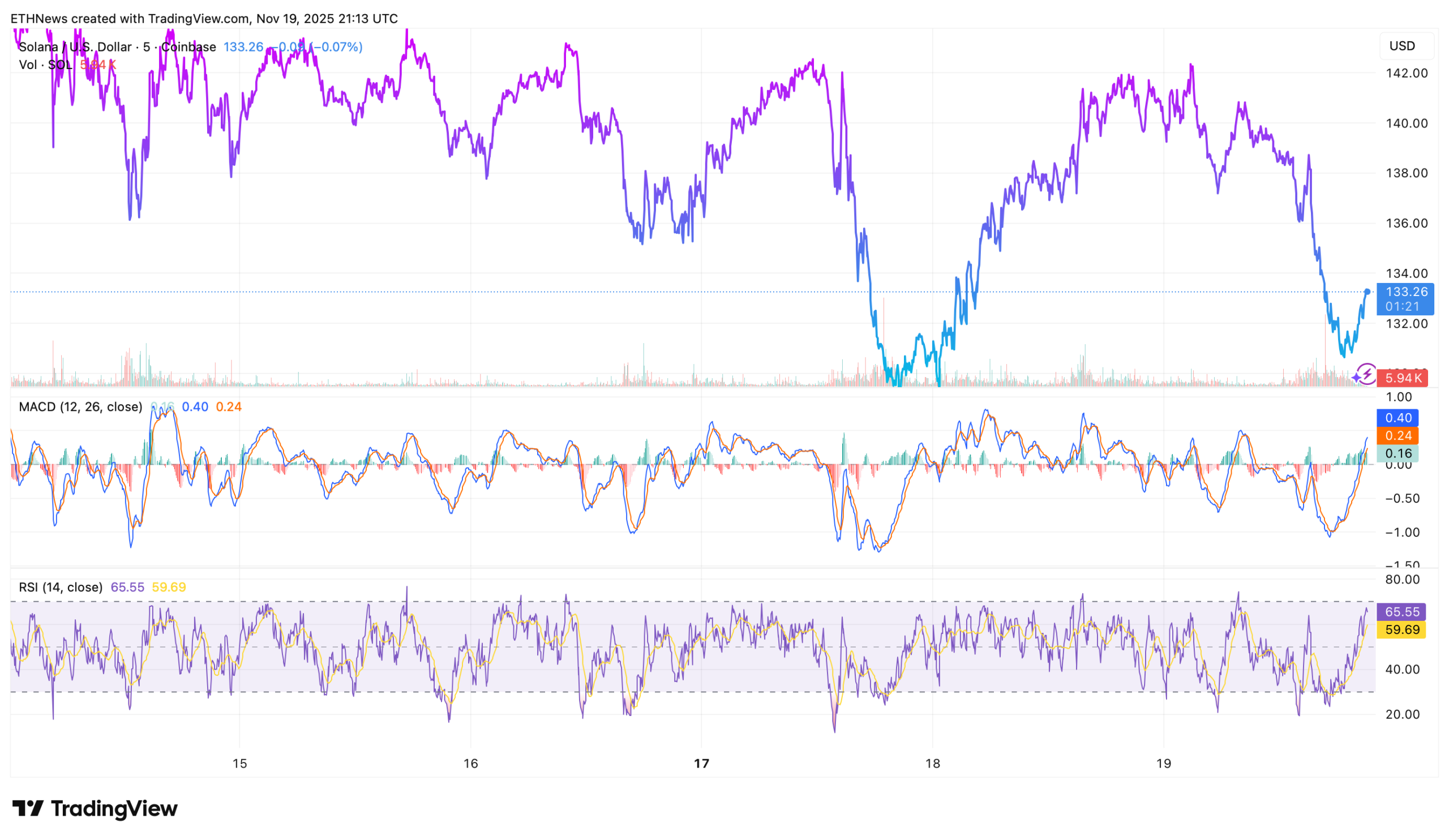

Solana extended its multi-day decline on Tuesday, falling another 5.4% to $133 and deepening its 13.4% weekly slide. The move mirrors broad market weakness but also reflects key technical breakdowns unique to SOL.

Market Pressure Pulls SOL Under Key Levels

Solana broke below the $140 psychological level, a zone that has acted as both support and resistance throughout Q4. Once this level failed, automated selling and stop-loss triggers accelerated the decline, pushing SOL toward the lower end of its recent range.

Trading volume dropped 26.7% over 24 hours, signaling traders stepped back rather than buying the dip. Market-wide risk-off sentiment, driven by Bitcoin slipping under $90K and ETF outflows, added further weight.

Technical Indicators Point to Bearish Momentum

SOL is trending beneath all crucial short-term moving averages.

- •7-day SMA: $140.77, now firmly overhead

- •MACD: Bearish but beginning to converge upward

SOL remains below every intraday moving average, confirming bears maintain short-term control.

With structure broken on the 4h and daily timeframes, the next major support sits at $126, a level that held twice in late October.

What Traders Should Monitor Next

A meaningful reversal requires a daily close above the 7-day SMA ($140.77). Without reclaiming this level, rallies are likely to reject and fall back toward $130 or $126.

Short-term sentiment remains fragile across the altcoin market. SOL’s strong ETF inflows and ecosystem strength have not been enough to offset the current macro-driven unwind.

Conclusion

Solana’s decline is being driven by a mix of market-wide risk aversion and a clear technical breakdown below $140. While the asset is approaching oversold territory on lower timeframes, bulls must reclaim $140.77 to invalidate the bearish structure. Until then, $126 remains the critical support to watch.