Bittensor’s first halving is scheduled for December 2025, at which point daily emissions will decrease from 7,200 TAO to 3,600 TAO. This mechanism is similar to Bitcoin’s scarcity model, but with a key difference: Bittensor’s token incentives are designed for the AI compute and model marketplace, rather than solely for monetary settlement. If the network continues to attract miners (validators) and the demand for on-chain AI services increases, the reduction in emissions could significantly impact both the tokenomics and market sentiment.

Currently, TAO is trading around $380, a notable decrease from its all-time high of approximately $760. For potential investors, this price gap presents a significant opportunity. If the broader market experiences an upturn in November and speculative positioning begins in anticipation of the halving, a return to the higher price range is a plausible scenario before the supply change in December.

The Thesis Making the Rounds: Bongo’s “Bitcoin 2012” Analogy

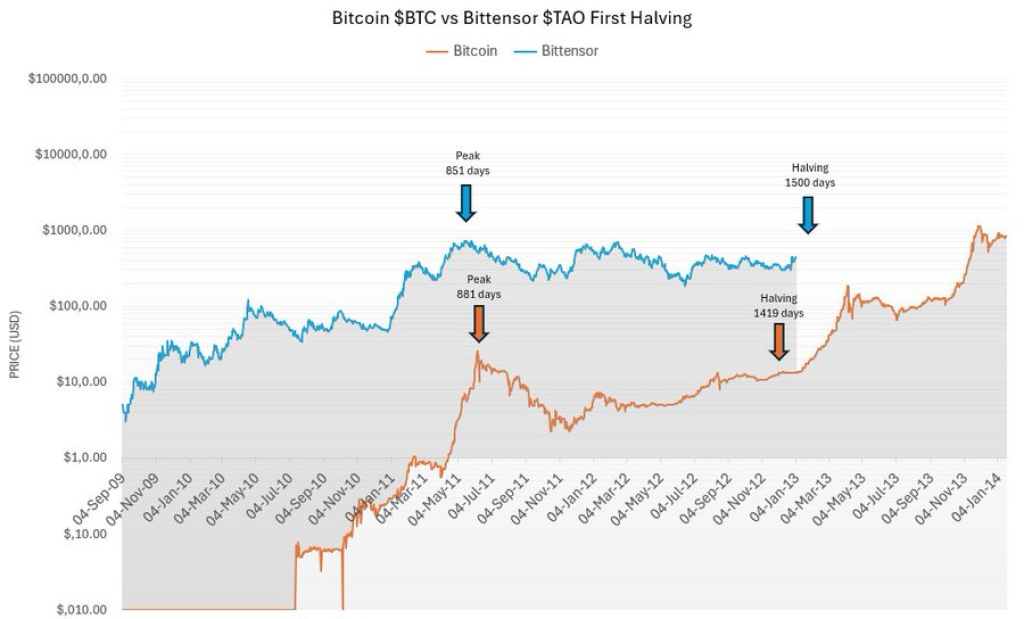

Crypto trader Bongo has proposed that Bittensor’s price trajectory is closely mirroring Bitcoin’s first halving cycle. According to his analysis, the early price action of TAO aligns with Bitcoin’s path from 2010 to 2012, which included a rapid price increase, a sharp decline, a period of sideways consolidation, and subsequently an expansion phase following the halving event.

Key Observations from Bongo's Analysis

- •Matching Timeframes: The duration between TAO’s local peaks and its upcoming halving event appears to be consistent with Bitcoin’s early cycle cadence.

- •Similar Peak-and-Bleed Behavior: Both assets have exhibited a pattern of a significant price peak followed by a substantial retracement, and then a prolonged consolidation phase leading up to the halving.

- •Pre-Halving Drift, Post-Halving Thrust: In Bitcoin’s initial halving cycle, the halving event served as a transition point from choppy consolidation to a sustained trend expansion. Bongo suggests that TAO could follow a similar pattern.

Bongo’s projection is ambitious, stating: "If it holds… a 10x post-halving #1 would see TAO around $5,000 by mid-2026." The underlying logic is straightforward: if TAO continues to follow Bitcoin’s early halving rhythm and demand substantially increases while its issuance rate is cut in half, the potential for rapid, compounding upside is significant.

Currently, TAO’s price structure appears constructive. The $350–$370 range has served as a strong pivot area, providing support during recent market fluctuations. A successful push by bulls above the $450–$500 range could indicate a significant shift in momentum. Beyond this, the $600–$650 range represents the next critical resistance zone before a potential retest of the $760 all-time high.

If the market begins to price in the upcoming halving as early as November, the TAO price could experience a pre-halving rally, reminiscent of Bitcoin’s notable “front-run rallies.” Historically, halving narratives alone have been potent enough to attract speculative capital, even before any actual supply reductions take effect.

Why the Bitcoin Analogy Holds Weight

Bittensor’s supply dynamics and its expanding role within the AI economy make the comparison to Bitcoin particularly relevant. Like Bitcoin, it operates as a decentralized network with a predetermined emission schedule. However, instead of functioning as “digital gold,” TAO serves as the currency for a global marketplace of machine learning models. The upcoming halving will reduce the rate at which new TAO tokens are issued, thereby increasing their scarcity over time, while simultaneously sustaining demand through validator incentives and rewards for AI tasks.

The psychological impact of a halving event should not be underestimated. Many cryptocurrency traders recall the significant price appreciation of Bitcoin following its early halving events, and this historical narrative can foster a self-reinforcing cycle of buying pressure. Nevertheless, there are crucial distinctions to consider: Bittensor’s market performance is intrinsically linked to AI adoption, data utilization, and computational demand. Consequently, its growth trajectory will be heavily influenced by real-world adoption, not solely by speculative trading.

TAO’s Path to $5,000

For Bongo’s $5,000 price target to materialize, Bittensor will require more than just market hype. It necessitates widespread adoption and substantial demand for its decentralized AI infrastructure. This implies an increase in the number of developers building subnets, greater adoption of Bittensor’s framework by enterprises for machine learning applications, and consistent on-chain activity that translates into tangible economic value.

Macroeconomic conditions will also play a pivotal role. If 2026 proves to be a strong year for the broader cryptocurrency market, rather than another bear market, TAO’s narrative of scarcity and utility could align perfectly with a general risk-on environment. A price increase from $380 to $5,000 would represent a 13x rally, which, while ambitious, is not unprecedented in the cryptocurrency space, especially for a token positioned at the intersection of two of the market’s most compelling narratives: artificial intelligence and decentralization.

TAO Price Outlook Ahead of December

In the immediate term, traders are closely monitoring the $450–$500 level as the critical resistance zone that needs to be overcome. If momentum builds significantly into November, TAO could readily retest its upper price range, approaching its all-time high, even before the halving occurs. A pre-halving rally, followed by a consolidation phase and then a post-halving breakout, would align closely with Bitcoin’s historical price patterns.

It is important to remember that in the cryptocurrency market, no outcome follows an exact script. However, history often provides valuable parallels, which is the core of Bongo’s analysis. The December halving serves as a clear catalyst, and with AI-related narratives showing no signs of abating, Bittensor may find itself at the forefront of the next major market cycle in 2026.

If the project can sustain genuine demand while simultaneously reducing its token emissions by half, TAO has the potential not only to echo Bitcoin’s success but also to carve out its own significant chapter in the next bull market narrative of the cryptocurrency space.