Key Updates on SUI Token Dynamics

- •$103.3M in SUI tokens will unlock on Nov 1, adding 1.21% to the circulating supply.

- •SUI DEX volume rose to $23B in October, despite a recent decrease in Total Value Locked (TVL) and price.

- •The market cap of SUI's stablecoins dropped 19% this week, reaching $932 million.

Price Activity Suggests Possible Rebound

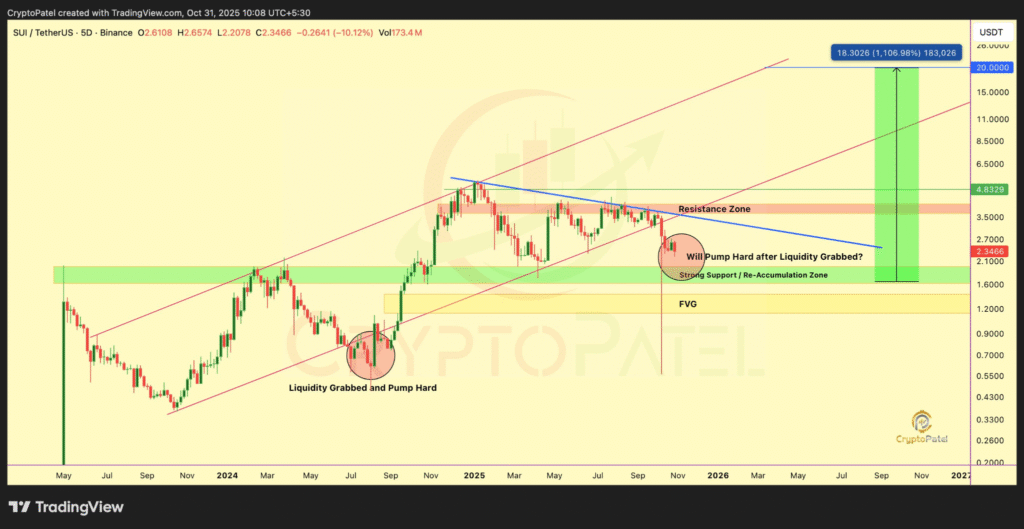

SUI is currently trading within a crucial support range situated between $2.10 and $1.80. This price action was highlighted by trader Crypto Patel on social media. Historically, similar periods of liquidity accumulation in this zone have preceded significant upward price movements, leading to speculation that a similar pattern may emerge again.

The current chart configuration indicates that SUI is consolidating below a resistance area. Should the price successfully break above this zone, certain market analysts project a potential long-term target of $20.

Technical indicators are presently displaying mixed signals. The 10-day Exponential Moving Average (EMA) is positioned at $2.48, serving as immediate resistance. Concurrently, the Relative Strength Index (RSI) is hovering near 36.9, suggesting an almost oversold condition.

Token Unlock Expected to Add Selling Pressure

According to data from Tokenomist, approximately 43.96 million SUI tokens, valued at an estimated $103.3 million, are scheduled for unlocking on November 1. This influx will represent a 1.21% increase in the circulating supply. It is noteworthy that only 36% of the total SUI token supply has been unlocked to date. Scheduled token releases of this magnitude often introduce short-term selling pressure, particularly in environments where market momentum is weak.

On-chain data reveals a deceleration in SUI's network activity. DeFiLlama reports that the total value locked on the Sui network has declined by 4.2% in the past 24 hours, settling at $1.74 billion. This marks the lowest recorded level since July. Furthermore, the stablecoin market capitalization on Sui has experienced a 19% decrease over the last week, falling to $932 million, which indicates a reduction in available liquidity for borrowing and trading activities.

DEX Volume Grows While Institutions Watch Closely

Notwithstanding the observed downturn in network metrics, SUI's decentralized exchange (DEX) activity has shown an upward trend. Monthly trading volume surged from $13.6 billion in September to $23 billion in October. This persistent growth suggests continued engagement from traders on the platform, even amidst prevailing bearish market conditions.

Developments aimed at enhancing SUI's utility are progressing for the longer term. The anticipated launch of new stablecoins, including suiUSDe and USDi, is slated for Q4 2025 through strategic collaborations with Ethena Labs and BlackRock's BUIDL fund. These upcoming stablecoins are expected to contribute to improved liquidity and utility within the Sui ecosystem.

Institutional interest in SUI is also demonstrably growing. Grayscale has established a SUI Trust, and Franklin Templeton has submitted an application for a spot SUI Exchange-Traded Fund (ETF). Furthermore, the venture capital firm a16z is expanding its investment exposure to Sui, indicating a rising interest from significant financial players.