Solana (SOL) is experiencing renewed bearish pressure, with its price falling below a critical resistance zone spanning $190 to $215. Market analyst DonAlt has observed a clear structural breakdown on the weekly TradingView chart, showing Solana trading at approximately $154.97, a decline of 5.83% over the past week.

The analyst highlights that a sustained recovery above the indicated red zone could signal a structural reversal. However, the current trend remains bearish until such confirmation is achieved. Below the resistance, a significant support area is identified at $144, which historically served as a point of accumulation in late 2023. This area is now considered Solana's bottom range, and a short-term bounce might occur if it is tested. Failure to maintain this support could lead to further price declines towards previous consolidation regions, suggesting that the negative outlook persists unless the upper range is reclaimed.

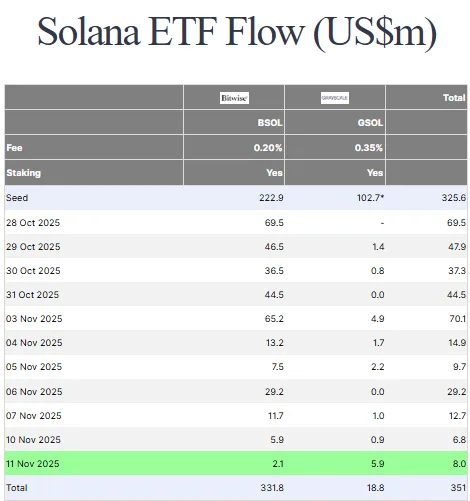

Solana ETFs Show Consistent Institutional Demand

Despite the recent price weakness, Solana's spot exchange-traded funds (ETFs) have continued to attract substantial inflows. Data from Farside Investors indicates that on November 10, 2025, Solana ETFs saw net inflows totaling $6.8 million, demonstrating ongoing institutional confidence in the market, even amidst volatility.

The primary drivers of these inflows are the BSOL and QSOL Solana ETFs. QSOL has a staking fee of 0.20% in addition to its 0.35% carrying fee. BSOL remains the dominant fund, having accumulated $331.8 million in inflows since its launch, while QSOL has attracted $18.8 million, bringing the total inflows to $351 million. The initial seed funding for these products was $325.6 million, with BSOL accounting for $222.9 million and QSOL for $102.7 million. Inflows observed at the beginning of November remained robust, with $8 million recorded on November 11, continuing the momentum seen since late October. Analysts interpret these figures as evidence of long-term commitment from institutional investors to Solana's staking-enabled ETF structure, indicating strong investor confidence despite short-term price challenges.

Bitwise Pioneers the Market with First Solana ETF Launch

Bitwise Asset Management has significantly impacted the regulatory landscape by launching the first U.S. spot Solana ETF during a recent government shutdown. The product, known as the Bitwise Solana Staking ETF (BSOL.P), tracks Solana's spot price and utilized an alternative approval process that did not require formal SEC sign-off, granting Bitwise a first-mover advantage in a sector anticipated to experience rapid growth. According to LSEG data, this product attracted $420 million in its initial week. JPMorgan analysts project that "altcoin" ETFs could attract $14 billion within their first six months, with Solana-related funds potentially drawing $6 billion of that amount. Matt Hougan, Chief Investment Officer at Bitwise, expressed the company's strategy of pursuing first-mover opportunities while adhering to regulations.

This development has prompted competitors such as Grayscale, VanEck, Fidelity, and Invesco to re-evaluate their filing strategies, with many adopting approaches similar to Bitwise. Grayscale has converted its private Solana fund into an ETF, and other firms are reportedly exploring similar launches, including products linked to Ripple's XRP.