Fundraising Round Overview

Stable’s second fundraising round, totaling $500 million, sold out in under 30 minutes. Despite a $100,000 wallet cap, most of the allocation went to institutional investors. This follows the project's first round, where $825 million was raised, with data revealing that 73% of the funds were deposited by insiders before the public announcement. This trend highlights the significant dominance of institutional investors over retail access in the cryptocurrency space.

While Stable introduces innovative technology, such as using USDT as gas for transactions, potential investors face risks due to unclear tokenomics and vesting schedules. In the current market conditions, patience and selectivity are advised over succumbing to Fear Of Missing Out (FOMO).

The Challenge of Accessing Stable's Fundraising

The recent fundraising event for Stable was notably inaccessible. Upon attempting to deposit funds shortly after the launch, the webpage became unresponsive, preventing participation. This lack of access, coupled with the absence of explicit airdrop expectations from the project team, led to a decision to abstain from investing, a choice that is often prudent in prevailing market conditions.

Further research into Stable revealed it is an L1 blockchain specifically engineered for stablecoins. Its primary objective is to address the persistent issues of high transaction fees and slow speeds commonly encountered when transacting with stablecoins, effectively making USDT transfers faster and more cost-efficient. The project's considerable traction is likely attributed to its impressive roster of backers, including a $28 million investment from Bitfinex in the seed round, which also serves as an advisor. Hack VC led this round, and Tether_to is also a supporter, aligning with Stable's core feature of utilizing USDT directly as gas, thereby enabling fast and protocol-layer-free transactions.

Yesterday's fundraising represented the second phase of capital infusion, with a $500 million allocation and a $100,000 cap per wallet. The entire sum was reportedly depleted in less than 30 minutes. The initial fundraising round secured $825 million, which was allegedly all accounted for within 10 minutes. A significant portion of participants in both rounds were major DeFi projects, such as ConcreteXYZ and Frax Finance.

The Dynamics of Insider Allocation

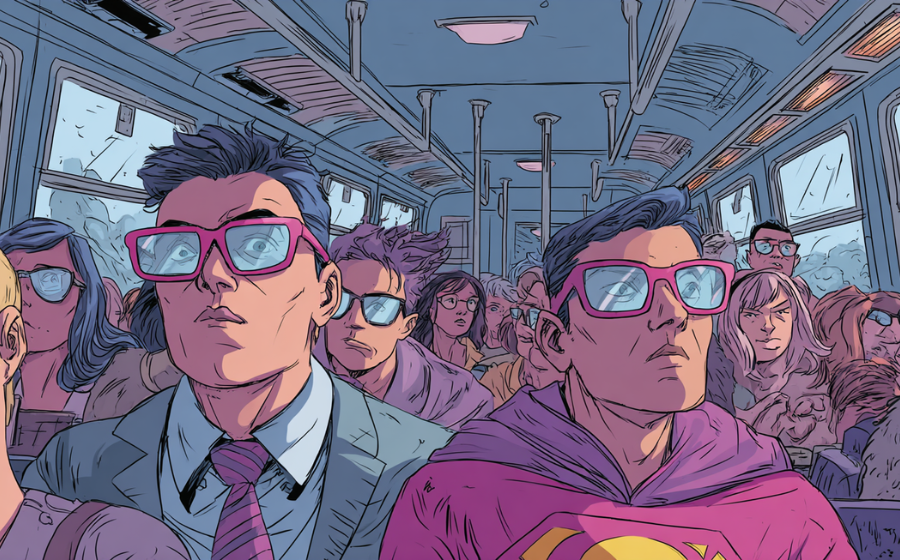

The intense demand for Stable's fundraising rounds, particularly the second $500 million round with its $100,000 wallet cap, led to widespread FOMO. Despite the cap, many individuals were unable to secure an allocation, with institutions reportedly dominating the participation. This situation is exacerbated by the revelation from the first round's data: approximately $600 million, or 73%, of the $825 million total was deposited by "insiders" prior to the public announcement.

