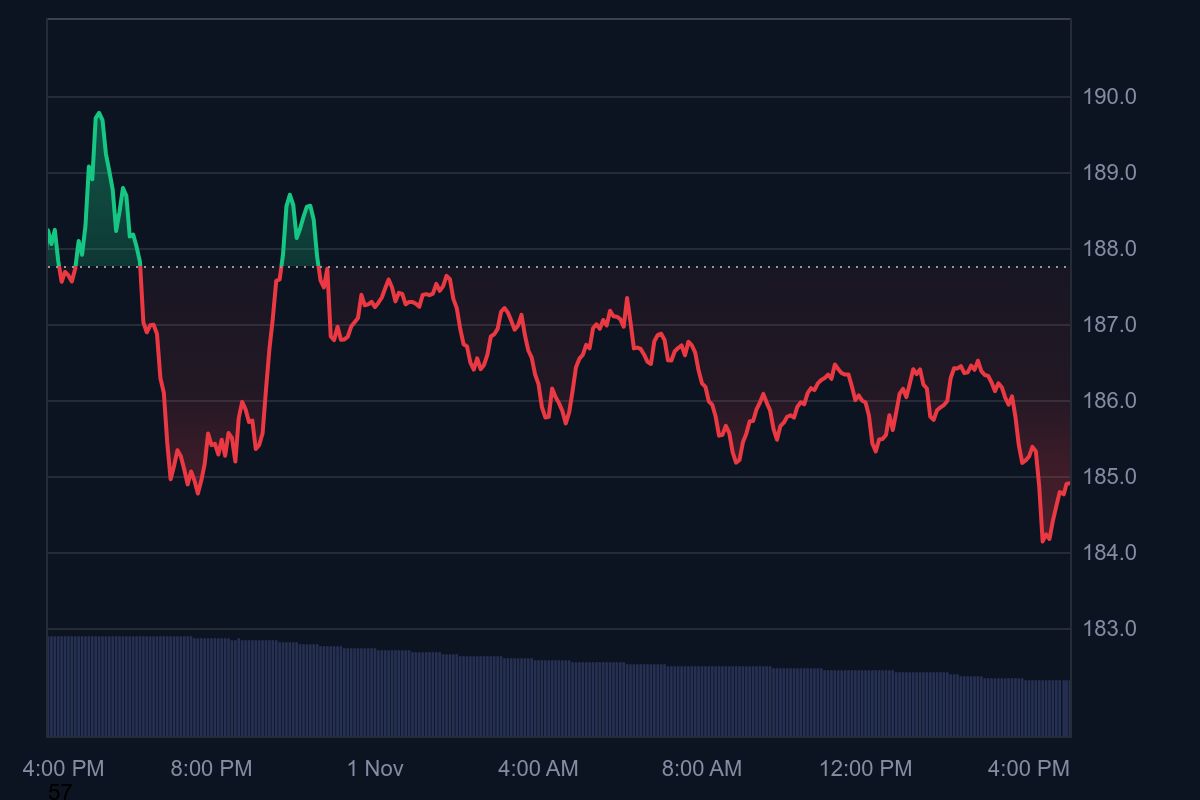

Solana (SOL) is currently trading at $184.83, reflecting a 1.72% decrease in the past 24 hours. The cryptocurrency maintains a substantial market capitalization of $102.1 billion, as reported by CoinMarketCap. Despite this recent price dip, the broader market trend of consistently higher lows remains intact, signaling continued underlying strength in Solana’s medium-term technical structure.

Analyst Observations on Recent Price Action

According to data shared by MakroVision Research, the recent recovery phase in Solana's price action has been described as "weak." This assessment is based on observations of rapid counter-movements and a general absence of sustained bullish momentum. The analyst further indicated that short-term resistance is now being defined by descending red trendlines. A decisive break above these trendlines will be crucial to confirm a resurgence in buying strength.

Key Technical Levels to Watch

- •

Support Zone

The critical support zone for Solana lies between $173 and $180. This area coincides with the 0.5 Fibonacci retracement level and represents a key region that bulls must defend. A breach below this zone could lead to further downside, with potential targets at the Golden Pocket, which spans from $155 to $148, corresponding to the 0.618 to 0.665 Fibonacci retracement levels.

- •

Resistance Zone

The immediate resistance level to monitor is at $204. A sustained breakout above this price point would enable Solana to stabilize and potentially regain upward momentum. Following a successful breach of $204, potential upside targets could extend towards $223 and $246.

On the downward side, maintaining a position above the mid-$170s is paramount for preserving Solana's current bullish structure. A failure to hold this level would likely precipitate a more significant retracement, potentially targeting the Golden Pocket area previously identified by MakroVision.

Outlook: Critical Moment for Solana’s Next Move

Solana's immediate price trajectory is heavily dependent on its ability to reclaim the $204 resistance level. Until this resistance is overcome, analysts generally view the current price action as a corrective phase within a larger consolidation pattern. The prevailing trend of higher lows continues to support Solana's long-term resilience. However, the current lack of substantial bullish volume indicates that traders are adopting a cautious stance, awaiting a clear breakout signal. A decisive move above $204 could initiate a new upward trend, whereas a failure to hold the $173 support might confirm a deeper correction towards the $150 region before a more robust recovery attempt can be mounted.