Key Insights

- •The Sui network outage revealed a consensus flaw but preserved data integrity and avoided chain rollback or security breach.

- •SUI price recovered after a liquidity sweep into a key demand zone, sparking controlled buying and directional continuation.

- •Structural support around $1.76-$1.80 remains critical as the market eyes a test of $2.00, with higher targets structurally aligned.

Network Outage and Recovery

The Sui blockchain network entered a period of stability after a sharp decline in late 2025, followed by a notable structural recovery. This shift came after a January 14 mainnet outage disrupted transaction processing for nearly six hours. The incident was traced to an edge-case flaw in Sui’s consensus engine, where conflicting transactions led validators to generate incompatible checkpoint data, halting the network.

Although the outage suspended all transaction submissions, users retained access to read-only data reflecting the last verified state. The disruption paused the creation of new blocks but did not cause any forks or rollbacks. Approximately $1 billion in on-chain value remained idle during the event. The Sui team identified the flaw and issued a fix, after which validators coordinated an upgrade to restore full operations.

Orderly Market Response Indicates Confidence Rather Than Exit

Despite the sudden network disruption, the wider market response remained composed. Participants re-evaluated their positions instead of exiting, suggesting confidence in the network’s resilience. The recovery process unfolded without panic, reinforcing the view that the outage was isolated rather than a reflection of systemic failure.

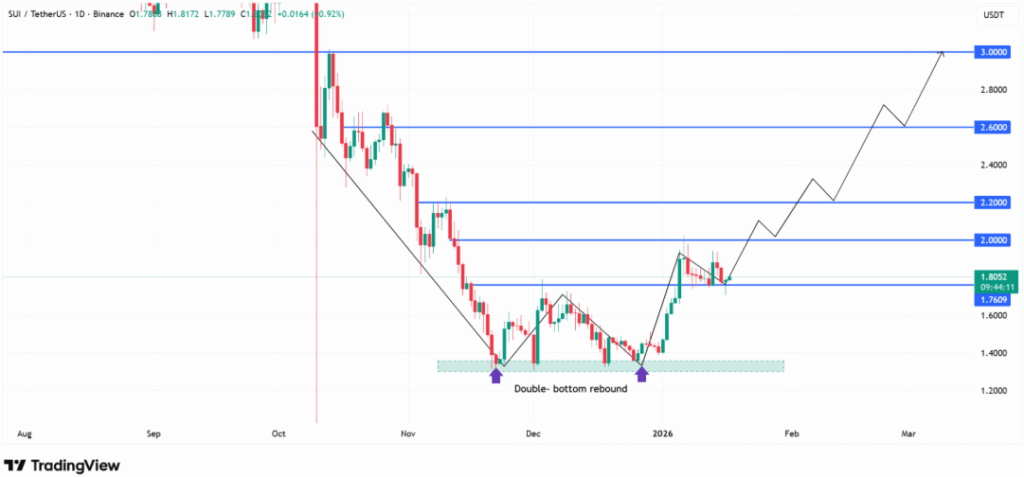

SUI price action revealed signs of structural accumulation rather than reactionary movement. After sweeping sell-side liquidity below prior weekly lows, prices entered the $1.35 to $1.40 demand zone. This region overlapped with a key bullish order block. Buyers absorbed the remaining supply, driving a sharp recovery and filling the nearby fair value gap, indicating a controlled re-entry.

Recovery Sustains Above $1.75 With Focus on $2.00 Level Test

SUI price established a higher-low formation and rebounded off the double bottom at the $1.35–$1.40 zone. This movement pushed the price above the $1.75 anchor, where it remains stable near $1.80. The current consolidation below $1.90 suggests a digestion phase. As long as support holds above $1.76, price movement targets the $2.00 level as the next structural test.

As recovery continues, intermediate resistance levels lie at $2.20 and $2.60, with $3.00 as a further potential target. However, a drop below $1.40 would invalidate the broader bullish structure. Current price behavior signals accumulation and structure-driven momentum rather than speculative volatility.