Tether's Growing Bitcoin Holdings

Tether, the issuer of the world’s largest stablecoin USDT, has recently added over 960 BTC, valued at approximately $98 million, to its reserves. This latest purchase increases Tether's total Bitcoin holdings to 87,296 BTC, with a current valuation of around $8.84 billion.

The company executed two recent transfers from Bitfinex wallets, including the 960 BTC and another significant transaction, consolidating assets in its reserve address. These movements are consistent with Tether’s ongoing strategy of allocating 15% of its net profits into Bitcoin reserves.

Tether typically conducts these allocations at the end of each quarter. However, this mid-quarter purchase suggests a proactive response to current market conditions. Bitcoin briefly dipped below $100,000 before recovering to over $105,000 during this accumulation period.

The company's average acquisition price for Bitcoin is approximately $49,121 per BTC. At current market prices, this yields Tether an unrealized profit of about $4.55 billion.

With its latest acquisitions, Tether now ranks as the sixth-largest corporate holder of Bitcoin globally and the second-largest among private entities that are not exchanges. Block.one continues to hold the largest reserve among private holders.

Market Accumulation Trends and Long-Term Holder Movements

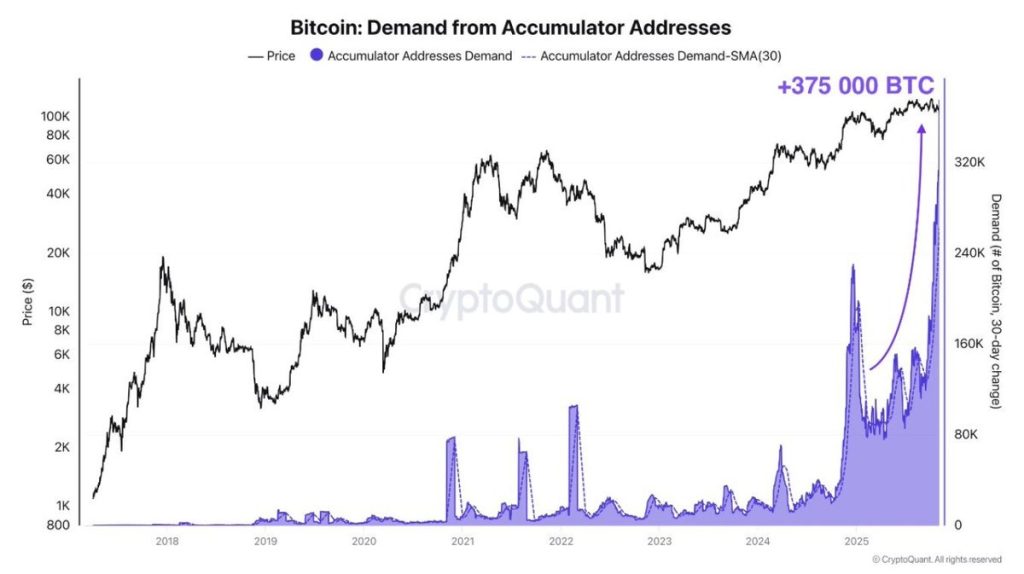

Data from CryptoQuant indicates a significant increase in Bitcoin accumulation across various holder groups in recent weeks. Accumulator addresses have more than doubled their total holdings, growing from approximately 130,000 BTC to 262,000 BTC within a two-month span.

The 30-day demand change metric shows that over 375,000 BTC have been absorbed from the available supply. This trend is consistent with historically strong accumulation phases, often driven by long-term holder confidence and strategic market positioning.

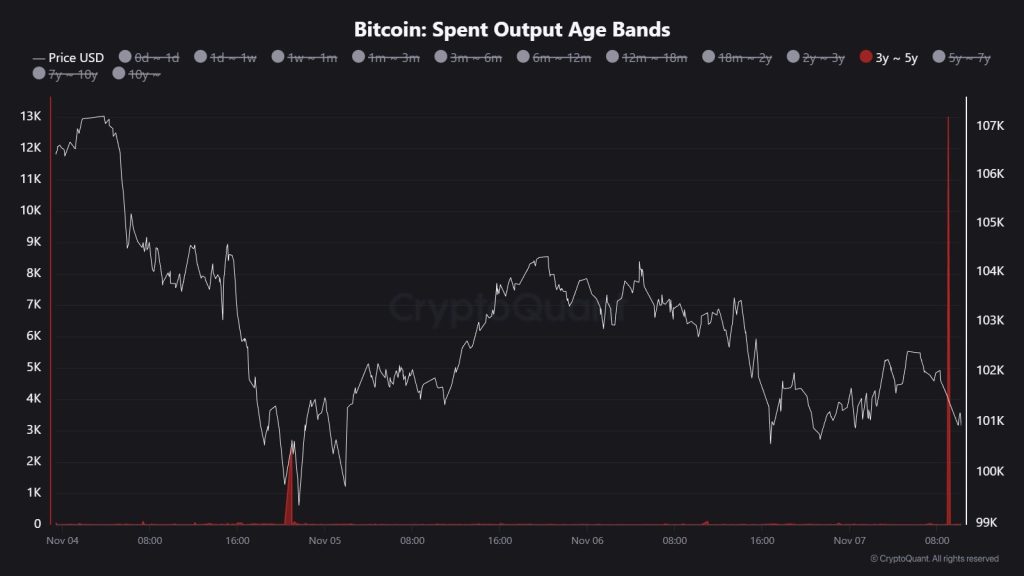

Furthermore, over 13,000 BTC that had remained dormant for periods ranging from three to five years have recently been moved on-chain. These movements suggest that long-term holders might be adjusting their positions in anticipation of potential volatility or significant market shifts.

Such activity from long-term holders often occurs near critical price levels or preceding major macroeconomic events or liquidity developments. The market continues to observe these trends to determine whether they will support sustained upward price movement or lead to near-term consolidation.