Key Developments and Industry Reactions

In 2024, Special Purpose Acquisition Companies (SPACs) successfully raised over $24 billion, indicating a resurgence of investor interest. The primary sectors attracting this significant funding include cryptocurrency, nuclear energy, and quantum computing. This allocation of capital represents a notable shift in investment focus compared to previous years, with the crypto industry expected to play a substantial role in bolstering technological advancements and driving adoption.

The substantial increase in SPAC funding suggests a potential turning point for the market. Projections indicate that 2025 could surpass 2021 in terms of SPAC transaction volume, signaling a strong outlook for the year ahead. However, historical performance data reveals challenges in maintaining investor confidence over the long term. Since 2019, only 11% of SPAC IPOs have seen their stock prices remain above their original issue price, and nearly half have experienced considerable value depreciation.

"Crypto 2025... will unite top global blockchain experts and leaders to discuss the industry's future." — ChainCatcher, Event Organizer

ChainCatcher and RootData are scheduled to host the "Crypto 2025: Breaking the Deadlock and New Birth" conference in April 2025. This event aims to bring together leading blockchain experts to deliberate on the future challenges and opportunities within the industry. The conference is anticipated to be a pivotal moment for the crypto sector, with discussions focusing on decentralized finance (DeFi), non-fungible tokens (NFTs), and regulatory themes that could significantly influence market strategies and investor sentiment towards blockchain innovations.

Historical SPAC Performance and Cryptocurrency Market Analysis

A notable observation regarding SPACs is their historical performance. Since 2019, a significant majority of companies that have gone public through SPACs have struggled to maintain their initial valuation. Only 11% of these companies have seen their stock prices stay above their IPO price, with almost half experiencing substantial declines. This trend suggests a degree of investor caution, even amidst recent surges in funding.

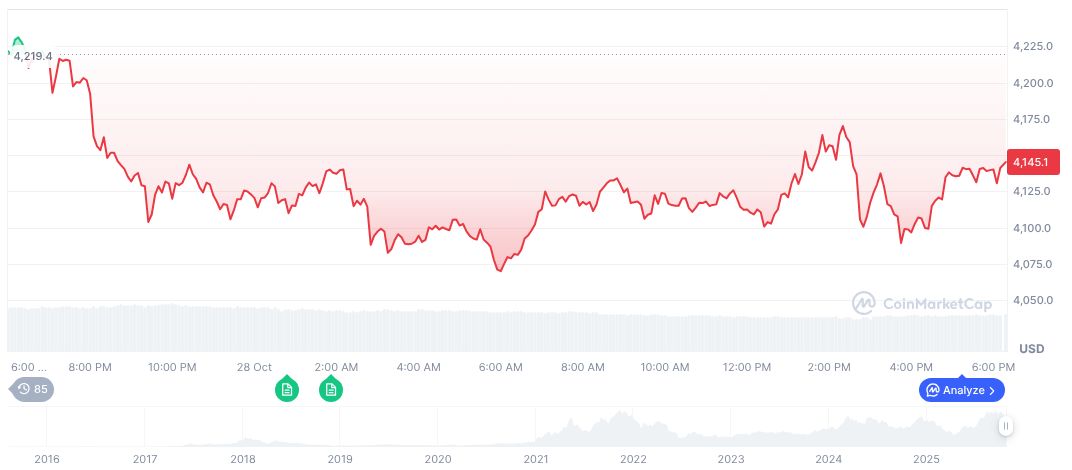

In the cryptocurrency market, Ethereum (ETH) is currently trading at $4,008.56, with a market capitalization of $483.83 billion. Recent trading data shows a 9.05% increase in trading volume over a 24-hour period, despite a 2.81% decrease in its price. Over a 90-day period, ETH has shown a gain of 3.82%, illustrating its price volatility and the dynamic nature of the cryptocurrency market.

Research from the Coincu research team suggests that a cautious yet strategic approach is advisable when monitoring SPAC trends. The considerable variations in the success rates of IPOs highlight the importance of thorough investor scrutiny. This scrutiny could potentially influence future regulatory frameworks and shape investment strategies within the cryptocurrency space.