Key Points

- •The bill aims to exempt small Bitcoin payments from capital gains tax.

- •Expected to increase everyday crypto use.

- •Projected to generate $600M over nine years.

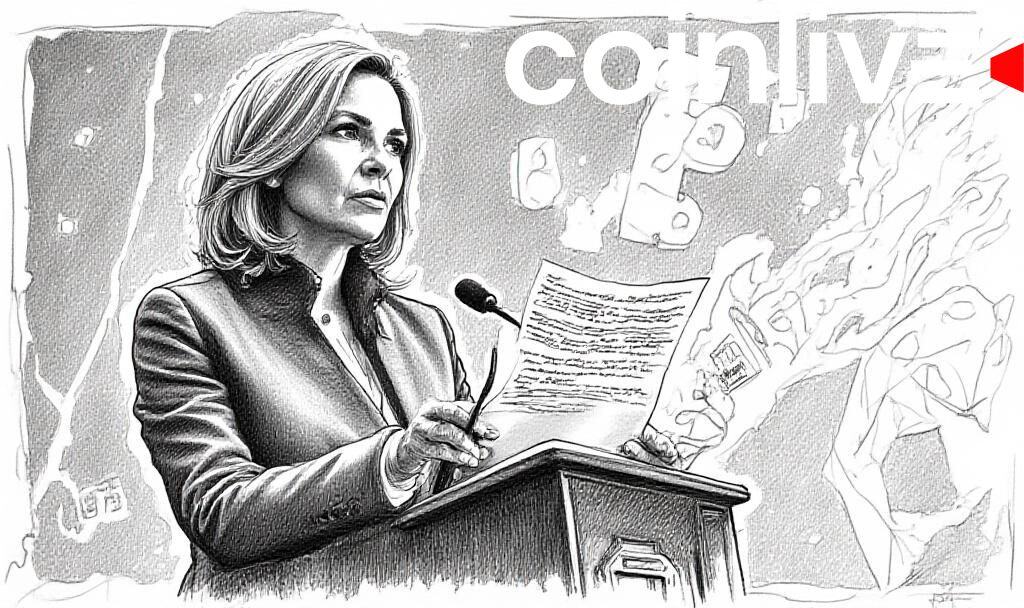

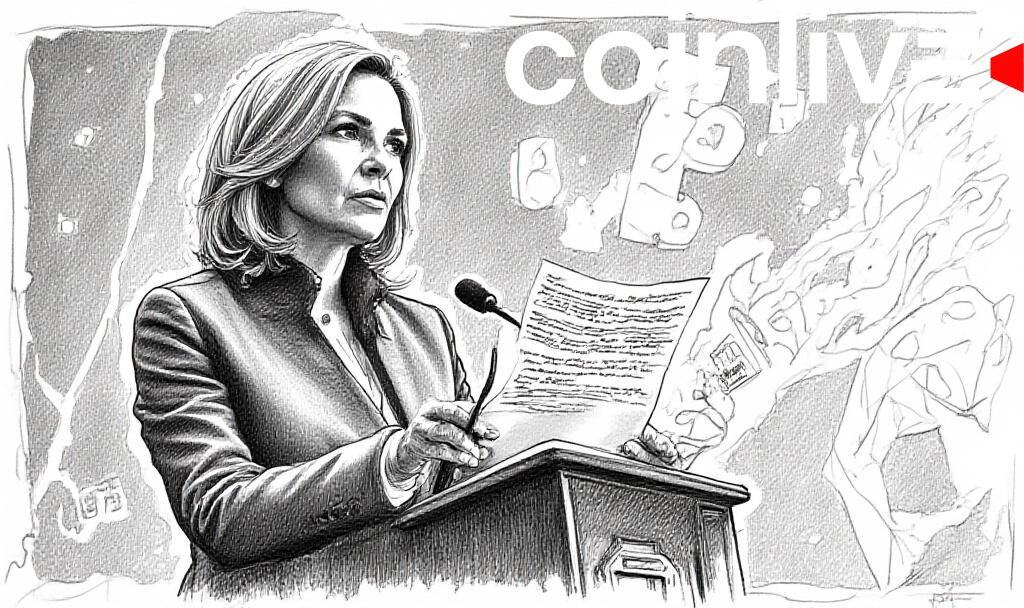

Senator Cynthia Lummis introduced legislation to exempt small Bitcoin payments under $300 from capital gains tax in the U.S., aiming to facilitate everyday cryptocurrency use.

The proposal removes key regulatory barriers, potentially increasing Bitcoin's everyday use and trading volumes, though it faces debate for excluding other cryptocurrencies.

Introduction of Legislation

Senator Cynthia Lummis introduces legislation that proposes a capital gains tax exemption for Bitcoin payments under $300. This move is aimed at facilitating everyday cryptocurrency use across the United States. Lummis, a prominent Bitcoin advocate, is pushing the Digital Asset Tax Legislation. Her bill seeks to enhance digital asset use by addressing current tax code limitations that hinder small cryptocurrency transactions.

Potential Impact on Bitcoin Use

The proposed bill impacts Bitcoin by potentially increasing its use for routine purchases. This could address existing regulatory friction, fostering broader adoption and enhancing its status as a transaction medium.

Cynthia Lummis, U.S. Senator, "In order to maintain our competitive edge, we must change our tax code to embrace our digital economy, not burden digital asset users. This groundbreaking legislation is fully paid-for, cuts through the bureaucratic red tape and establishes common-sense rules that reflect how digital technologies function in the real world. We cannot allow our archaic tax policies to stifle American innovation, and my legislation ensures Americans can participate in the digital economy without inadvertent tax violations."

The financial implications are notable, with projections indicating a $600 million net revenue generation between 2025 and 2034. Analysts note the bill's focus on Bitcoin and suggest a broader scope might be more beneficial.

Historical Context and Future Projections

Historically, tax exemptions can stimulate digital currency use. Similar measures in other regions have bolstered crypto market dynamics. U.S. adoption of this bill might set precedents for future regulatory frameworks. Potential outcomes include increased transaction volumes and liquidity in Bitcoin markets, augmented by historical trends in countries without crypto capital gains taxes. Analysts anticipate shifts in market behavior if broader cryptocurrency inclusivity occurs.