A loud claim is making the rounds in the metals community right now, and it’s centered on one idea: the paper silver market may be carrying a short position that is simply too large to ignore.

Macro commentator NoLimit says the numbers are extreme. In his words, “Silver production: ~800M ounces/year. Bank shorts: 4.4 BILLION ounces.” His argument is that if silver keeps climbing, large financial institutions could be forced into a scramble to cover positions, and that could trigger violent price swings.

What the Claim Is Based On

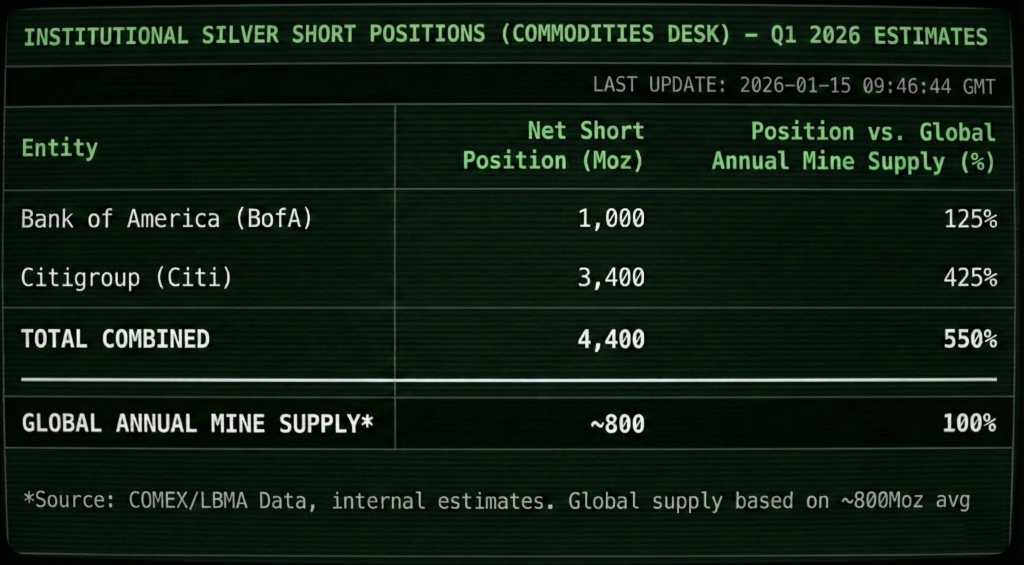

The claim is supported by an image that breaks the story down into a simple table titled “Institutional Silver Short Positions (Commodities Desk) – Q1 2026 Estimates.”

It lists the following estimates:

- •Bank of America at 1,000 million ounces net short (shown as 125% of global annual mine supply).

- •Citigroup at 3,400 million ounces net short (shown as 425% of global annual mine supply).

- •Total combined at 4,400 million ounces, which the table frames as 550% of global annual mine supply.

The table also lists global annual mine supply at roughly 800 million ounces (100%).

If those figures were accurate, the headline implication is obvious: the paper short exposure would be multiples of what the world produces in a year.

Analysis of Market Movements

NoLimit argues that recent price action wasn’t “normal volatility.” He points to silver spiking near $92, dumping fast, bouncing, and then selling off again. He frames it as deliberate pressure to prevent a clean break above $100, because a move like that could trigger margin stress for large short holders.

He also claims the physical market is sending a different signal. He mentions lease rates rising and “backwardation,” which is when spot prices trade above futures prices. His takeaway is that some buyers want metal now, not a paper promise later. He even suggests “cash settlement” and “force majeure” risk if the market tightens further.

A More Grounded Perspective

It is important to note that the image itself says “internal estimates.” That detail is significant. Without a clear, verifiable source, the numbers should be treated as a claim, not a confirmed fact.

Furthermore, a “short” position doesn’t automatically imply a negative outcome or a guaranteed loss. Banks can hold short positions for various reasons, including hedging exposure for their clients, engaging in market making activities, or offsetting other existing positions. A large gross number can appear alarming without a complete understanding of the offsetting positions and collateral involved.

That said, the broader point remains relevant and worth observing. When silver exhibits significant volatility and the discussion surrounding the “paper vs. physical” market intensifies, it typically indicates crowded positioning and rising stress levels within the market.

If silver continues to hold elevated price levels and physical tightness genuinely becomes apparent through factors such as rising premiums, delivery delays, or sustained backwardation, the narrative of a potential squeeze will likely gain considerable momentum. Conversely, if these conditions do not materialize, this situation could be another instance of significant claims circulating alongside a strong chart performance.