The cryptocurrency market experienced a rebound on Monday, following a volatile second week of October that had previously erased earlier gains. Major digital assets, including Bitcoin and Ethereum, saw significant surges attributed to renewed optimism regarding a potential U.S. Federal Reserve rate cut later this month.

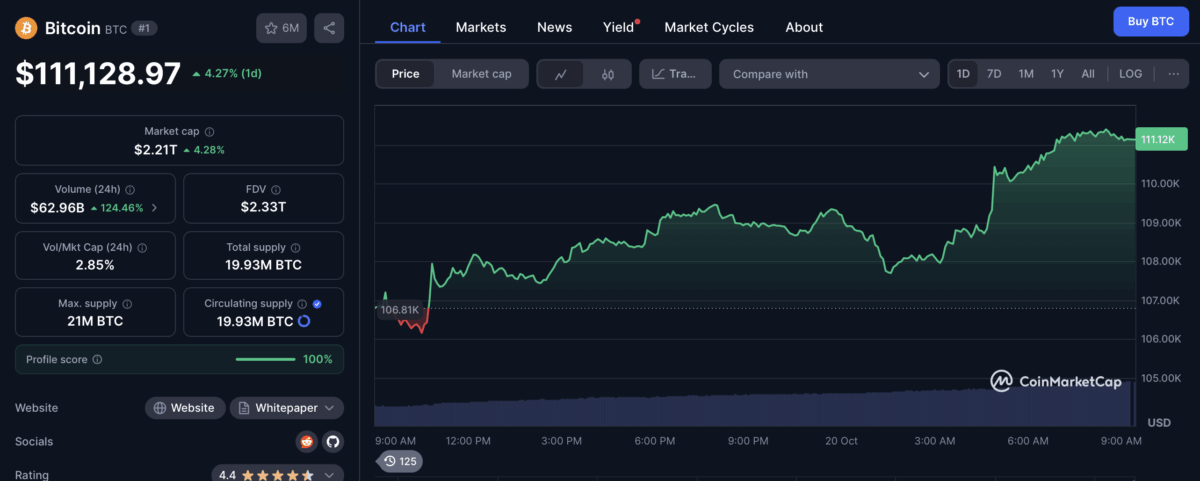

At the time of reporting, Bitcoin, the largest cryptocurrency by market capitalization, was trading at $111,150. This represents a 4.2% increase over the last 24 hours, recovering from a close below $105,000 last week. The rally was accompanied by a substantial 118% spike in trading activity, with volume exceeding $61 billion.

Ethereum also posted gains, rising by 3.9% and reclaiming the $4,000 level. The second-largest cryptocurrency is currently trading at $4,035, having fallen to $3,900 last Friday. The overall market sentiment reflects this positive trend, with the total market capitalization up by 4.21% today, reaching $3.76 trillion. Daily trading volume has surged by 70%, exceeding $165 billion.

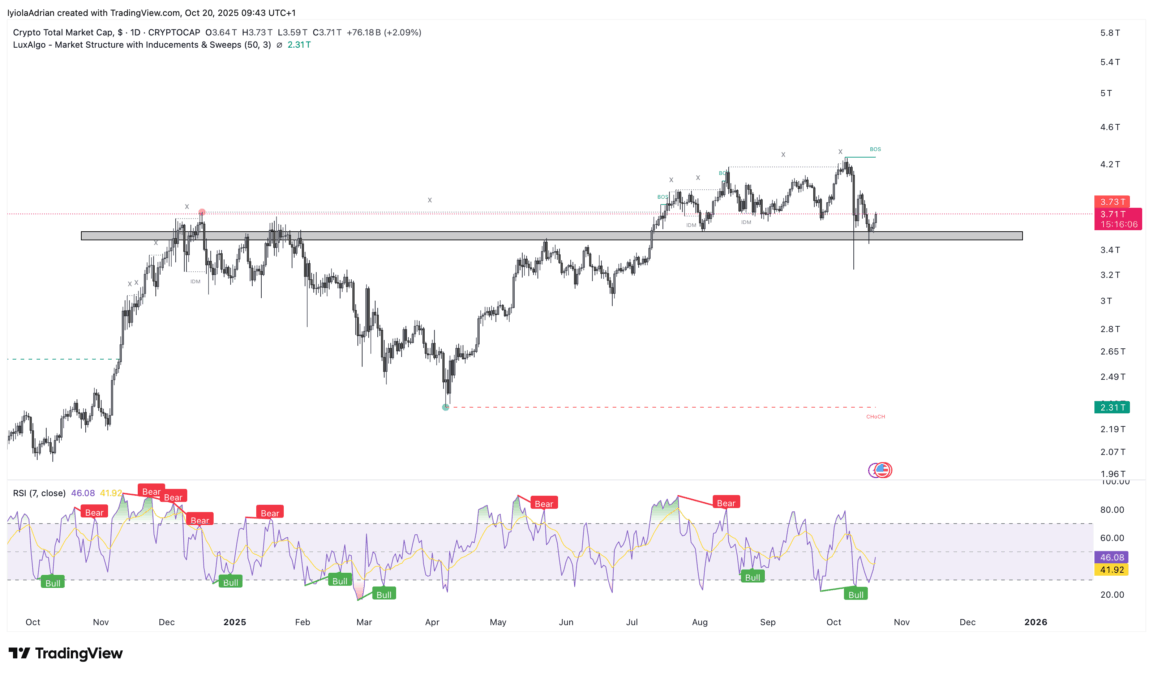

Market Capitalization Finds Support at $3.6 Trillion

This market recovery follows two weeks of price corrections that had initially driven the total market capitalization as low as $3.45 trillion. The market has since stabilized near the $3.6 trillion support zone. Technical indicators suggest a shift in momentum, with the Relative Strength Index (RSI) at 46, indicating that selling pressure has eased and a reemergence of bullish sentiment is underway.

Furthermore, the Fear and Greed index has shown improvement, recovering from a reading of 22 (indicating extreme fear) to 30, which reflects a growing sense of cautious optimism among investors.

A significant contributing factor to today's surge is the anticipation of a U.S. Federal Reserve rate cut. According to the CME FedWatch Tool, there is a 100% probability that the Federal Reserve will announce a rate cut at its upcoming meeting on October 29. Rate cuts typically benefit financial markets by reducing borrowing costs for investors, thereby encouraging increased risk-taking and investment.

$332 Million in Shorts Liquidated

The rapid price recovery has led to substantial liquidations across derivatives exchanges. Over the past 24 hours, more than $493 million in leveraged positions have been liquidated. Of this total, $322 million represents traders who had bet against the market's upward movement.

Bitcoin Treasury Stocks Collapse, Retail Investors Lose $17B