Why Pre-IPO Tokens Are Getting All the Attention

For beginners, the idea sounds complex, but it’s actually simple when explained step by step.

Pre-IPO Tokens let investors join promising ventures before they hit public markets, bridging blockchain and early-stage investing.

This guide walks you through what Pre-IPO Tokens are, how they work, and how to join projects like IPO Genie ($IPO), a platform connecting investors with private-market opportunities. We’ll cover the basics of blockchain layers, compare active presales, and show how the $50,000 IPO Genie Airdrop rewards 40 participants during its live campaign. |

By the end, you’ll know what makes IPO Genie slightly brighter than its peers and why many believe it could reshape how everyday investors approach early-stage funding.

What Defines a Winning Pre-IPO Token Project

Successful Crypto Presales share a few consistent traits:

- •Real-world utility that extends beyond speculation.

- •Transparent smart-contract audits and clear tokenomics.

- •Active communities that drive participation.

- •Measurable milestones rather than vague promises.

Projects combining these features tend to sustain long-term interest, giving holders more than just short-term gains.

Understanding the Technology: How Pre-IPO Tokens Operate

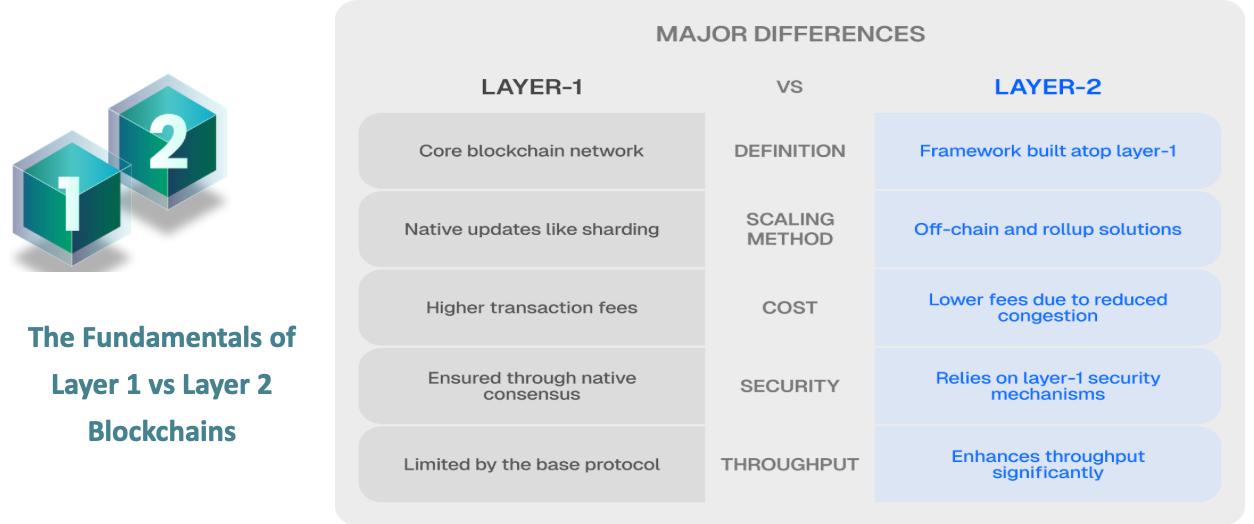

Most Pre-IPO Tokens are built on Layer 1 blockchains, such as Ethereum, which provide the base network for transactions and smart contracts.

Layer 2 solutions then make trading faster and cheaper by processing batches of transactions off-chain before settling them back on Layer 1. (Click on images for more information on blockchain layers.)

This structure gives investors:

- •Faster settlement and lower fees.

- •On-chain transparency of ownership.

- •Easier cross-chain movement between ecosystems.

IPO Genie uses Ethereum ERC-20 standards, with bridges to Solana, Base, and other L2s ensuring both compliance and scalability. That foundation attracts retail and institutional investors who want verified, secure participation in private-market opportunities.

