An Ethereum address holding 31.77 million USDT has been frozen, according to Whale Alert. This occurred on November 8, 2025, marking a compliance-related action by Tether.

The freeze underscores Tether’s active role in compliance, highlighting the centralized control over USDT tokens, though no immediate market impact or regulatory statements have emerged.

Stablecoin Scrutiny Intensifies

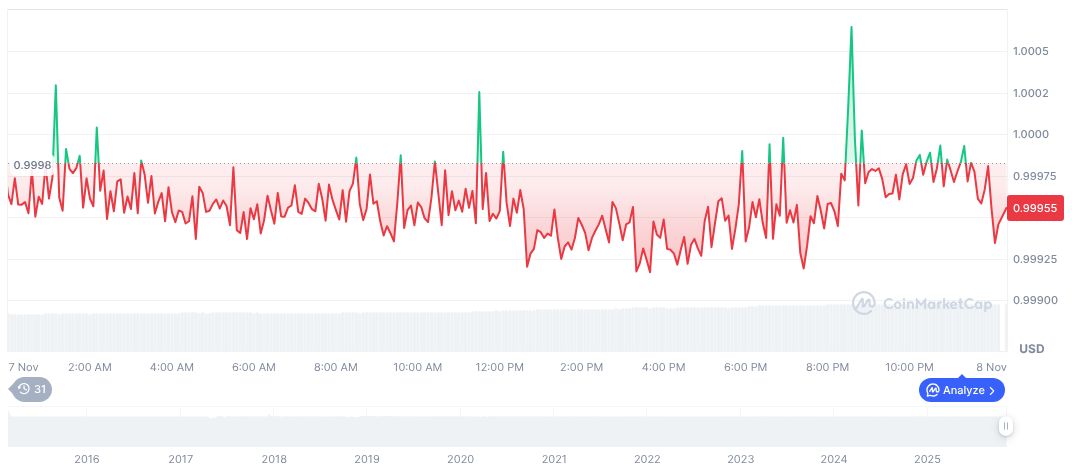

Tether USDt is priced at $0.99976 with a market cap of approximately $183.41 billion, indicating a stable presence in the market. The circulating supply reaches 183.45 billion, as verified by CoinMarketCap data, showing little movement in the coin's value despite the freeze.

The freeze potentially signals ongoing regulatory scrutiny of stablecoins in general.

"31,765,779 #USDT (31,778,899 USD) has just been frozen. Transaction Details. Blockchain: Ethereum. Timestamp: 06:36 AM" — Whale Alert System, Official Tracker.

Market Implications and Future Outlook

Tether has historically performed asset freezes for compliance reasons, underscoring the importance of centralized control in maintaining regulated stability within the decentralized crypto environment.

Historical analyses suggest these incidents may affect how stablecoins are perceived in broader financial frameworks, potentially prompting policy adaptations.

Experts believe that the recent freeze by Tether could lead to increased regulatory oversight on stablecoins, impacting their usage and adoption in the future.