Key Developments in Stablecoin Regulation

The Swedish central bank, Riksbank, has reported substantial convergence between the US and Europe in stablecoin policies. This alignment focuses on critical areas such as central bank settlement access and the utilization of central bank reserves by stablecoin issuers. The report indicates that while both regions legally permit the use of these reserves, operational limitations continue to exist for stablecoin collateral.

This growing harmonization in stablecoin regulation is expected to impact market dynamics, liquidity, and the overall regulatory frameworks within both the US and European markets. The Riksbank's findings suggest a move towards more synchronized oversight in the digital asset space.

US and EU Harmonize Stablecoin Regulations

The Swedish Riksbank's report highlights significant convergence in stablecoin policies between the US and Europe. A primary focus of this alignment is the extent to which stablecoin issuers can access central bank settlement systems, use central bank reserves as collateral, and receive liquidity support. Both regions have legally sanctioned the use of these reserves; however, operational restrictions remain in place.

A notable shift observed is the European Central Bank's decision to grant non-bank payment institutions access to central bank accounts. This policy change brings European regulations closer to those in the US, although regulations concerning stablecoin backing remain stringent. The Riksbank's ongoing work with the ECB on modernizing payment infrastructure suggests that further adjustments to policy may be considered in the future.

Market responses to these developments suggest a cautiously optimistic outlook regarding the nuanced unification of policies. While official statements have been reserved, the broader community is closely observing these evolving regulatory landscapes. This period of quiet consensus building underscores the recognized necessity of clear stablecoin regulation for maintaining monetary stability and fostering innovation.

ECB's New Access Policy Influences Market Dynamics

The European Central Bank's allowance of central bank account balances for non-bank payment institutions represents a significant policy shift. This access was previously highly restricted, indicating a deliberate step toward broader regulatory alignment between major economic blocs.

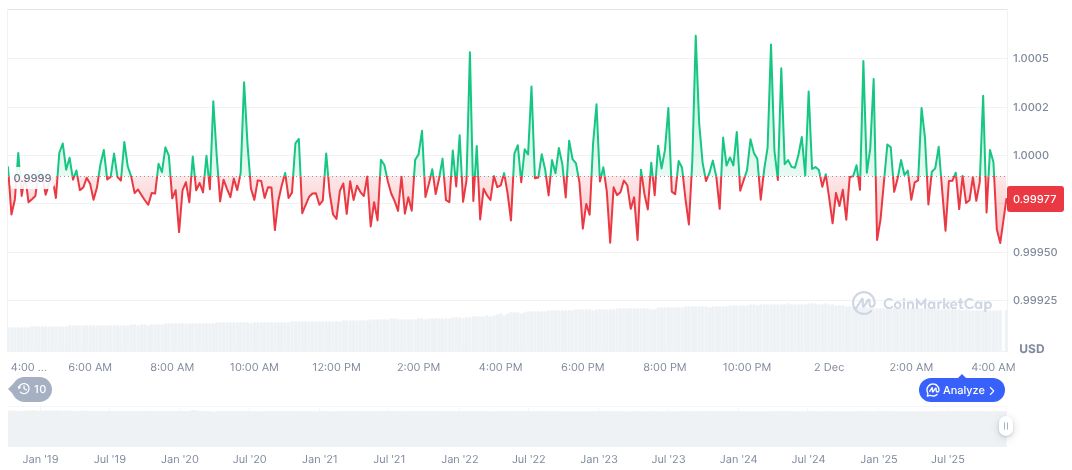

Data from CoinMarketCap shows that USDC maintains a stable price of $1.00, with a market capitalization of $77.39 billion. The 24-hour trading volume has seen an increase of 67.80%. In the past day, USDC experienced a 1.83% decrease in value, and over the past week, it has declined by 1.04%. The circulating supply is approximately 77.40 billion as of December 2, 2025.

Research anticipates that regulatory harmonization may enhance systemic resilience and encourage innovation within the stablecoin market. Simultaneously, it could influence funding stability. Historical trends indicate a consistent, albeit moderated, movement towards regulatory clarity, which is crucial for integrating stablecoins more effectively into traditional financial systems.