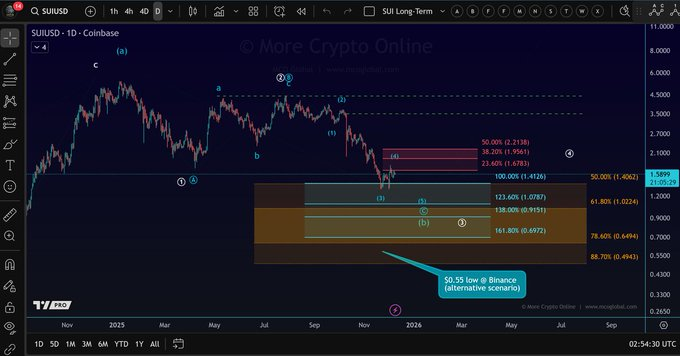

SUI trades under the $1.67–$2.21 resistance range, keeping the corrective structure in place across the broader trend. The intraday action is characterized by consistent selling with the price adjusting between $1.65 and $1.58 with unsuccessful recovery efforts. Downside Fibonacci targets near $1.02, $0.87, and $0.69 stay active as momentum remains tilted lower.

SUI still adheres to a corrective course since recent activity remains in line with a more expansive downward structure. The market shows limited recovery strength while intraday pressure maintains the token near the lower end of its recent range.

Corrective Structure Defines the Current Market Setting

SUI remains inside a multi-month corrective pattern that has shaped market direction since mid-2025. The chart displays a sequence of lower swing highs, showing the larger trend still pointing downward as early 2026 begins. Current movement reflects a bounce inside this framework rather than a directional turn.

Momentum stays weak while SUI trades below the $1.67–$2.21 zone. The chart supports this view, with Fibonacci clusters marking that region as a major resistance boundary. Price action currently sits around $1.58–$1.60, keeping the token below the key barrier.

The daily structure includes retracements at $2.13 and $2.32, forming the upper invalidation area. A sustained break above those levels would be required to confirm a stronger shift. Until then, the broader corrective landscape continues to restrict upside potential.

Intraday Decline Shows Persistent Selling Activity

The 24-hour chart indicates that the SUI has retreated after early readings of about $1.65 to around $1.58. The whole session was characterized by lower highs and lower lows, which implied that sellers were active during the entire period. Each brief recovery attempt faded quickly, leaving momentum pointed lower.

Mid-session movement saw the price slip to around $1.60 before a small bounce appeared. That move failed to gain follow-through, suggesting buyers struggled to maintain pressure at higher levels. The pattern remained dominated by short-term selling flows.

Prices later on in the day consolidated around $1.58-$1.60. The already tight range had briefly stabilized following the previous sell off. However, the lack of sustained support around mid-range levels kept the market leaning downward as activity slowed.

Broader Network Themes Add Context to Market Conditions

A separate report frames on-chain entertainment as a potential driver for broader Web3 adoption. The idea presents consumer-focused experiences as a key entry point, implying that accessible digital environments can attract new users. This aligns with ongoing shifts in blockchain engagement.

SUI is positioned as a network aiming for fast and secure performance to support user experiences. The description ties its infrastructure to a smoother transactional environment, suggesting that such efficiency may support long-term ecosystem activity. The commentary focuses on user perception rather than specific technical metrics.

The Sandbox appears in the broader conversation as a cultural layer built on gaming, digital LAND, avatars, and branded virtual worlds. Its framework connects user ownership with interactive environments and a creator economy powered by SAND. This positions the project within a larger entertainment-driven digital landscape.