Stable's Second Pre-Deposit Phase Targets Significant Liquidity Enhancement

Stable, a prominent stablecoin public chain, has announced the commencement of its second pre-deposit phase, scheduled to begin on November 6, 2025. This phase is designed to accept up to $500 million in USDC, with the strategic objective of enhancing on-chain liquidity. The initiative is specifically crafted to bolster institutional market access and improve the overall liquidity of stablecoins, signaling considerable interest from mainstream financial institutions in the digital asset space.

The project, led by Joshua Harding, aims to convert deposited USDC into new USDT, thereby directly increasing on-chain USDT liquidity. This move is intended to serve as a bridge, connecting institutional funds with on-chain markets and leveraging Stable's infrastructure for seamless financial transactions through stablecoins. The initiative has garnered support from notable industry figures, including Paolo Ardoino and Bryan Johnson, underscoring its perceived importance and potential impact within the cryptocurrency ecosystem.

Paolo Ardoino, the CEO of Tether, has publicly commended Stable for its innovative approach, highlighting its potential to significantly influence the utilization of stablecoins in mainstream financial markets. This endorsement from a key player in the stablecoin industry suggests a strong alignment with the strategic goals of institutional investors and traditional finance entities.

"The support we have received from major investors in both crypto and traditional finance shows that they share our vision, one that we are incredibly excited to work alongside them to make a reality." - Joshua Harding, Founder and CEO, Stable

Market Implications and Historical Context of Stablecoin Evolution

The second phase of Stable's pre-deposit initiative draws parallels with previous stablecoin migrations, such as Tron’s USDT migration. These historical events have often been instrumental in reinforcing institutional financial strategies, particularly during periods of market fluctuation, and highlight a recurring pattern in the evolution of stablecoin utility and adoption.

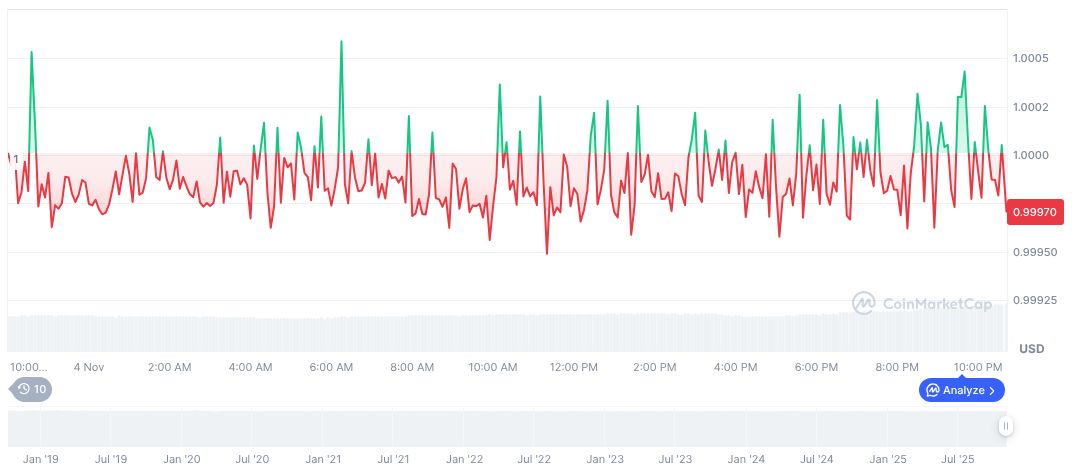

As of recent data, USDC maintains a stable price of $1.00, with an approximate market capitalization of $75 billion and a 24-hour trading volume around $23 billion. These figures, sourced from CoinMarketCap, indicate a robust market presence for USDC, with minimal price volatility observed over various timeframes. The stability and liquidity of USDC are key factors in its widespread adoption by both retail and institutional users.

Reports suggest that Stable's current efforts could have extensive implications for the overall liquidity within the stablecoin ecosystem. This aligns with historical precedents set by other stablecoin initiatives that have successfully enhanced usability and market integration. Furthermore, the emphasis on stablecoin compliance, particularly in line with regulatory frameworks like the GENIUS Act, is seen as a catalyst for positive growth potential and enhanced market legitimacy for these digital assets.