The Solana price experienced a 3% decline in the past 24 hours, trading at $136.60 as of 4:29 a.m. EST. This movement occurred amidst a surge in trading volume, which increased by 69% to $9.5 billion.

This development follows the launch of VanEck's Solana ETF (exchange-traded fund) on Nasdaq. VanEck has announced a waiver of its sponsor fee for the Solana ETF (VSOL) at launch, applicable to the first $1 billion in assets or until February 17, 2026, whichever comes first.

VSOL is now the second spot SOL ETF available in the US and offers a staking yield of 5.70%.

🚨BREAKING: VanEck’s @Solana ETF goes live for trading, seeding with $7.32 million.pic.twitter.com/4LbSnyZRVG

— SolanaFloor (@SolanaFloor) November 17, 2025

The fund is trading on the Cboe BZX Exchange with an initial sponsor fee of 0.30% being waived. Concurrently, SOL Strategies has also agreed to waive its 0.28% staking provider fee for the same period.

Gemini Trust Company will serve as the primary custodian, with Coinbase Custody Trust Company providing additional custody services.

State Street Bank and Trust Company is responsible for cash custody and fund administration. Van Eck Associates Corporation had previously provided $10 million in seed funding on October 29.

The introduction of the ETF may open avenues for institutional investment, raising questions about its potential impact on the Solana price.

Solana Price Drops Into Key Support Zone As Bearish Pressure Intensifies

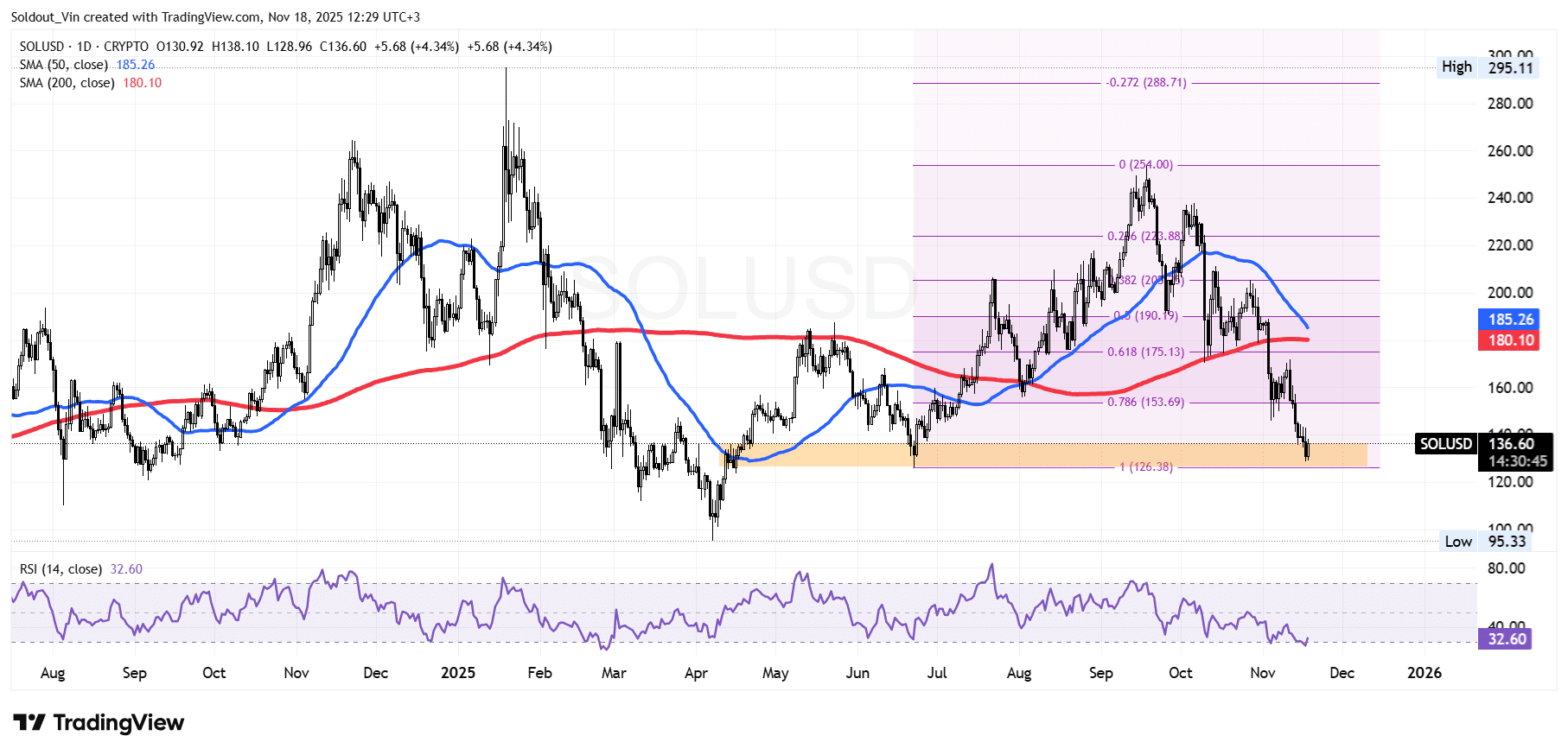

Following a strong rally from the $126 zone in June, the SOL price advanced towards the $254 region in September.

However, the Solana price encountered resistance at this level, leading to a multi-week corrective phase. During this period, SOL traded within a weakening structure, transitioning from mild consolidation to a deeper bearish retracement.

Bulls attempted to defend the 0.382 and 0.5 Fibonacci levels in October, but sustained selling pressure pushed the price below the 0.618 level at $175 and subsequently below the 0.786 retracement near $153.

This downward trend has now brought the SOL price directly into the significant demand zone located between $126 and $135. Recent price action indicates a clear touch of this zone following a rapid decline, underscoring the prevailing market uncertainty.

Further reinforcing the bearish sentiment, the 50-day Simple Moving Average (SMA) has sharply curved downwards and is currently positioned slightly above the 200-day SMA.

Additionally, the Relative Strength Index (RSI) has moved towards the 30-oversold level, currently standing at 32. This indicates the intensity of the bearish momentum but also suggests that SOL may be approaching conditions where relief bounces are typically observed.

SOL Price Prediction

Based on the SOL/USD chart analysis, the Solana price is demonstrating strong bearish momentum. It is trading below both the 50-day and 200-day SMAs, and has fallen below each major Fibonacci retracement level.

Should the bearish pressure persist and SOL close decisively below the $126 level, the next anticipated downside target is near $110, with a potential further decline extending towards $95.

Conversely, if oversold conditions trigger a buying opportunity for bulls, initial resistance is expected around $153, close to the 0.786 Fib level. A sustained recovery would necessitate reclaiming the $175 zone and breaking above the 50-day SMA, which would then weaken the current bearish outlook.

Related News

- •Bitcoin Slumps Below $90K, Ethereum And XRP Slide As ‘Extreme Fear’ Grips Investors

- •Bitcoin Price Plunges Below $90K As Saylor Buys $835M BTC

- •El Salvador Buys The Dip With $101M Bitcoin Purchase