Solana's Expanding Ecosystem

Solana’s on-chain application ecosystem has expanded at an exceptional pace over the past two years.

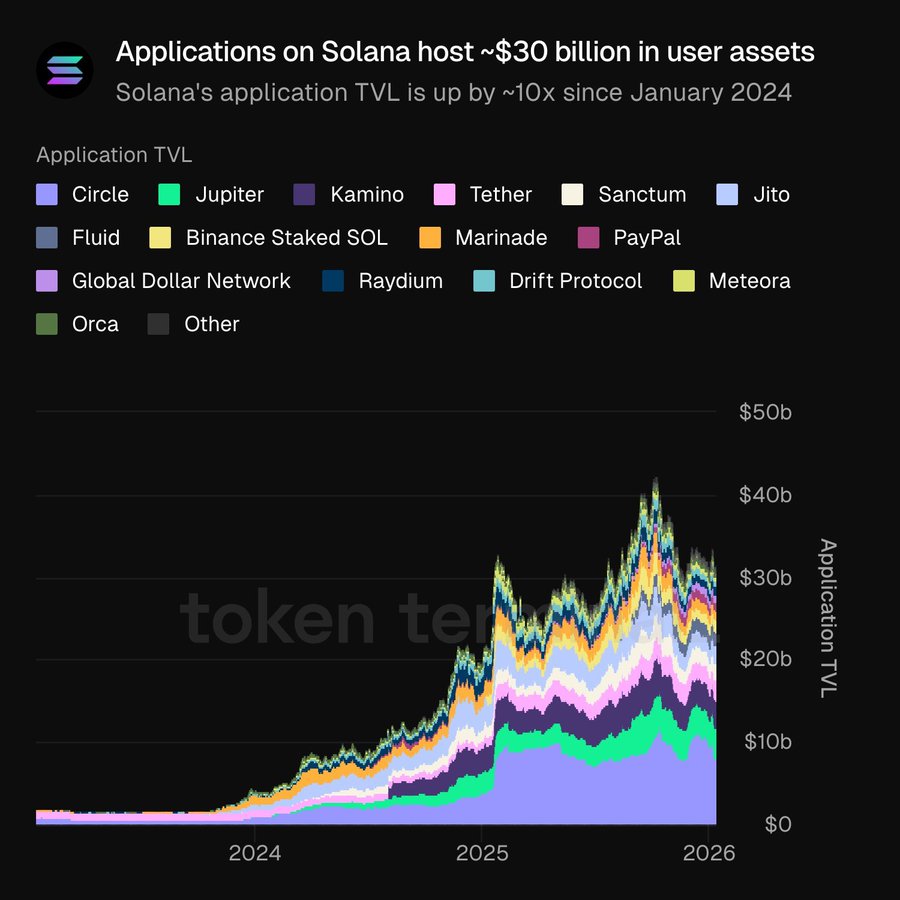

According to recent data, application TVL on Solana has increased roughly tenfold since January 2024, climbing from low single-digit billions to over $30 billion in user assets by early 2026.

The growth is broad-based rather than driven by a single protocol. The stacked TVL breakdown shows capital distributed across multiple application categories, including stablecoin issuers, liquid staking protocols, DEXs, and trading platforms.

Names such as Circle, Tether, Jupiter, Raydium, Jito, Marinade, Kamino, Drift, and Meteora all contribute meaningfully to the total.

A key takeaway from the chart is depth, not just headline growth. While total TVL surged sharply during major expansion phases in 2024 and 2025, the composition also diversified. No single application dominates the stack, suggesting Solana’s TVL growth is supported by multiple active use cases rather than isolated yield cycles.

Persistent Growth Trends

The data also shows periods of volatility, with drawdowns following peaks, but the broader trend remains upward. Even after pullbacks, application TVL consistently reclaims higher ranges, indicating persistent capital retention within Solana-based apps.

Overall, the chart highlights a structural shift: Solana has moved from an emerging ecosystem to one hosting tens of billions of dollars in active application-layer capital, supported by a wide set of protocols rather than temporary inflows.