The Solana price climbed 1% over the past 24 hours to $143.28 as of 2:28 a.m. EST on trading volume that plunged 28% to $5.5 billion.

This comes as Solana Mobile announced that its SKR token, linked to its Seeker phone, will launch early next year. The token will have a total supply of 10 billion tokens, with 30% allocated for airdrops and 25% for growth and partnerships.

Seek and you will find.

SKR is coming in January 2026 🧵 pic.twitter.com/cwtlp8G8Zf

— Seeker | Solana Mobile (@solanamobile) December 3, 2025

Of the total supply, 10% will be allocated for liquidity, 10% for a community treasury, 15% for Solana Mobile, and 10% for Solana Labs.

SKR tokens will utilize a linear inflation model designed to incentivize early participants to secure the ecosystem through staking and to drive platform growth. The first-year inflation rate is set at 10%, with a decay mechanism that reduces it by 25% annually until it stabilizes at a terminal rate of 2%.

Meanwhile, according to SoSoValue data, US Spot SOL ETFs (exchange-traded funds) recorded a daily net inflow of $45.7 million on Monday.

With the Solana price now in recovery mode, the question remains whether its price can head higher.

Solana Price Poised For A Breakout

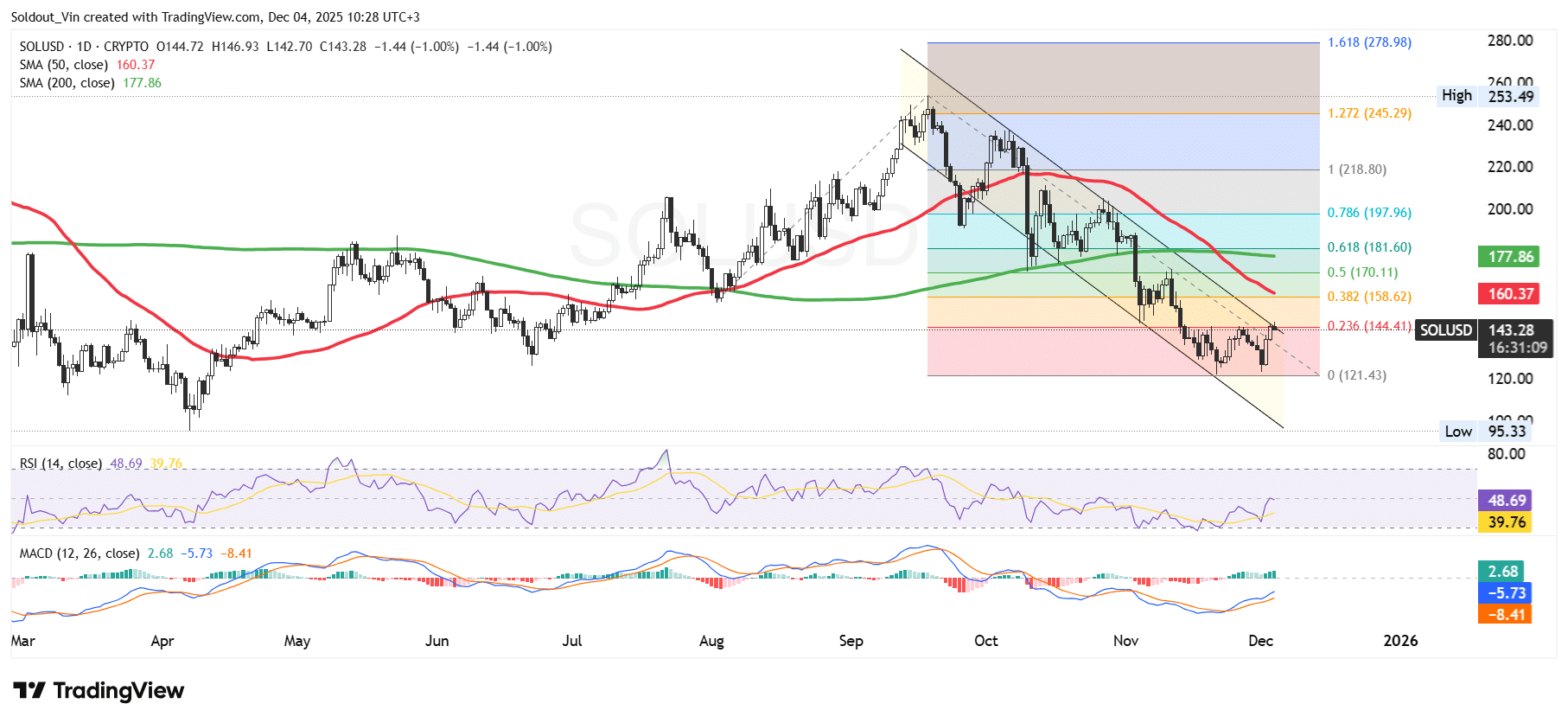

After trading in a sideways pattern around the $160 level from May to August, the SOL price then rallied to $252 in September. However, after reaching this zone, the bears took charge of the Solana price, driving it through a falling channel pattern and causing it to cross and break key Fibonacci Retracement chart support levels.

The area around $122 on the 0 Fib level provided key support for the price of SOL, pushing it into a recovery. SOL is currently trading within the upper boundary of the falling channel, as the bulls eye a potential breakout.

As the downtrend continues, the price of the Solana token has traded below both the 50-day and 200-day Simple Moving Averages (SMAs), indicating that sellers have maintained control. The downtrend was also reinforced by a death cross forming around $180.

Meanwhile, the Relative Strength Index (RSI) is showing signs of recovery, with the RSI climbing towards the 50-midline, currently at 48. This is a key signal that buyers are gaining momentum.

The Moving Average Convergence Divergence (MACD) is also indicating that buyers are stepping in, as the blue MACD line has crossed above the orange signal line. Green bars on the histogram are also forming above the zero line, which shows that SOL is experiencing positive momentum.

SOL Price Prediction

According to the SOL/USD chart analysis on the daily timeframe, the Solana price is poised for a sustained bullish recovery above the falling channel.

If the Solana price breaks out and breaches the 0.382 Fib level at $158.62 and the 50-day SMA at $160.37, the next key resistance level to watch is the 200-day SMA at $177.86.

Conversely, if the bears regain control at this level, potentially pushed by the negative SMA indicators, the SOL price could drop back below the channel, with the next key support level at $110.