Strategic Pivot Amidst Shifting Macroeconomic Landscape

Tether is actively adjusting its reserve strategy in anticipation of potential interest-rate cuts by the Federal Reserve. This marks a significant departure from its traditional reliance on U.S. Treasuries, with the company increasing its allocation to alternative assets such as gold and Bitcoin. This strategic shift reflects Tether's adaptation to a rapidly evolving macroeconomic environment, according to its executives.

Arthur Hayes, founder of BitMEX, suggests that Tether's reserve modifications are a deliberate effort to prepare for impending changes in the macro backdrop. With increasing expectations of rate cuts, the yields on Treasuries are likely to decrease, making alternative assets more attractive for high-velocity stablecoin issuers like USDT.

S&P Global, which currently rates Tether as "weak," has also observed the company's increased investment in assets that exhibit significant value fluctuations. The agency has cautioned that this reserve composition could expose USDT to greater vulnerability if market volatility intensifies during the next macroeconomic cycle. These observations come at a time when stablecoins are facing heightened scrutiny from regulators and institutional investors.

Tether Defends Strategy as Market Evolution

Tether CEO Paolo Ardoino has addressed concerns by asserting that the company does not hold any "toxic assets." He explained that the evolving reserve composition is indicative of a broader industry trend. Ardoino stated that Tether's reserve strategy aligns with the growing movement towards financial systems that operate independently of the traditional banking framework, a direction that stablecoins have been championing for years.

Tether maintains that a diversified reserve base enhances the token's stability, particularly as global demand for non-bank digital dollars continues to grow.

Detailed Reserve Breakdown

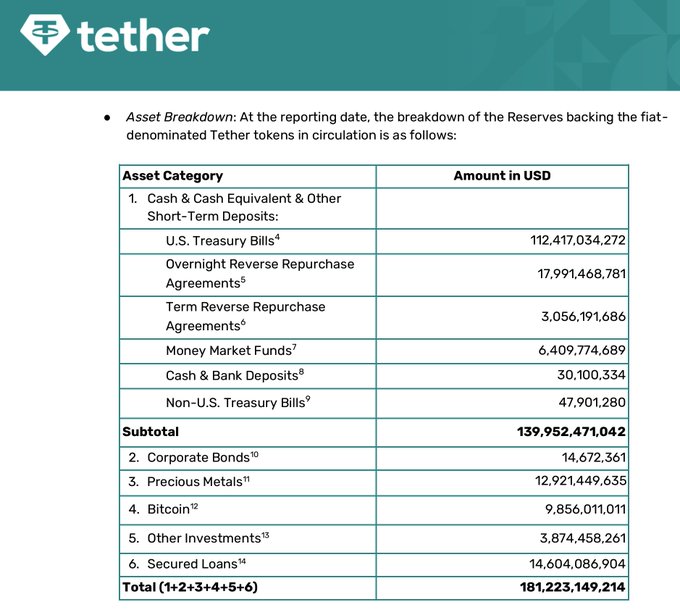

The most recent reserve report from Tether outlines substantial changes in its asset allocation:

- •U.S. Treasury Bills: $112.4 billion

- •Reverse repo agreements (overnight + term): Approximately $21 billion combined

- •Money market funds and bank deposits: Over $36.5 million

- •Non-U.S. Treasuries: $47.9 million

- •Corporate bonds: $14.6 million

- •Precious metals (including gold): $12.9 billion

- •Bitcoin: $9.85 billion

- •Other investments: $3.9 billion

- •Secured loans: $14.6 billion

Cumulatively, Tether now holds $181.2 billion in reserves, encompassing both traditional and alternative assets. The most notable increases are in precious metals and Bitcoin, which together account for over $22.7 billion. This represents a significant shift for a company that has historically been closely associated with short-term Treasuries.

A New Era for Stablecoin Reserve Models

Tether's strategic adjustments could potentially influence other major stablecoin issuers. As global liquidity conditions evolve and U.S. yields approach their zenith, stablecoin companies may increasingly rebalance their reserves towards assets that offer long-term appreciation or protection against inflation. Gold and Bitcoin fit this profile, although they do not provide the predictable yield characteristic of Treasuries.

If the Federal Reserve implements rate cuts more rapidly than anticipated in 2026, Tether's current strategy might prove to be forward-thinking. However, an escalation in market volatility could present challenges for the new reserve structure.