Key Market Events on the Horizon

The cryptocurrency market is anticipating a pivotal week with several significant events scheduled, including the mainnet launch of Stable Protocol, multiple substantial token unlocks, and key macroeconomic updates. These developments are expected to influence token supplies and overall market dynamics, potentially leading to notable price fluctuations and shaping the future economic landscape of various cryptocurrencies.

Stable Protocol Mainnet Aims to Enhance DeFi Engagement

Stable Protocol's mainnet launch, scheduled for December 8, 2025, marks a significant advancement for the Decentralized Finance (DeFi) sector. The development team has emphasized that this transition will enable permissionless issuance and redemption of tokens, thereby creating new avenues for developers and integrators within the DeFi ecosystem. The transition from testnet to full production is a critical step, allowing for seamless integration into existing DeFi platforms and the creation of new financial products.

The immediate implications of Stable's mainnet launch are anticipated to include an increase in Total Value Locked (TVL) and enhanced integration with current DeFi ecosystems. Concurrently, the upcoming release of MOVE tokens on December 9, 2025, is intended to foster ecosystem development. Market participants are preparing for potential shifts in liquidity dynamics that may arise from these events. Experts suggest that these developments could also stimulate on-chain activity by attracting a larger number of developers and liquidity providers to the platform.

Market reactions to these impending events are varied. Some stakeholders are optimistic that the new opportunities within DeFi, driven by Stable's launch, will spur innovation. Conversely, others express concerns regarding potential market disruptions stemming from the significant token unlocks.

MOVE Token Unlocks Anticipated to Increase Market Volatility

The launch of Stable Protocol's mainnet could mirror past successful DeFi platform debuts, such as Arbitrum One, which experienced a measurable increase in DeFi participation and network activity. This historical trend suggests a potentially similar positive trajectory for upcoming DeFi ecosystems.

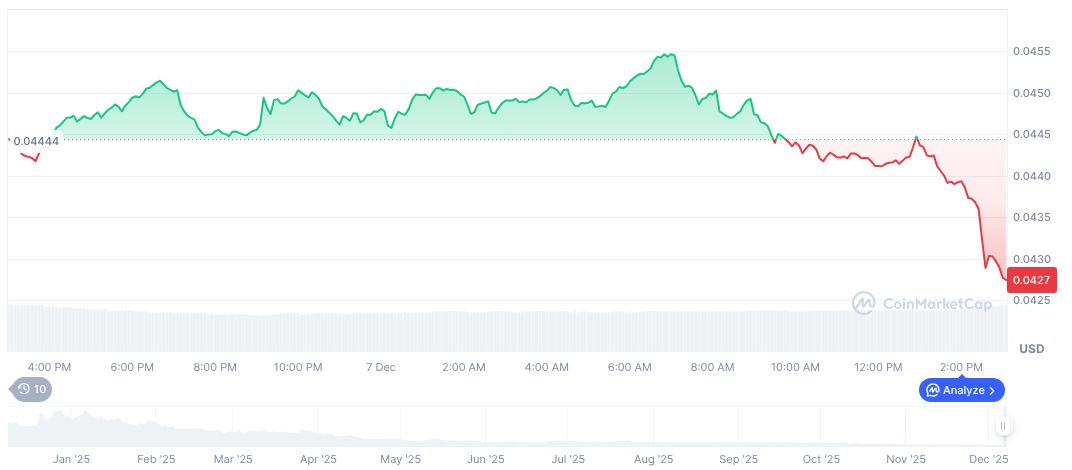

As of December 7, 2025, the MOVE token was trading at $0.04, reflecting a 3.78% decrease over the preceding 24 hours. The token's current market capitalization stands at $119.75 million, with a total circulating supply of 2.8 billion tokens. The MOVE market has demonstrated considerable volatility, with price changes of -60.84% over the past 60 days indicating significant fluctuations.

Research from the Coincu team indicates that these upcoming events could lead to short-term market fluctuations, particularly when influenced by macroeconomic factors, such as potential decisions from the Federal Reserve within the current week. While historical trends suggest a renewed interest in DeFi following the launch of platforms like Stable, the substantial unlock of MOVE tokens is a key factor that could exacerbate market volatility.