Key Developments in Tether's USDT Issuance on Tron

Tether minted a substantial 22.7 billion USDT on the Tron blockchain throughout 2025. This issuance has elevated the total supply of USDT on Tron to 82.4 billion. Concurrently, the number of USDT holders on the Tron network saw an increase of 11 million individuals during the same period.

This notable expansion in both USDT supply and holder base on Tron signifies a heightened level of adoption for the stablecoin on the network. Such growth has the potential to enhance liquidity and stimulate trading activities within the broader cryptocurrency market.

Tether's Major USDT Release on Tron Blockchain

Tron's significance in the cryptocurrency market has demonstrably grown with the issuance of 22.7 billion new USDT on its blockchain network in 2025. This expansion is further evidenced by the total supply reaching 82.4 billion USDT, according to data from Lookonchain. The network's appeal is also highlighted by the addition of 11 million new USDT holders, indicating a surge in interest and user adoption.

These developments may signal an increase in liquidity available within decentralized finance (DeFi) platforms, with Tron's robust infrastructure well-suited to support high-volume transactions. However, industry observers are maintaining a cautious outlook regarding the immediate market effects, acknowledging the potential for liquidity shifts across other token markets, including Bitcoin and various altcoins.

Market reactions to these developments have been varied, with no significant official statements from regulatory bodies observed. Prominent figures within Tether, such as Paolo Ardoino, have continued to emphasize strategic inventory management, reflecting an adaptable approach to market dynamics. Discussions within community forums primarily revolve around the implications of this growth for Tron and its potential to solidify its position within the stablecoin ecosystem.

Tron's Growing Dominance in USDT Transactions

Tron's role in facilitating USDT transactions was particularly dominant in 2025, with an impressive reported total of $7.9 trillion in transfers. This volume underscores its critical function as a settlement layer for stablecoins.

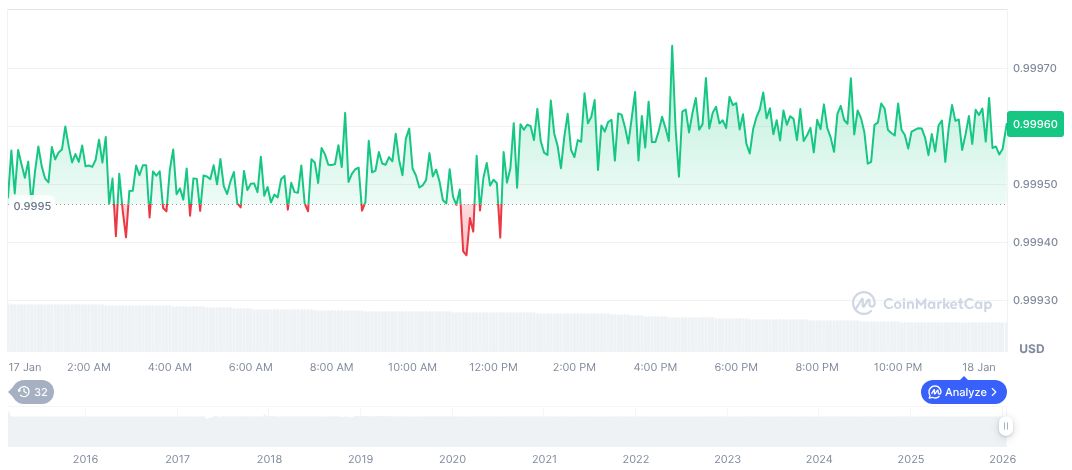

As of January 18, 2026, Tether USDt (USDT) maintained a stable price of $1.00, boasting a significant market capitalization of $186.78 billion, which accounted for 5.80% of the overall market dominance. The 24-hour trading volume experienced a decrease of 34.17%, settling at $47.79 billion. Data from CoinMarketCap indicates that the stablecoin's price has shown minimal fluctuation over recent months.

Insights from the Coincu research team suggest that Tron's increased USDT activities could establish a new precedent for future blockchain applications in financial markets. This trend points towards potential narratives that may shape the landscape of 2026, particularly concerning the integration of blockchain technology within traditional finance sectors.