The Cathie Wood-backed Solana treasury firm Solmate Infrastructure saw its prices surge over 30% after the company announced its plans for an aggressive mergers and acquisitions (M&A) strategy and confirmed additional SOL buys at discounted prices. This surge occurs as institutional adoption for Solana continues to grow, with Fidelity also recently rolling out Solana trading access for both retail and institutional clients.

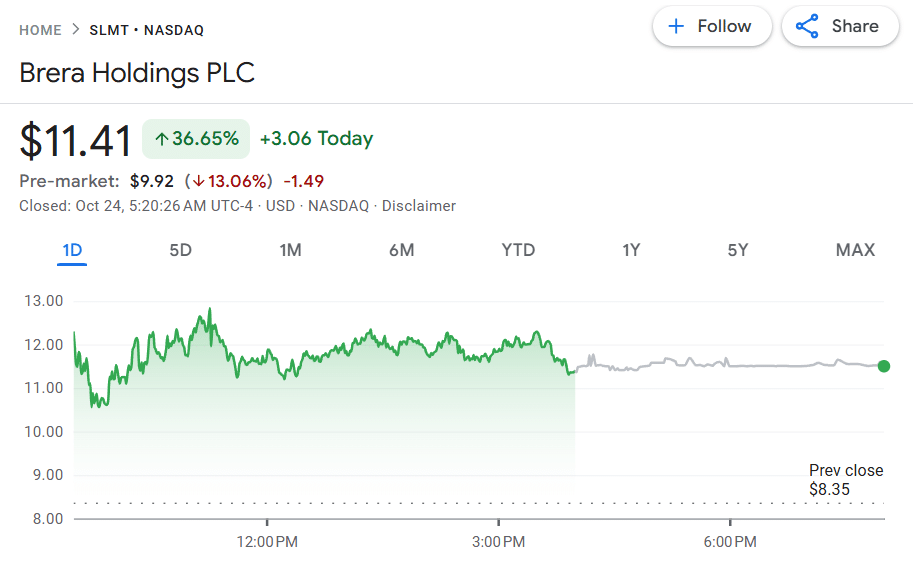

Solmate Infrastructure (SLMT), which rebranded from Brera Holdings, saw its share price reach an intraday high of $13 in the latest trading session. It then retraced to close the trading day off at $11.41, marking a 36.65% gain for the day. However, there has been some pre-market selling activity that has pushed the stock’s share price down more than 13%.

The price of Solana also rose more than 1% in the past 24 hours, according to CoinMarketCap data.

Solmate Infrastructure to Launch UAE’s First Performant Solana Validator

The Nasdaq-listed firm announced that it has completed the assembly of its first validator hardware in the United Arab Emirates (UAE) and is gearing up to launch the region’s first “performant Solana validator.” This validator is part of the company’s plan to integrate real infrastructure with its growing SOL treasury.

Solmate Infrastructure also stated in a recent press release that it has purchased SOL tokens “at a historic discount to market prices” to support its validator operations. While the company did not disclose the exact size of this purchase, it did confirm a $50 million acquisition of SOL tokens at a 15% discount earlier this month. Those tokens were bought around the same time the crypto market experienced a record liquidation on October 10.

Aggressive M&A Strategy Unveiled

In the press release, Solmate Infrastructure also announced its intention to pursue “an aggressive M&A strategy, exploring opportunities across the Solana value chain.” The company added that “Acquisition targets will be selected with rigorous criteria designed to ensure synergy and supercharge SOL-per-share growth.”

Regarding the types of companies Solmate Infrastructure intends to acquire or merge with, the company’s CEO Marco Santori clarified that they are not interested “in simply bolting on smaller companies to generate revenue.” He further explained, “We are targeting businesses for which our SOL treasury will be fuel for their engine of growth – just like it is for ours – and will use that growth to accrete more SOL-per-share for Solmate investors.”

The upcoming validator launch, token purchases, and M&A strategy follow asset manager Ark Invest’s disclosure of an 11.5% ownership stake in Solmate Infrastructure.

Fidelity Gives Clients Access to SOL Trading

Solmate Infrastructure’s initiatives within the Solana ecosystem are indicative of a broader trend of institutional adoption of SOL and its underlying blockchain. Among the firms embracing this trend is Fidelity, which has added SOL trading to its suite of crypto products, enabling both institutional and retail investors to trade the altcoin.

Fidelity announced that it will integrate SOL trading across its Fidelity Crypto, Fidelity Crypto for IRAs, Fidelity Crypto for Wealth Managers, and Fidelity Digital Assets platforms. Nick Ducoff, head of institutional growth at the Solana Foundation, confirmed this development on X.

Retail investors in U.S. can now purchase SOL in their @Fidelity brokerage account

Some screenshots from my account

NFA pic.twitter.com/gDqOdSpp6C

— Nick Ducoff (@nickducoff) October 23, 2025

On Thursday, Fidelity published an explainer detailing the Solana blockchain, highlighting its capacity to process approximately 60,000 transactions per minute on average. This significantly surpasses the estimated transaction rates of 250 per minute for Bitcoin and 800 per minute for Ethereum. The company also emphasized Solana’s minimal fees, which amount to just a fraction of a cent.

20 Firms Control $3.9 Billion In SOL

Other institutions have also invested in SOL. Data from Strategic SOL Reserve indicates that twenty companies currently hold the cryptocurrency as part of a strategic reserve. Collectively, these companies possess 20.312 million SOL tokens, representing approximately 3.53% of the crypto’s total supply. At current market prices, these combined holdings are valued at around $3.9 billion.

Forward Industries leads these institutional holdings with 6.82 million SOL. Solana Company ranks second with its treasury of approximately 2.2 million tokens, while DeFi Development Corp holds the third-largest position with 2.196 million SOL.