Market Dynamics Driven by Stablecoin Liquidity

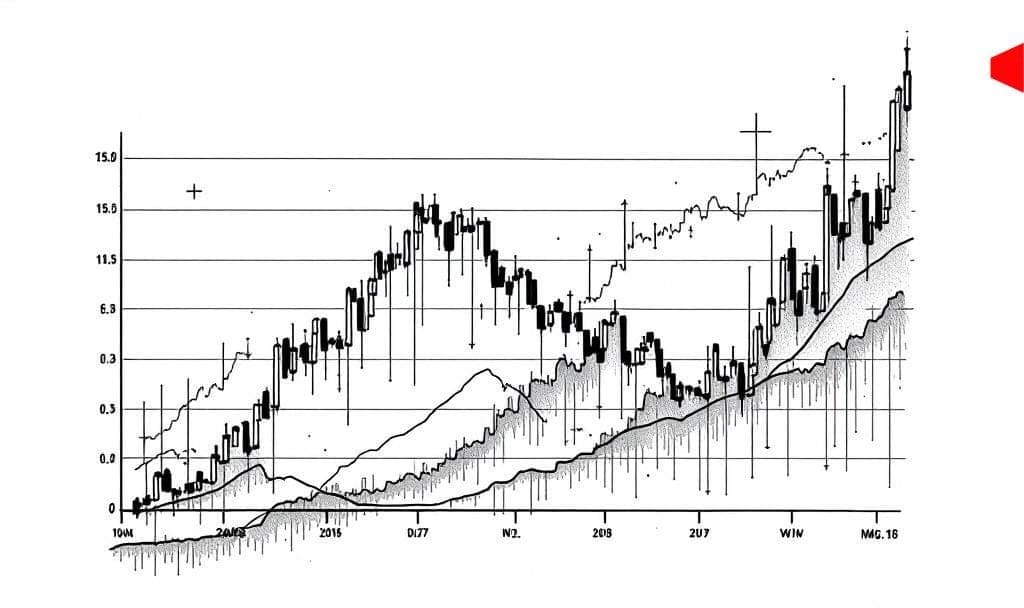

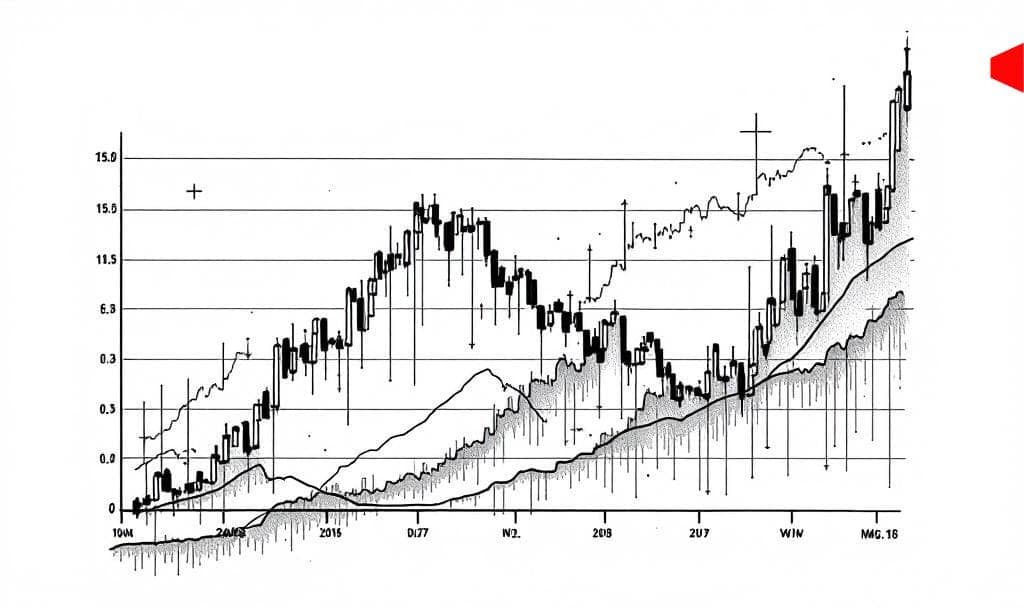

Rising stablecoin liquidity on Binance is driving a bullish consolidation phase for Bitcoin. This trend is supported by substantial inflows of Tether and USD Coin, according to on-chain data from CryptoQuant.

With Binance central to these events, the important inflow of capital has been described as "dry powder," poised for rapid deployment into the cryptocurrency market.

Exchange Reserves and Investor Appetite

The immediate effect of these inflows includes the reduction of Bitcoin reserves on exchanges, signaling a potential shift towards self-custody among investors.

Such liquidity trends suggest an increasing appetite for altcoins, indicating a broadened market scope as investors seek higher-risk opportunities within the cryptocurrency ecosystem.

Historical Precedents and Market Maturation

These movements reflect historical precedents where stablecoin inflows have preceded market expansions, particularly during Bitcoin's previous accumulation periods.

Increased stablecoin use on platforms like Binance signifies a maturing market structure, as liquidity provision and capital rotation advance potential bullish market cycles.

Stablecoins directly eat into the ‘Bitcoin as everyday money and emerging market escape hatch’ segment while deepening on-chain dollar liquidity and absorbing Treasury bills. That’s a direct hit to Ark’s earlier total addressable market assumptions. — Cathie Wood, CEO, ARK Invest