Michael Saylor has signaled that Strategy may purchase more Bitcoin this week, following a post on X (formerly Twitter) where he shared a screenshot of the SaylorTracker chart with the caption, "₿ack to Orange Dots?"

Historically, similar posts made on Sundays have preceded announcements from Strategy regarding the acquisition of additional BTC.

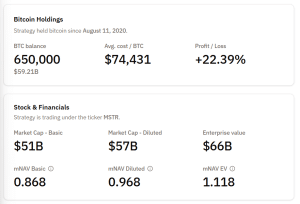

A fresh purchase would increase the company's Bitcoin holdings to over 650,000 BTC, currently valued at more than $59 billion, with an unrealized gain of approximately 22%.

If the company announces another Bitcoin acquisition later today, its substantial BTC reserves will surpass 650,000 coins, accumulated at an average price of $74,431.

Saylor's question about returning to "orange dots" refers to markers on the SaylorTracker chart. Last week, Strategy added its first green dot to the chart, signifying the establishment of a $1.4 billion USD reserve intended to cover dividend payment obligations.

Strategy's Recent Buying Activity Could Signal a Bear Market

Strategy has continued to acquire Bitcoin during periods of price weakness, although recent purchases have been smaller in volume compared to earlier in the year.

Over the past two months, the company's Bitcoin purchases have generally been less than 1,000 coins. An exception occurred on November 17, when Strategy bought 8,178 BTC for $836 million, according to the company's website.

Commenting on Strategy's Bitcoin buying activity, CryptoQuant issued a warning that the slowdown in purchases and the establishment of the $1.4 billion USD reserve could be precautionary measures taken by the company in anticipation of a prolonged bear market.

JPMorgan: Strategy Holds the Key to BTC Direction; MSCI Exclusion Risk Looms

Given Strategy's significant holdings in the largest cryptocurrency by market capitalization, JPMorgan analysts have stated that the company is pivotal to BTC's future direction.

Analysts, led by managing director Nikolaos Panigirtzoglou, noted that the ratio between Strategy's enterprise value and its BTC holdings, or mNAV, has remained above 1, which they described as an "encouraging" sign for the broader market.

This report followed a period where Strategy's stock price plummeted by more than 54% over the last six months, coinciding with a general pullback in digital asset treasury (DAT) firms.

In addition to the correction within the DAT sector, Strategy is preparing for a potential removal from MSCI indexes next month. JPMorgan indicated that if this occurs, it could result in up to $12 billion in lost buying power for Strategy's stock (MSTR). MSCI's decision is expected on January 15.

Last week, Cantor Fitzgerald reduced its price target for Strategy's share price by 60%, but it maintained its "buy" rating for MSTR, stating that fears of a selloff are "overblown."

Michael Saylor has reportedly been in discussions with MSCI. Strive CEO Matt Cole has urged MSCI to reconsider its proposal to remove treasury firms from its indexes, warning that such a move would limit investors' access to "the fastest-growing part of the global economy."

— Matt Cole (@ColeMacro) December 5, 2025

Bitwise CIO Matt Hougan stated last week that concerns about MSTR being forced to sell Bitcoin if delisted from MSCI indexes are "flat wrong."

"I understand why bears want to embrace the MSTR ‘doom loop’ idea," Hougan wrote in a December 3 note to clients. "It would indeed be very bad for the bitcoin market if MSTR had to sell its $60 billion of bitcoin in one go. But with no debt due until 2027 and enough cash to cover interest payments for the foreseeable future, I just don’t see it happening."