Short-term Bitcoin holders remain highly reactive to recent price movements, with on-chain data showing a clear tendency to realize profits during the latest rebound.

While the move higher can be classified as technical in nature, behavior among newer holders suggests caution rather than renewed conviction.

As Bitcoin trades closer to the short-term holder realized price, currently around $102,000, capital preservation appears to be taking priority. Rather than increasing exposure, some holders are using strength to exit positions, especially as price revisits levels seen before the recent correction.

Profit-Taking Accelerates on Price Strength

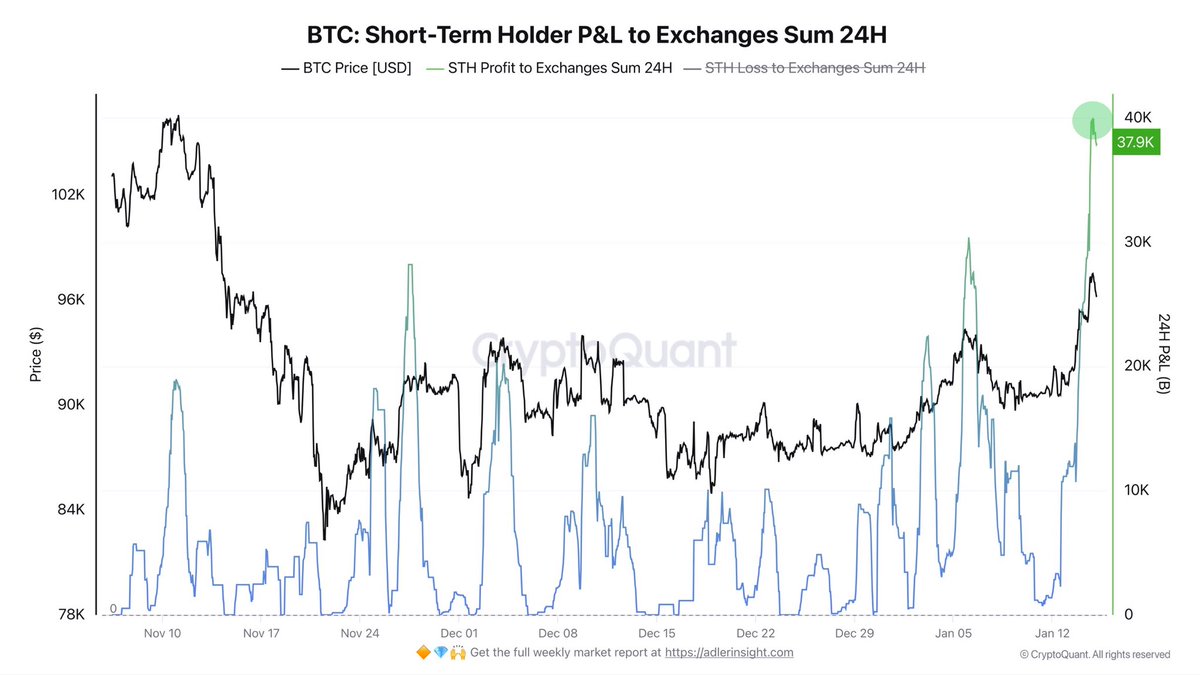

On January 6, when Bitcoin climbed back to $94,000 for the first time since mid-November, short-term holders sent more than 30,000 BTC in profit to exchanges. That activity coincided with a sharp increase in realized gains, signaling that a meaningful portion of the cohort chose to lock in returns instead of holding through volatility.

The pattern intensified further as price continued higher. Data shows that when Bitcoin broke above $97,000, more than 40,000 BTC in profits were sent to exchanges in a single day. The scale of these transfers stands out relative to prior weeks, marking one of the largest short-term holder profit events in the current cycle.

On-Chain Data Highlights Sensitivity to Recent Correction

The accompanying chart from CryptoQuant illustrates how closely short-term holder behavior tracks price rebounds. Each sharp rise in BTC price has been met with a corresponding spike in profits sent to exchanges, reinforcing the view that confidence within this group remains fragile.

Short-term holders appear to still be impacted by the recent drawdown, with unrealized profits not yet sufficient to shift behavior back toward accumulation. Until price moves decisively beyond their cost basis and holds, selling pressure from this cohort is likely to remain present during rallies.

For now, the data suggests that additional upside and stronger confirmation will be required to rebuild confidence among short-term holders and encourage holding rather than distribution into strength.