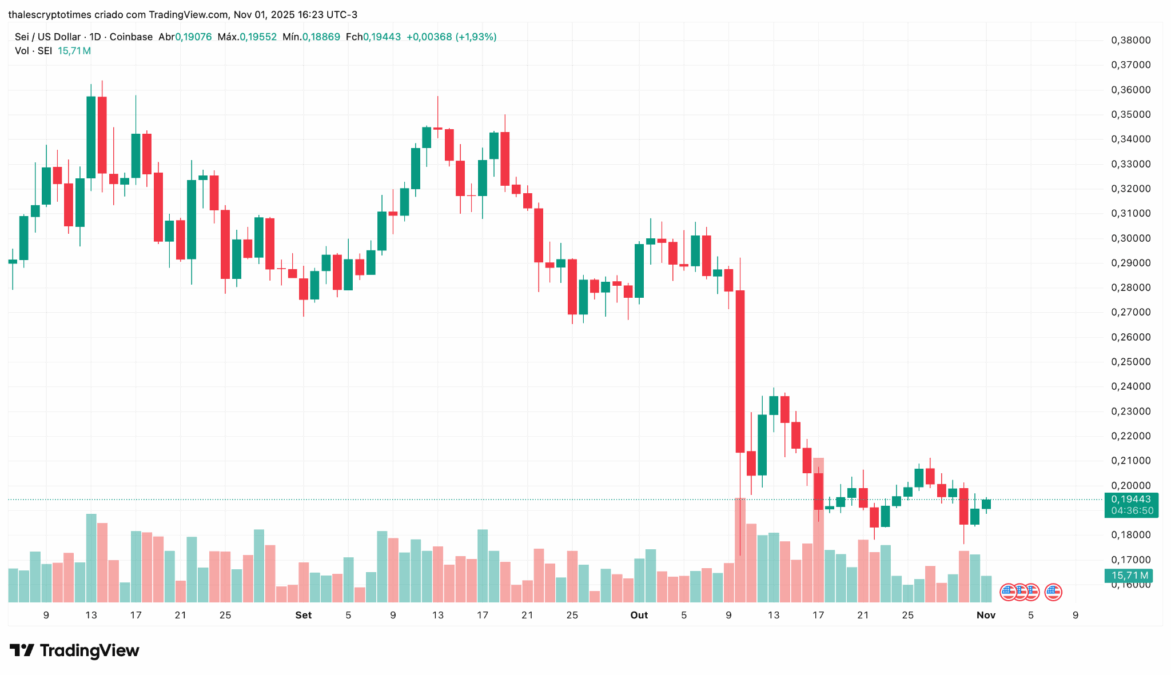

Despite the listing, the SEI token experienced a price decline between 4% and 10% within its first 24 hours of trading, settling around $0.19. This dip occurred even as on-chain data indicated robust trading volumes. Analysts attribute this short-term price movement to a confluence of factors, including broader macroeconomic pressures and a general risk-averse sentiment in the market. This sentiment was amplified following the U.S. Federal Reserve's recent indication of potential delays in interest rate cuts, which contributed to a $200 billion reduction in the global cryptocurrency market capitalization.

Robinhood Listing Coincides with Price Correction

The listing on Robinhood, officially announced on October 30, followed a week of positive momentum for SEI, which saw its price rally by nearly 15% in anticipation of its U.S. retail debut. However, this upward trend reversed as major cryptocurrencies like Bitcoin fell below the $110,000 mark and Ethereum dropped below $3,900, impacting the broader altcoin market.

Technical analysts, such as @Ali_Charts, observed that the TD Sequential indicator for SEI presented a buy signal at the $0.19 level, suggesting this price point could serve as a potential short-term support area.

While short-term traders may have experienced losses, the Robinhood listing nonetheless positions Sei among a select group of newer blockchain tokens that have secured access to regulated exchanges in the United States.

Institutional Adoption Bolsters Sei's Market Position

Sei is engineered as a high-performance Layer-1 blockchain, integrating parallel execution capabilities, advanced consensus mechanisms, and optimized storage solutions. These features are designed to deliver throughput comparable to Web2 applications while maintaining decentralization.

The timing of the Robinhood listing follows closely behind significant developments on the institutional front. Just weeks prior, major financial entities BlackRock and Brevan Howard expanded their tokenized fund operations onto the Sei Network through KAIO, a platform specializing in regulated real-world assets.

This integration allows investors to engage with on-chain representations of institutional funds, such as the BlackRock ICS US Dollar Liquidity Fund, directly utilizing Sei's underlying infrastructure.

The contrast between SEI's retail price volatility and its increasing institutional engagement highlights the network's growing appeal across different segments of the investor landscape.

By combining regulated fund tokenization with broad retail accessibility, Sei is actively developing a hybrid ecosystem that bridges institutional finance with retail participation.

Sei's strategy of integrating institutional partnerships with widespread retail reach will be a key test of its resilience as it moves into 2026. The network's recovery prospects are now closely tied to the broader market's ability to regain stability.