SUI Price Performance and Technical Indicators

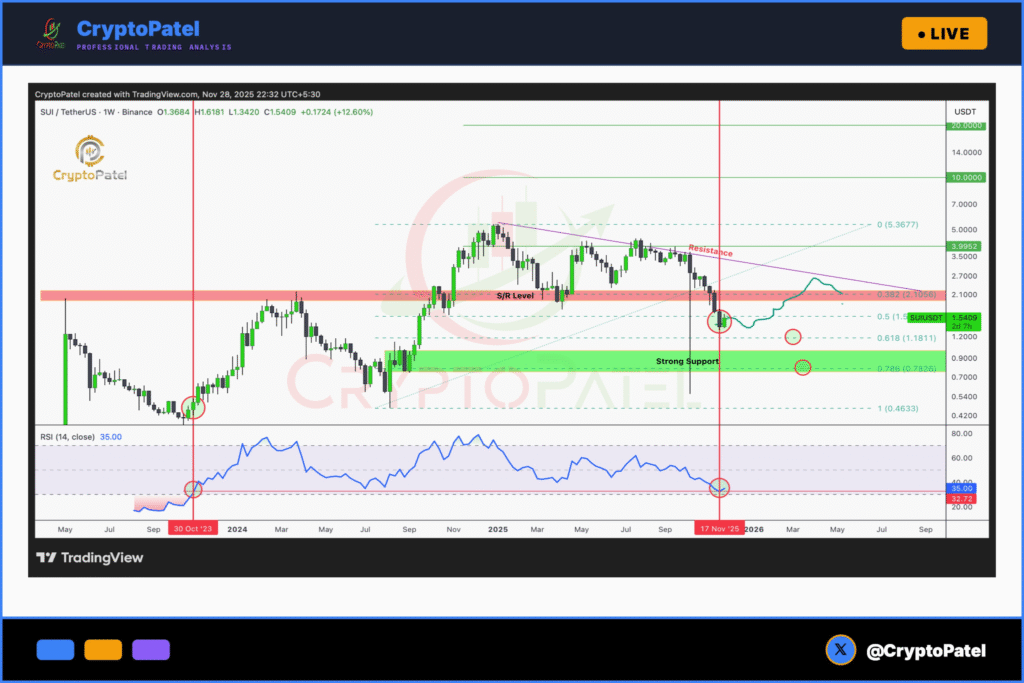

Sui (SUI) has experienced a significant price increase, gaining nearly 13% over the past week and reaching a trading price of $1.50 on November 29. This surge follows a notable decline that pushed the token into oversold territory on the weekly Relative Strength Index (RSI), a technical indicator often signaling a potential trend reversal.

According to analyst Crypto Patel, SUI demonstrated a rebound near the 0.618 Fibonacci retracement level, a significant point of interest for technical traders. Patel highlighted that the weekly RSI has reached its most oversold level observed since the beginning of 2023, suggesting the possibility of a price reversal.

Patel identified a specific support zone on the price chart and indicated that short-term price targets could potentially reach between $2.2 and $3. Furthermore, he suggested that broader, macro targets might extend to $10–$20, contingent on the strength of the recovery. Patel emphasized that this information is not financial advice and encouraged readers to conduct their own research.

Decline in TVL and DEX Volumes Indicate Bearish Sentiment

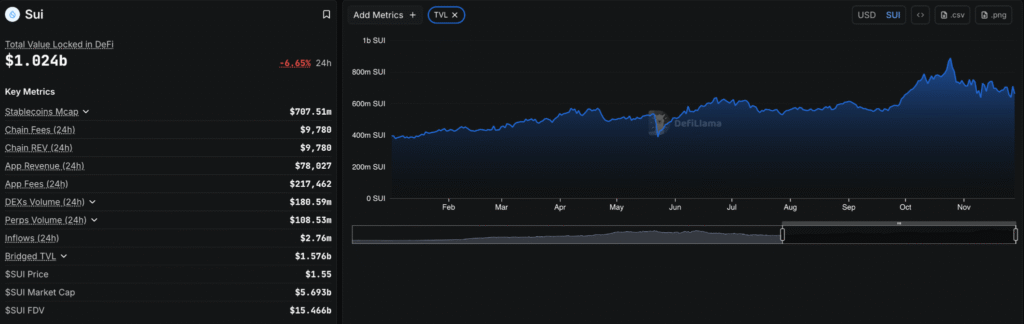

Data from DeFi Llama reveals a substantial 25% decrease in the total value locked (TVL) within Sui's decentralized finance (DeFi) ecosystem. The TVL has fallen from 889 million SUI tokens recorded on October 25 to 661 million tokens as of the end of November.

This decline in TVL appears to correlate with the market's reaction following the U.S. Federal Reserve's most recent meeting, where discussions included the possibility of a third interest rate cut in 2025. The reduction in TVL, as reported by DeFi Llama, reflects a cautious stance adopted by investors during the recent period of market selling pressure.

Additionally, the network's decentralized exchange (DEX) volumes are projected to reach their lowest monthly figure in five months, indicating a decrease in active trader participation. Despite the recent price recovery, the subdued activity across DeFi platforms could potentially exert downward pressure on overall market sentiment. However, technical traders are closely monitoring the situation to observe if current support levels can be maintained.

Market Outlook and Technical Setup Remain Key Factors

Some market observers interpret the current price rebound as a technical correction rather than a definitive shift to a new upward trend. The bounce observed from the Fibonacci level, coupled with the oversold RSI reading, suggests the potential for short-term upward momentum.

The sustainability of this recovery will likely depend on Sui's ability to hold its current support levels. While analyst projections and an increase in trading volume hint at renewed investor interest, the ongoing decline in TVL and DEX volumes continues to suggest a degree of caution within the market.