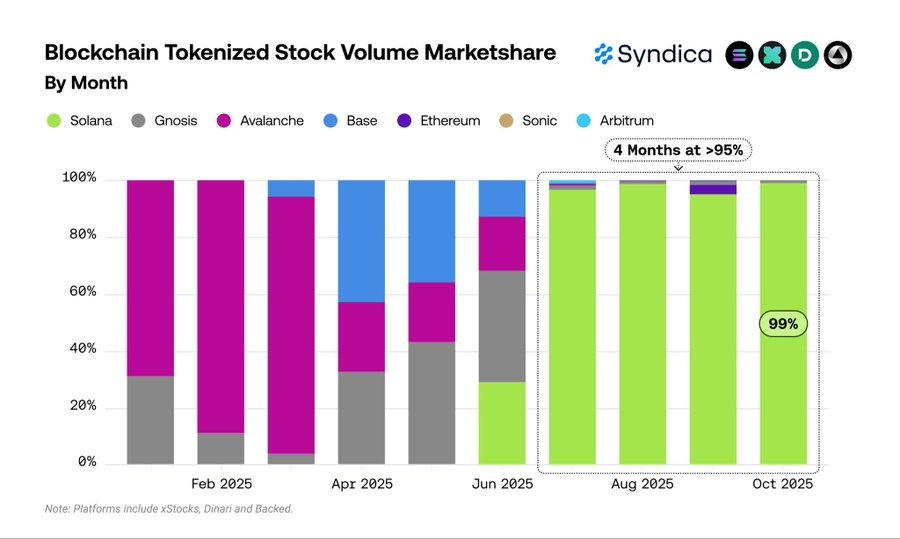

Solana has entered one of its strongest dominance phases to date, becoming the undisputed leader in tokenized stock trading throughout 2025.

New market data shows that from July through October 2025, Solana consistently captured over 95% of all tokenized stock trading volume. In October alone, the network reached an extraordinary 99% market share, outperforming every L1 and L2 chain combined and solidifying its position at the center of on-chain financial activity.

The chart illustrates just how dramatic this shift has been. Earlier in the year, platforms such as Avalanche, Gnosis, Base, and Arbitrum shared sizeable portions of the market. February and April still show a mixed environment, with Avalanche dominating early months and Base taking the largest share in April. By June, market share remained fragmented, with several chains carrying meaningful weight. Then, almost abruptly, the landscape flipped.

Beginning in July 2025, Solana’s share expands into a near-total takeover. The green bars representing Solana stretch almost completely across the July, August, September, and October columns, each surpassing the 95% threshold. None of the competing networks show more than a sliver of activity during this period, demonstrating just how decisively Solana captured flows across tokenized stock platforms such as xStocks, Dinari, and Backed.

This four-month window shows more than a temporary trend. It reflects Solana’s rapid consolidation of the tokenized financial markets that have migrated toward chains with higher throughput, lower latency, and efficient execution environments. While other ecosystems once shared the demand for tokenized equities, Solana’s architecture has propelled it into a level of dominance that reshapes how tokenized assets trade on-chain.

The data suggests that as tokenized financial instruments continue to scale, Solana’s performance advantage is translating directly into real-world usage. If these patterns persist, the network could retain a structural lead in tokenized assets heading into 2026, forcing competing chains to rethink their approach to high-volume financial markets.