Introduction: Why Solana Keeps Appearing Everywhere

A consistent pattern emerges when reviewing major crypto research reports from institutions like Messari, Bitwise, and Galaxy Research. Solana frequently features as a central theme rather than a peripheral mention. Initially, this repetition might seem coincidental, but over time, it warrants deeper scrutiny.

This observation raises a critical question: To what extent does this confidence stem from genuine analysis versus existing institutional exposure? In other words, is Solana genuinely presenting a unique structural opportunity, or are narratives being shaped by the current positions of institutional capital?

Galaxy's core argument focuses not primarily on SOL price appreciation but on a broader shift in on-chain economies. They posit a transition from meme-driven speculation toward real revenue-driven activity. Within this framework, Galaxy forecasts Solana's on-chain capital markets could expand from approximately $750 million to $2 billion. This perspective aligns with other research, including discussions on Layer 1 valuation traps and the expectation that 2026 may mark the first significant year for DePIN revenue generation.

Before fully embracing this thesis, it is essential to differentiate between incentives and fundamental value.

Solana, Institutional Positions, and Narrative Incentives

Addressing the less comfortable aspects first, the extent of institutional exposure tied to Solana is significant. An AI model was used to estimate the "skin in the game" across major research-driven institutions. While these figures are indicative, the ranges themselves offer valuable insights.

Galaxy Digital is deeply integrated within the Solana ecosystem. They co-issued the Invesco Galaxy SOL ETF, operate as a leading Solana validator, and have participated in digital asset treasury initiatives. Their SOL exposure was accumulated across various phases, including purchases during the FTX bankruptcy liquidation in 2023 at approximately $20–$40, followed by ETF-related accumulation in 2025 around $100–$120.

Bitwise has recently launched BSOL, a staking-focused ETF that has surpassed $500 million in assets under management. The majority of their exposure appears to be driven by recent ETF subscriptions, suggesting an average cost basis above $120.

Messari's position is structurally different. As a long-term research partner of the Solana Foundation, many of its core contributors and affiliated venture funds participated in early private funding rounds during 2020–2021, with estimated costs potentially below $10.

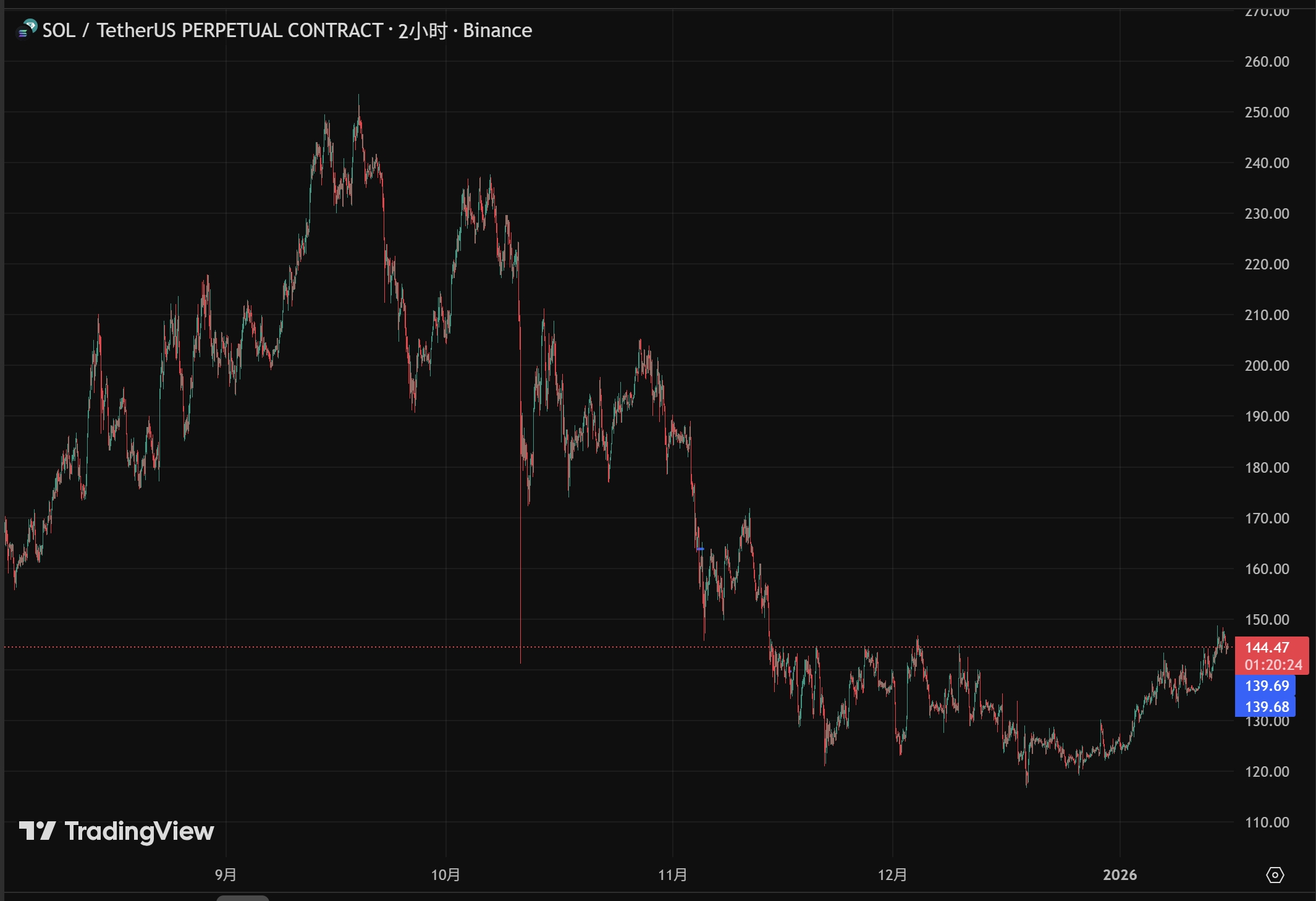

As of January 12, 2026, SOL trades at $139.

