Precious Metals Dominate the Top of Global Markets

Silver has surged into the second spot among the world’s largest assets by market capitalization, overtaking NVIDIA and solidifying its role as a primary beneficiary of the current macro uncertainty.

At the same time, Bitcoin now ranks eighth globally, sitting behind a mix of precious metals and mega-cap U.S. technology firms.

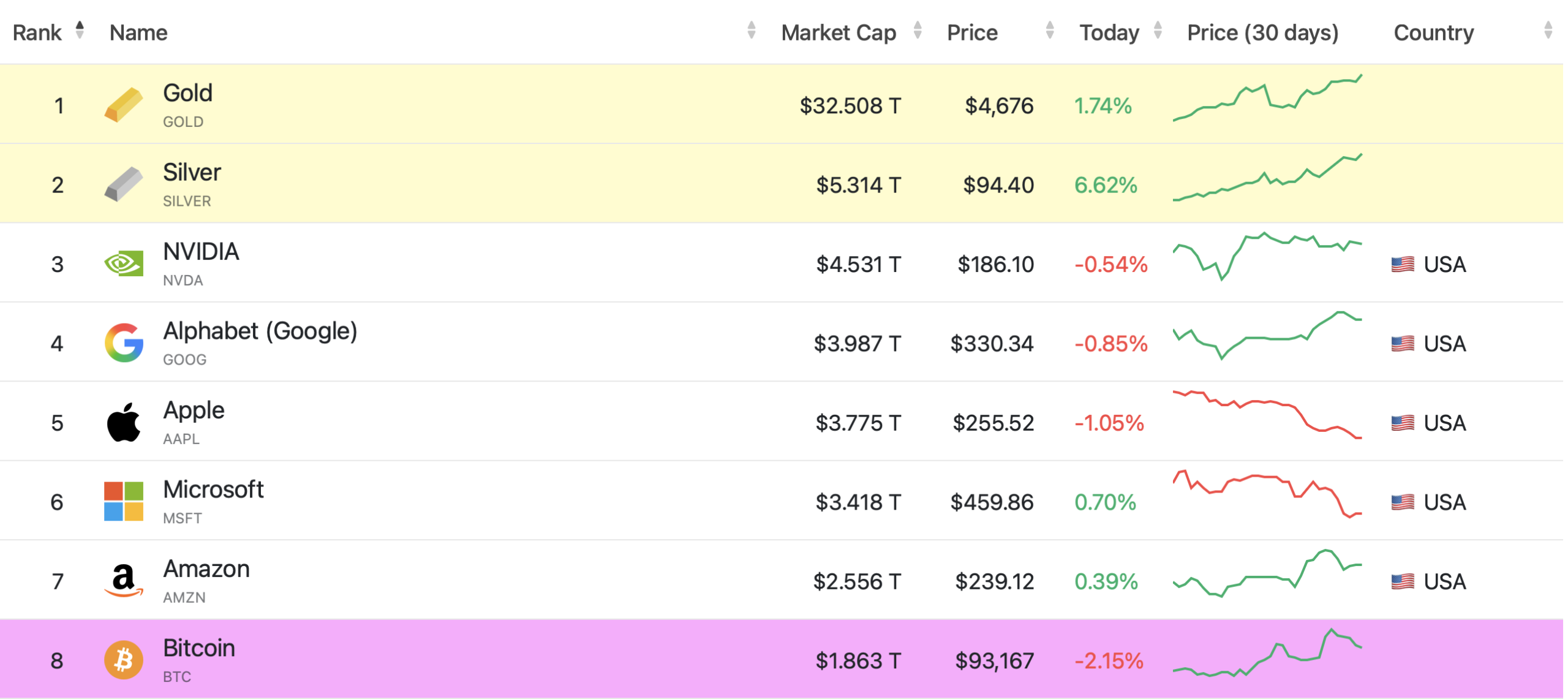

According to the latest global asset rankings, Gold remains firmly in first place with a market capitalization of roughly $32.5 trillion, reflecting persistent demand for safe-haven assets amid geopolitical tensions and tariff risks.

Silver has now climbed to second place, reaching an estimated $5.3 trillion market cap, driven by a powerful combination of investment inflows and industrial demand. Prices are hovering near $94 per ounce, marking one of the strongest rallies in silver’s modern history. The move places silver ahead of Nvidia, which previously held the third position during the peak of the AI-driven equity boom.

This reshuffling highlights a clear rotation toward hard assets, as investors increasingly hedge against policy uncertainty, trade friction, and slowing global growth.

Tech Giants Slip as Metals Gain Ground

Nvidia now ranks third, with a market capitalization near $4.5 trillion, followed closely by Alphabet, Apple, and Microsoft. While these firms remain dominant, recent price softness suggests capital is temporarily rotating out of high-beta growth stocks and into defensive assets.

The divergence is especially visible when comparing performance: silver is up more than 6% on the day, while several mega-cap tech names are trading flat to lower.

Bitcoin Holds Firm in the Global Top Ten

Bitcoin currently sits in eighth place globally, with a market capitalization of approximately $1.86 trillion and a price near $93,000. While BTC has pulled back modestly on the day, its position among the world’s largest assets underscores how far the asset has matured.

Despite being overtaken by silver’s explosive rally, Bitcoin continues to rank above most global equities and commodities, reinforcing its status as a macro-relevant asset rather than a fringe alternative investment.

What the Rankings Signal

The latest asset leaderboard reflects a market environment defined by risk aversion, inflation hedging, and geopolitical anxiety. Precious metals are reclaiming dominance, while Bitcoin remains a key pillar of the alternative asset class. Together, silver’s breakout and Bitcoin’s top-ten ranking suggest that investors are increasingly positioning for volatility rather than chasing pure growth.

As capital continues to rotate, these rankings may serve as an early signal of a broader shift in global asset allocation priorities.