Solana price has continued its recent recovery, reaching its highest level since November of last year. The soaring network activity and significant exchange-traded fund (ETF) inflows suggest that the cryptocurrency has room for further gains. Solana has moved into a technical bull market after rising by 25% from its lowest level in December. The number of active addresses in the network has jumped to its highest level in months, and technical analysis suggests that the token has more upside potential in the near term.

Solana (SOL) rose to $145, marking a 25% increase from its lowest point in December, as the broader crypto market rally continued.

Robust Network Activity Fuels Solana's Recovery

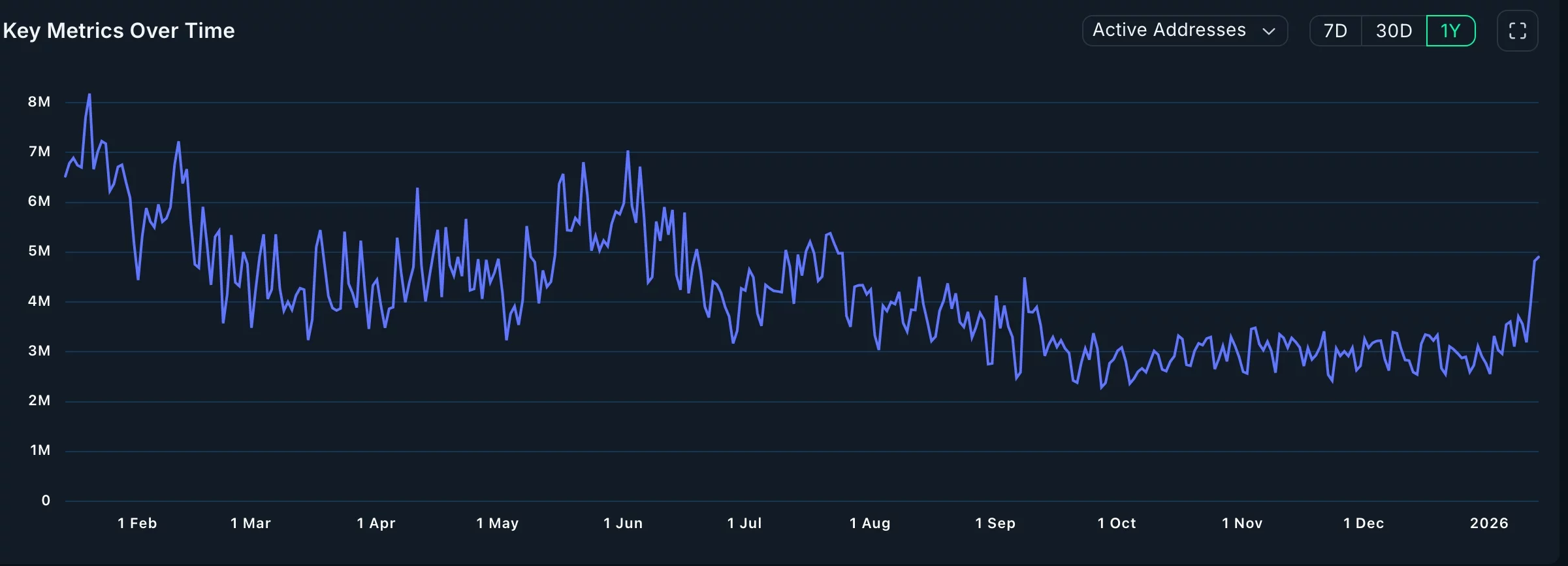

Data from Nansen indicates that Solana exhibits strong network metrics, which are likely supporting its ongoing recovery. The number of active addresses on the network has surged to over 4.8 million, a significant increase from the December low of 2.4 million. These figures represent the highest level observed in over six months.

Further data reveals a substantial increase in the number of transactions processed on the network, reaching over 97.2 million. This is the highest number of transactions recorded since August of last year. In the last 30 days alone, Solana has handled over 1.7 billion transactions, a volume considerably higher than other popular blockchains such as Ethereum and Binance Smart Chain (BSC).

Solana's ecosystem is also demonstrating impressive growth, notably led by the decentralized exchange Pump. The network processed transactions valued at over $121 billion in the last 30 days, exceeding the combined total of Ethereum, BSC, and Base Blockchain.

Strong Institutional and Retail Demand for Solana

Solana is also experiencing robust demand from both American institutional and retail investors. The cumulative inflows into Solana's exchange-traded funds (ETFs) have risen to over $833 million, with net assets reaching $1.18 billion. This growth is largely attributed to Solana's strong performance in key areas such as decentralized finance (DeFi) and real-world asset tokenization, where it stands as the second-largest blockchain network after Ethereum.

Upcoming Alpenglow Upgrade Poised to Drive Further Growth

Solana's next significant catalyst is expected this quarter with the launch of the Alpenglow upgrade. This upgrade is set to introduce new features, including faster transaction speeds and major architectural enhancements, which are anticipated to further boost the network's capabilities and appeal.

Solana Price Technical Analysis Indicates Further Upside

On the 12-hour timeframe chart, the SOL token has shown a significant upward trend, climbing from its December low of $117 to its current price of $145. The token has formed a rounded bottom pattern and is approaching the 23.6% Fibonacci Retracement level.

Solana has moved above the 50-period Exponential Moving Average (EMA) and has successfully flipped the Supertrend indicator from red to green. Historically, cryptocurrencies and other assets tend to experience rallies when the Supertrend indicator turns green.

Based on this technical analysis, the next key target for Solana's price is the 50% retracement level, situated at $185. This represents an approximately 40% increase from its current trading level.