These positions do not invalidate the thesis. However, they do necessitate a higher standard of scrutiny for the arguments that follow.

Solana and the Shift from Meme Speculation to Real Revenue

Galaxy's thesis does not claim that memes will disappear entirely. Instead, it suggests a gradual decline in the dominance of purely speculative memes, with business-backed memes becoming increasingly relevant.

In practical terms, meme activity will not vanish. However, tokens driven solely by fear, uncertainty, and doubt (FUD) and fear of missing out (FOMO) will face exponentially increasing difficulty in generating sustainable profits. Over time, this will lead to a dilution of their share of total market capitalization.

Several structural forces are driving this transition.

Meme Failure Rates and Capital Exhaustion

Data from 2024 to 2025 tracking launch platforms like Pump.fun indicates that fewer than 2% of tokens successfully reach major decentralized exchanges. Among those that do, approximately 99% lose nearly all of their value within three months.

This extreme failure rate has consequences beyond direct financial loss. Repeated experiences of losing all invested capital create severe fatigue among retail participants, both psychologically and financially. Consequently, attention itself becomes a scarce resource.

Meme Markets, Solana, and the Limits of a Purely Speculative Cycle

By the end of 2025, total trading volume within the meme sector had declined by approximately 65% compared to levels earlier in the year. Even after accounting for broader market corrections, this suggests that the influx of new capital is no longer keeping pace with token issuance.

Once a market enters a phase dominated by capital circulation rather than expansion, funds naturally migrate toward assets with higher perceived certainty. This transition is not ideological; it is structural.

Institutional Capital and the Redefinition of Meme Value

Institutional participation is the most decisive variable in this shift. As regulatory clarity improves and compliant access expands, institutional analysts face clear constraints.

They cannot justify allocating $100 million based solely on a meme's visual appeal or social virality. What they can justify is a narrative supported by measurable outputs: a project that utilized meme-driven distribution to acquire one million active users, generates $50 million in annual fees, and trades at an attractive price-to-sales ratio.

This distinction fundamentally reshapes how memes are evaluated.

Three Meme Categories in a Solana-Based, Revenue-Driven Market

Under this framework, memes can be broadly divided into three categories.

Pure emotion memes are characterized by speed, speculation, and player-versus-player (PvP) dynamics. Their core indicators include social media engagement, whale positioning, and short-term volume spikes. They exist to capture fleeting attention.

Cultural or community memes, such as DOGE, PEPE, or WIF, function as long-term symbolic assets. Their value is supported by persistent community identity, address growth, and secondary market depth.

The third category comprises business-backed or revenue-generating memes. These projects are supported by real services, such as AI infrastructure, PayFi systems, or hardware networks. Their key metrics include protocol revenue, buyback mechanisms, and business growth rates.

This is where attention intersects with fundamentals.

Solana Memes: From Attention Only to Attention Plus Floor Value

Pure emotion memes follow a simple equation: value equals attention. When attention fades, liquidity dries up, and prices collapse.

Some traders can consistently profit from this dynamic through real-time sentiment monitoring and disciplined position management. However, this approach demands constant focus and is unsuitable for many participants.

As institutional capital enters the market, the valuation framework evolves. For business-backed memes, value becomes attention plus floor value.

Consider an AI compute project launched through meme-based distribution. When token prices fall to a certain threshold, revenue generated from compute rentals can trigger buybacks and burns. In bullish environments, such tokens can rally like memes through narrative amplification. In bearish conditions, they behave more like blue-chip assets, supported by cash flow.

The resulting payoff profile resembles a leveraged convertible instrument.

Why Solana Infrastructure Enables Revenue-Driven Memes

These models favor environments capable of supporting high-frequency settlement at low cost. Solana's infrastructure enables payment flows, asset tokenization, and compute markets to operate economically on-chain.

For this reason, the opportunity lies not in chasing every new meme but in identifying projects with real businesses operating on Solana, using meme mechanics as a distribution layer rather than their sole source of value.

Solana Risks: Firedancer and Retail Behavior

This thesis depends on key assumptions. First, if Firedancer experiences major bugs or significant delays, Solana's financial-grade narrative would be severely undermined.

Second, the analysis may underestimate how deeply retail behavior remains tied to emotional trading. Speculative memes will not disappear, and transitions of this scale rarely occur as quickly as research reports imply.

The balance between speculative and business-backed memes on Solana will shift gradually, not abruptly.

Conclusion: A Selective Solana Opportunity, Not a Blind Bet

Galaxy's thesis does not offer a blanket endorsement of SOL. Instead, it provides a framework for filtering opportunities. Attention will always matter. What changes is whether attention can be converted into durable economic value.

For investors unwilling to compete in full-time on-chain PvP, a more viable path may lie in projects that combine viral distribution with real revenue, using Solana as a settlement backbone.

This approach does not guarantee success. However, it explains why, despite potential incentive conflicts, Solana continues to appear in serious institutional research—and why the thesis deserves engagement rather than dismissal.