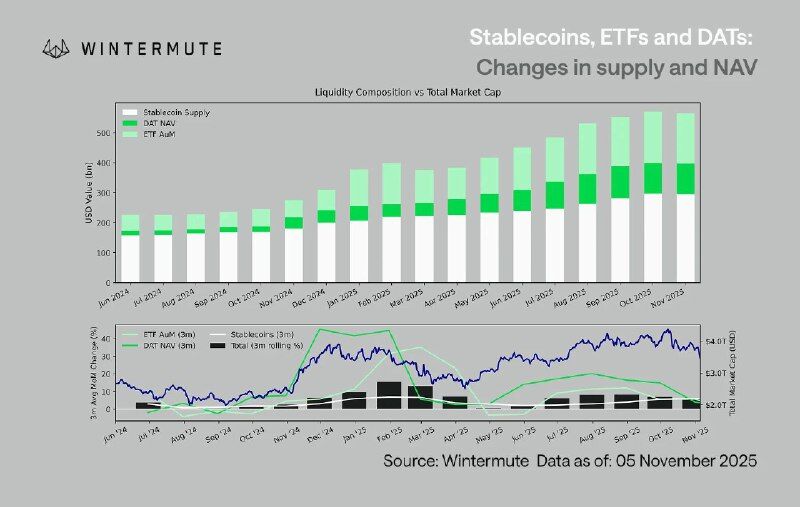

After an explosive year of liquidity expansion, Wintermute’s latest data reveals that stablecoins, exchange-traded funds (ETFs), and digital asset trusts (DATs) have collectively surged from $180 billion in 2024 to $560 billion in November 2025, a more than 3x increase.

However, that momentum appears to be slowing, signaling that crypto’s most important liquidity engines may be entering a consolidation phase.

From Explosive Growth to Plateau

According to Wintermute’s breakdown, the combined market value of stablecoins, ETFs, and DATs expanded rapidly throughout late 2024 and the first half of 2025, driven by strong institutional inflows and new product launches.

Stablecoins, led by USDT, USDC, and PYUSD, remain the backbone of digital liquidity, providing a reliable on-chain base layer for trading and settlement. Meanwhile, the rise of spot Bitcoin and Ethereum ETFs added unprecedented institutional depth, contributing to much of the year’s liquidity acceleration.

DATs, including private funds and tokenized treasury instruments, filled the gap between DeFi and traditional finance, collectively pushing the digital asset liquidity base above half a trillion dollars for the first time in history.

Why the Momentum Is Slowing

Wintermute’s report notes that the rate of growth has significantly decelerated since August 2025, with ETF inflows and DAT expansion stabilizing. Analysts attribute this slowdown to a combination of macro tightening, profit-taking, and reduced stablecoin minting activity following months of risk-on sentiment earlier in the year.

The data also shows a flattening of the 3-month rolling change in NAV, suggesting that crypto liquidity may have reached a cyclical peak before potential reacceleration in 2026.

The Road Ahead

The big question now: Where does the next liquidity wave come from?

Some analysts point to tokenized U.S. Treasuries and real-world asset ETFs as the next major driver, while others expect a shift toward layer-2 settlement tokens and cross-chain stablecoin protocols.

Wintermute’s data implies that while the first institutional phase of digital liquidity growth may be maturing, the underlying infrastructure, particularly in stablecoin velocity and ETF adoption, continues to strengthen.

If 2024–2025 marked the buildout phase of crypto liquidity, the next stage could define how effectively that liquidity flows into risk assets and real-world use cases.