This pattern is common with highly sought-after projects, where the majority of the allocation is secured by well-connected entities long before the general public becomes aware. However, investing under such circumstances can be risky, as capital may be locked up for extended periods with uncertain exit strategies. The project team has not provided clear airdrop commitments, and the tokenomics model remains undisclosed in the whitepaper, adding to the investment uncertainty.

Prioritizing Better Opportunities

When a particular project's investment opportunity does not align, the prudent approach is to move on to other prospects rather than chasing every available option. The cryptocurrency landscape is rich with diverse opportunities, and sometimes the most strategic investment decision is to refrain from investing altogether. Committing capital to an investment with ambiguous terms is often less advantageous than identifying projects that offer greater transparency and more equitable distribution mechanisms.

The prevalent situation with Stable underscores a broader trend within the cryptocurrency market. Projects that secure substantial institutional backing often cultivate an environment of artificial scarcity, which in turn fuels retail FOMO. However, a closer examination frequently reveals that the majority of allocations are predetermined through private channels, rendering public rounds largely symbolic and offering a facade of community involvement while the primary transactions have already occurred much earlier.

While Stable possesses promising technological foundations, credible backers, and addresses a genuine problem in stablecoin transaction costs, this does not necessitate forcing participation in every funding round regardless of the cost. Future opportunities to engage with the project may arise through secondary markets, subsequent funding rounds, or by utilizing the product post-launch.

The critical takeaway from this experience is the importance of maintaining investment discipline. The impulse to follow the crowd should be resisted. Thorough research, a clear understanding of investment terms, and a careful evaluation of the risk-reward ratio are essential for making logical, rather than emotional, decisions. In a dynamic market characterized by continuous new launches, patience emerges as a significant competitive advantage.

Understanding Market Dynamics

The Stable fundraising scenario serves as a clear illustration of the current state of cryptocurrency fundraising. The era where retail investors had a substantial chance at early-stage opportunities has largely passed. Today, access is often determined by connections, timing, and participation in exclusive networks. While a $100,000 wallet cap might seem substantial, it becomes less significant when institutions can deploy multiple wallets and coordinate their entry strategies.

Furthermore, the lack of transparency regarding token distribution and vesting schedules is a cause for concern. Investing capital without a complete understanding of the tokenomics is akin to making a blind bet. Although the project has prominent supporters, this does not guarantee favorable terms for later investors; in many cases, it implies the opposite, with early backers and insiders negotiating more advantageous conditions.

The innovative feature of using USDT as gas addresses a genuine challenge in the crypto ecosystem. Currently, stablecoin transfers require paying gas fees in the native token of the blockchain, adding complexity and cost. If Stable can simplify this process and eliminate protocol-layer fees, it would represent a significant advancement. However, technological innovation alone is not sufficient justification for blind investment, especially when entry conditions are vague and lock-up periods are undefined.

The Broader Context of Crypto Fundraising

Observing the broader cryptocurrency landscape reveals a recurring pattern in high-profile project launches. Projects announce public funding rounds, attracting significant retail interest, only for it to emerge that the majority of allocations were already secured by pre-positioned insiders. While not necessarily indicative of malicious intent, this trend prompts questions about the true meaning of "public" in these fundraising efforts. If 73% of an allocation is committed before any public announcement, its classification as a public round becomes debatable.

This dynamic creates a challenging environment for average investors. While the desire to participate early in promising projects is strong, retail investors often find themselves competing against sophisticated players who possess superior information, advanced infrastructure, and greater capital resources. The odds are inherently skewed, making it crucial to recognize this reality for informed decision-making.

This does not imply that early-stage investment opportunities should be abandoned entirely. Instead, a more discerning and strategic approach is warranted. Investors should prioritize projects that demonstrate genuine transparency, employ fair distribution mechanisms, and offer clear tokenomics. Rushing into situations with vague terms and opaque allocation processes should be avoided. Capital is a valuable resource, and its judicious deployment sometimes necessitates declining participation in the most trending opportunities.

Maintaining a disciplined and positive outlook is recommended, recognizing that new projects and opportunities will continue to emerge. Allowing FOMO to dictate investment choices can be detrimental. The cryptocurrency space tends to reward patience and meticulous analysis more than impulsive pursuit. Adopting a calm and analytical approach, rather than a reactive one, is often more beneficial.