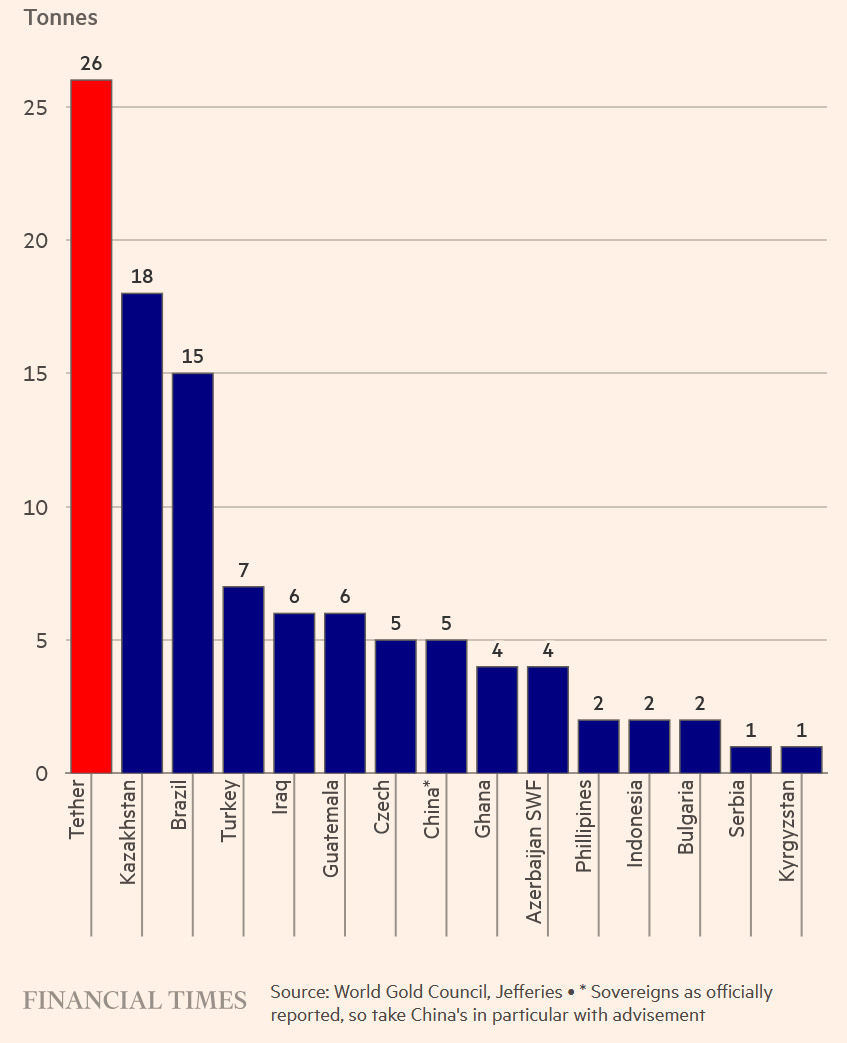

A surprising shift is unfolding in global gold markets: Tether is now buying more gold than most central banks. A chart circulating this week highlights how aggressively the company is accumulating the metal, revealing that its purchases outpace those of major sovereign buyers such as Kazakhstan, Brazil, and Turkey.

The chart shows Tether acquiring 26 tonnes of gold, more than any country in the comparison set. Kazakhstan follows with 18 tonnes, Brazil with 15, while others like Turkey and Iraq are clustered around the mid-single digits. Nations such as Bulgaria, Serbia, and the Philippines appear far lower on the list, with only 1–2 tonnes each.

This places Tether, a private crypto company, at the top of a ranking typically reserved for central banks and sovereign wealth funds. The idea that a stablecoin issuer is becoming one of the strongest forces behind gold demand is already sparking conversation across both the crypto and precious-metals worlds.

Tether has long been known for its heavy exposure to U.S. Treasuries, but its gold accumulation adds a new layer to the narrative. Gold investors, particularly the traditional “gold bugs”, may be surprised to learn that one of the biggest drivers behind recent upward price pressure isn’t a central bank or government, but a blockchain company reshaping reserve strategies.

If Tether continues purchasing at this scale, its influence on global commodities markets could grow well beyond crypto, signaling a new era where digital-asset giants play a direct role in shaping traditional macroeconomic flows.