Strategy shares experienced a significant surge, climbing almost 6% in after-hours trading. This rally followed the Bitcoin treasury firm's announcement of third-quarter financial results that surpassed analyst expectations. Adding to the positive sentiment, CEO Michael Saylor indicated that the company is unlikely to acquire smaller rivals.

The company reported diluted earnings per share of $8.42 for the three months ending September 30, exceeding Wall Street's forecast of $8.15. Revenue for the quarter reached $2.8 billion. This marks a substantial rebound from a $340.2 million loss recorded in the same period last year, though it fell short of the record $10 billion profit achieved in the previous quarter.

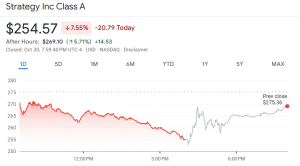

Despite the stronger financial performance, Strategy's stock has faced downward pressure recently. It has declined more than 20% over the past month and over 30% in the last six months. This trend is largely attributed to the ongoing decline in Bitcoin's price, which directly impacts the value of Strategy's substantial crypto holdings, currently valued at $47.4 billion.

Strategy (MSTR) closed the most recent trading day down more than 7%, according to data from Google Finance.

Michael Saylor Unlikely to Pursue Acquisitions of Smaller Rivals

Several firms, including Japan-based Metaplanet and the leading Ethereum treasury firm BitMine Immersion Technologies, have recently experienced significant double-digit drops in their stock prices. Smaller digital asset treasury (DAT) firms, in general, have been facing considerable challenges.

These market conditions have led some analysts to predict that larger DAT firms might begin acquiring smaller competitors. However, Strategy CEO Michael Saylor has stated that the company has no immediate plans for mergers or acquisitions. He cited "a lot of uncertainty" among digital asset treasuries as a primary reason for this cautious approach.

"We don’t have any plans to pursue M&A activity, even if it would look to be potentially accretive," Saylor stated. "An idea that looks good when you start might not still be a good idea six months later."

While ruling out immediate acquisition plans, Saylor did not completely close the door on future M&A activity, adding, "I don’t think we would ever say ‘we would never, never, never, ever.’"

Bitcoin Price Declines Impact Strategy's Treasury Performance

Strategy holds the distinction of being the largest corporate Bitcoin holder globally, with 640,808 BTC on its balance sheet. The company began its Bitcoin acquisition strategy in 2020 and has continued to accumulate the leading cryptocurrency, even as some competitors have slowed or halted their accumulation efforts.

Earlier this week, Strategy acquired an additional 390 BTC for approximately $43.4 million, at an average purchase price of $111,053 per BTC.

The recent 4% slide in Bitcoin's price over the past month, coupled with the decline in Strategy's stock price, has put pressure on the company's BTC treasury performance. According to SaylorTracker, Strategy's mark-to-market net asset value (mNAV) has fallen from a peak of 3.89x in November to its current level of 1.16x.

Despite the decrease in mNAV, Strategy reported that its Bitcoin yields have reached 26% year-to-date, resulting in a $13 billion gain. The company also reiterated its full-year outlook, projecting a 30% BTC yield and a net income of $24 billion. This projection is based on an estimation that the Bitcoin price will reach $150,000 by the end of the year.

With Bitcoin trading at $109,898.61 as of 1:50 a.m. EST, the cryptocurrency's price would need to climb approximately 36% to meet Strategy's year-end target.