Silver has experienced a significant upward trend, transcending its status as a mere commodity. With prices currently trading around $90 per ounce, the metal's popularity is driven by factors extending beyond traditional supply and demand dynamics.

Two distinct analytical perspectives are currently shaping the discourse on silver's future trajectory. One perspective is grounded in long-term monetary valuation, while the other focuses on geopolitical influences and market behavior during periods of global stress. Collectively, these viewpoints suggest that the silver market may still have considerable room for further movement.

This analysis will delve into both arguments and examine the accompanying chart data.

Katusa Research: The Case for Silver's Undervaluation

Katusa Research presents a compelling argument that silver is currently mispriced when assessed from a monetary perspective rather than a trading standpoint.

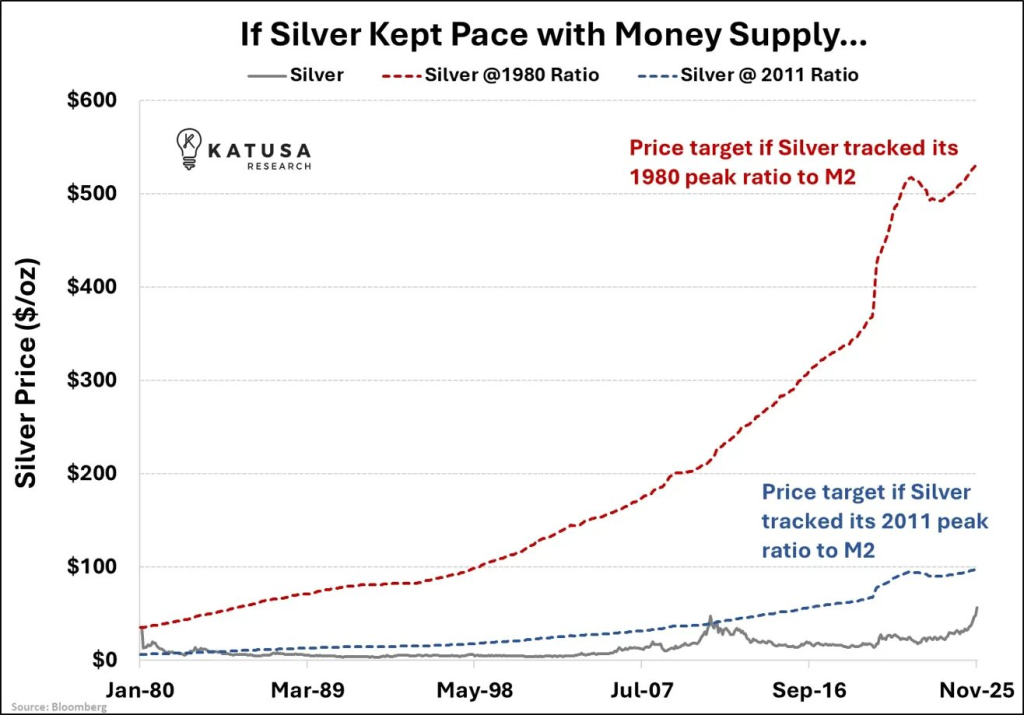

Their central thesis posits that silver's price has not kept pace with the substantial expansion of the global fiat money supply.

The research highlights a comparison between silver's price and the growth of the M2 money supply over several decades. Two significant reference scenarios emerge from this comparison:

- •If silver were to merely match its 2011 peak ratio relative to the money supply, its fair value would be approximately $97 per ounce. This current valuation suggests that silver has only recently caught up to its post-financial crisis pricing levels.

- •A more striking scenario considers the 1980 ratio. If silver were to revert to the same relationship with the money supply observed during its historical peak in 1980, the implied price would be around $531 per ounce.

This perspective is not a short-term forecast but rather a structural valuation argument. It suggests that if silver were to fully reprice to reflect decades of currency debasement, its current prices might still be considered low in real terms.

This view is particularly noteworthy as it does not rely on speculative demand. Instead, it is based on the existing quantity of fiat currency in circulation compared to the limited supply of silver.

Within this framework, silver's ascent above $90 appears less like a speculative peak and more like a long-overdue adjustment.

The Kobeissi Letter: Silver's Dominance as a Safe Haven

The Kobeissi Letter offers a second prediction, framing silver's rally through the lens of global instability rather than purely valuation metrics.

Their analysis is centered on performance and macroeconomic behavior.

Silver recently achieved its most substantial annual gain since 1979, increasing by 148% during 2025. This period was characterized by trade wars, stress in the bond market, and escalating geopolitical risks. In contrast, bonds have experienced significant declines, and cryptocurrencies have maintained high volatility, making traditional safe-haven assets increasingly attractive.

The accompanying chart illustrates silver's reaction to major geopolitical events:

The chart clearly demonstrates how each wave of trade tension contributed to higher silver prices:

- •In January 2025, as trade tariff threats emerged, silver began to break out of its established range.

- •In April, during a period of heightened global tension, silver consolidated its gains while maintaining support.

- •By August, following the resolution of a trade deal, silver experienced another surge.

- •In October, after intensified tariff threats, silver's price accelerated sharply.

- •More recently, with renewed pressure related to international trade disputes, silver has surged toward the $90 mark.

A key observation is that silver's price movements have not been random. Each significant geopolitical shock has resulted in a higher price base and a stronger subsequent rally. This pattern suggests that silver is increasingly being recognized as a strategic asset, beyond its role as an industrial metal.

Kobeissi's conclusion is direct: in an increasingly uncertain world with diminished stability and fractured global trade, gold and silver are natural beneficiaries. Silver, with its smaller market capitalization and dual function as both a monetary and industrial metal, tends to exhibit more rapid price movements.

Synergy Between the Two Analytical Perspectives

The convergence of these two predictions significantly strengthens their impact, as they are not mutually exclusive but rather complementary.

Katusa Research posits that silver is undervalued relative to the broader monetary system.

Concurrently, The Kobeissi Letter demonstrates that silver is already functioning as a crisis hedge in practice.

One argument suggests that silver's theoretical value should be considerably higher, while the other illustrates that capital is actively flowing into silver for protection in the current environment.

When narratives of valuation and capital flow align, markets often experience more pronounced movements than anticipated.

This does not imply a direct and uninterrupted ascent to $500. Market dynamics are rarely linear, and corrections, pullbacks, and sharp volatility are to be expected at these price levels. However, it does suggest that the long-term price potential for silver may be substantially higher than what most investors currently perceive.