Senate Banking Committee Delays CLARITY Act Vote

The Senate Banking Committee has announced a delay in its scheduled hearing for the CLARITY Act. This postponement follows the withdrawal of support from key industry players, most notably Coinbase, and ongoing concerns raised by Democratic senators regarding the bill's current provisions.

The decision highlights the complex and often contentious relationship between the burgeoning cryptocurrency industry and traditional financial institutions, as lawmakers grapple with establishing a regulatory framework that can accommodate both.

Coinbase Withdraws Support Over Banking Bias in Bill Amendments

Coinbase, a leading cryptocurrency exchange, has officially withdrawn its support for the CLARITY Act, citing significant dissatisfaction with recent amendments. According to Coinbase CEO Brian Armstrong, the revised bill appeared to make excessive concessions to traditional financial institutions, thereby diluting provisions that were intended to be favorable to the crypto sector.

Armstrong articulated the company's stance, stating, "We’d rather have no bill than a bad bill." This sentiment reflects a broader concern within the cryptocurrency community that the bill, in its current form, disproportionately benefits established banks. Specific areas of contention included changes related to stablecoin yields and tokenization, which were perceived as favoring traditional finance.

The extensive 278-page bill, which saw its amendments released earlier this week, prompted a strong negative reaction from Coinbase and other crypto firms. Furthermore, some Democratic senators have voiced ethical concerns, advocating for measures to prevent government officials from exploiting cryptocurrency projects. Progress on the bill was further hindered by resistant state members, including Senator Ruben Gallego, who cited disruptions to meeting schedules.

The market has responded to these developments with varied reactions, illustrating the divisions within the industry. While some firms continue to support the bill's passage, others, aligning with Coinbase's position, have chosen to delay rather than accept a diluted version of crypto-friendly legislation. Banking Committee Chairman Tim Scott has indicated that "sincere" negotiations are ongoing, suggesting that efforts are being made to reconvene and find common ground amidst these challenges.

USDC Stability Amidst Legislative Uncertainties

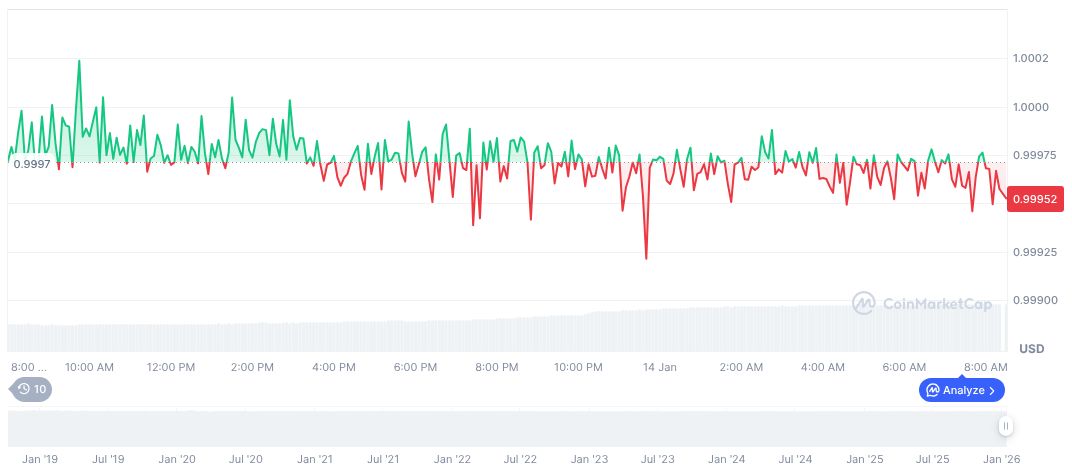

Despite the legislative uncertainties surrounding the CLARITY Act, the market performance of USD Coin (USDC) has remained relatively stable. As of January 15, 2026, CoinMarketCap data shows USDC trading at $1.00, with a market capitalization of approximately $75,724,246,740.00.

Recent 24-hour trading volume indicates a slight decrease of -4.65%, suggesting ongoing market activity and minor volatility. Over a 90-day period, USDC's price has shown minimal fluctuation, shifting by -0.02%, which demonstrates its continued success in maintaining its peg to the US dollar.

Insights from Coincu suggest that the current regulatory ambiguities could lead to prolonged periods of uncertainty for the cryptocurrency industry, potentially impacting stablecoins and the broader decentralized finance ecosystem. The unresolved jurisdictional clarity between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) further contributes to the likelihood of delays in establishing a comprehensive regulatory structure for the crypto market. This situation necessitates careful navigation by all stakeholders as the legislative landscape continues to evolve.

It is important to note that a similar bill iteration in the House of Representatives passed unopposed in July 2025, showcasing a level of legislative consensus that has not yet been achieved in the current Senate proceedings.