Strategy, identified as Bitcoin’s largest corporate holder, has significantly decreased its Bitcoin purchases throughout 2025. Data from CryptoQuant indicates a substantial shift from aggressive Bitcoin accumulation to minimal acquisition. This abrupt change has prompted discussions regarding the long-term viability of Strategy’s Bitcoin holdings and potential adjustments to its investment strategy.

A Significant Drop in Purchases

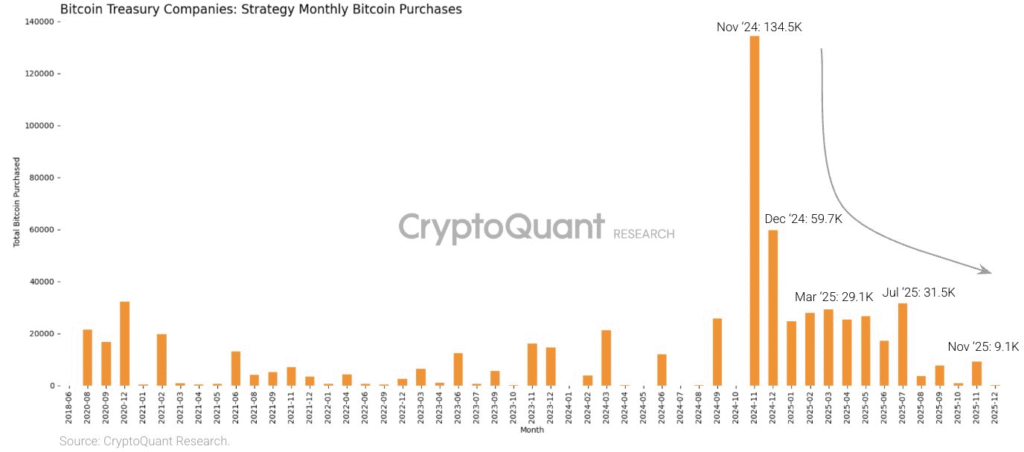

During the peak of Bitcoin’s bull market in November 2024, Strategy acquired 134,500 BTC. However, by November 2025, the company’s monthly Bitcoin purchases had dwindled to just 9,100 BTC.

This downward trend continued into December, with only 135 BTC purchased, marking one of the slowest months in recent years. This development reflects a broader pattern of reduced buying pressure from major institutional investors, exacerbated by a more cautious market sentiment following the ongoing downturn.

Eli Cohen, a corporate lawyer for Centrifuge, commented on the potential risks, stating, "Public companies can and do completely implode. Enron, Lehman Brothers, and recently banks like Silicon Valley Bank have all seen such failures. No company, no matter how large, is too big to fail."

Strategy’s decision to scale back its Bitcoin acquisitions is viewed as a necessary measure to maintain its stability, though it has also raised concerns about the firm’s financial resilience.

Strategy’s Financial Strategy to Secure Cash Flow

In response to growing concerns about its financial stability, Strategy has established a reserve of $1.44 billion to meet its financial obligations. This reserve is intended to ensure the company can cover its dividend payments and interest on outstanding debt for a minimum of 12 months.

To further bolster its long-term financial health, the firm plans to maintain sufficient liquidity to extend this coverage period to 24 months.

Despite the cautious approach to new Bitcoin purchases, Strategy’s overall holdings remain substantial, comprising 650,000 BTC valued at approximately $60 billion. This represents 3.1% of Bitcoin’s total supply, positioning the firm as a significant player in the market. However, the slowdown in its Bitcoin accumulation has drawn scrutiny from both internal stakeholders and external observers.