How IPO Genie Changes the Pre-IPO Token Model

Unlike many presales that focus only on trading or staking, IPO Genie links blockchain access to real venture deals. Holding $IPO gives you:

- •Access to pre-IPO startups and verified private companies.

- •On-chain tracking of allocations, rewards, and exits.

- •Staking rewards and governance rights for active users.

- •Entry tiers starting from $10 USD, making it inclusive.

The platform’s roadmap (from its January 2025 whitepaper) shows a $100 M AUM target by 2026, built through partnerships with hedge funds and VCs. That goal sits atop strong tokenomics: 50% presale allocation, 20% liquidity reserve, and fully locked team tokens for 2 years.

And yes, the ongoing $50 000 Airdrop invites community participation on Telegram and X-Twitter through simple verified social tasks rewarding 40 winners with free $IPO tokens.

Other Notable Crypto Presales of 2025 (Constructive Comparison)

| Project | Focus Area | Presale Stage | Token Price | Listed On | Key Highlight |

| HYPER | AI Automation | Stage 3 | ≈ $0.0132 USD | CoinMarketCap | High DeFi use and strong liquidity. |

| BlastUP | Launchpad Ecosystem | Stage 2 | ≈ $0.05 USD | CoinMarketCap | Fast community growth and tiered staking. |

| Ozak AI | Data Analytics Tools | Stage 2 | ≈ $0.012 USD | CoinMarketCap | Expanding user base and cross-chain plans. |

| IPO Genie ($IPO) | Private Market Access | Stage 5 Presale | $0.0001014 USD | CoinMarketCap | Real asset linkage + Airdrop with 40 prizes worth $50 K. |

All four projects show momentum in the AI and DeFi sectors. HYPER and Ozak AI lead with smart-contract efficiency; BlastUP builds on community utility. IPO Genie, however, merges both: delivering access, transparency, and liquidity through real-world asset bridges. That layered approach, supported by audited contracts and staking rewards, makes it a more balanced long-term play.

The Future of Pre-IPO Tokens: Real Access for Every Investor

Speculation aside, the momentum behind Pre-IPO Tokens lies in real accessibility. The tokenized private-market model lets anyone join opportunities once limited to accredited investors. Analysts expect this segment to exceed $10 T in tokenized assets by 2030.

As IPO Genie’s ecosystem matures with cross-chain bridges, DAO governance, and transparent on-chain deal records, it may set the standard for future investment access. That’s why its supporters see it as more than a presale token: it’s a pathway to inclusive wealth creation.

Final Thoughts: Your First Step Into Pre-IPO Investing

For beginners, investing in Pre-IPO Tokens doesn’t have to feel overwhelming. Start small, stay informed, and choose projects that show structure, not hype. IPO Genie ($IPO) stands out because it combines real-world deal access, strong tokenomics, and a growing community driven by fair rewards.

Join the IPO Genie Airdrop today, complete the Airdrop tasks, and experience how Pre-IPO Tokens can connect you to the future of venture investing.

Frequently Asked Questions

- What are Pre-IPO Tokens?

Pre-IPO Tokens represent ownership or access rights to companies before they go public. They use blockchain technology to make early-stage investing transparent and borderless. - Is IPO Genie a secure project?

Yes. IPO Genie runs on audited smart contracts and built-in compliance systems. Assets are custodied through partners like Fireblocks, and all transactions are recorded on-chain. - How can I join the IPO Genie Airdrop?

Visit the IPO Genie Airdrop page, connect your wallet, verify your email, and complete simple social tasks to earn entries for the $50 000 prize pool shared among 40 winners. - Are Pre-IPO Tokens a good long-term investment?

They carry risk, but projects with real utility and compliance—like IPO Genie—offer a balanced way to access high-growth markets that were once off-limits to retail investors.

This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies and Pre-IPO Tokens involves risk, including potential loss of capital. Readers should conduct their own research and consult qualified advisors before investing.