Despite recent market struggles, long-term holders of Bittensor (TAO) maintain a strong conviction in the project. Crypto veteran WIZZ, a prominent voice with over 800,000 followers on X, has put forth one of the most ambitious predictions, suggesting that TAO could reach between $3,000 and $5,000 by 2026. WIZZ views TAO as a key player in the artificial intelligence (AI) crypto space for the upcoming market cycle, with the imminent halving event, now approximately 30 days away, serving as a significant driver of this optimism.

The halving mechanism is designed to reduce TAO's daily issuance by half, which will consequently decrease the fresh supply entering the market and tighten available liquidity. Coupled with the ongoing expansion of Bittensor's ecosystem, which includes subnet upgrades and increased model participation, many traders anticipate that this supply shock could act as a potent catalyst for a substantial price increase in 2025 and 2026. However, evaluating the feasibility of price targets as high as $3,000 or $5,000 necessitates a thorough examination of the current chart structure and the broader market context.

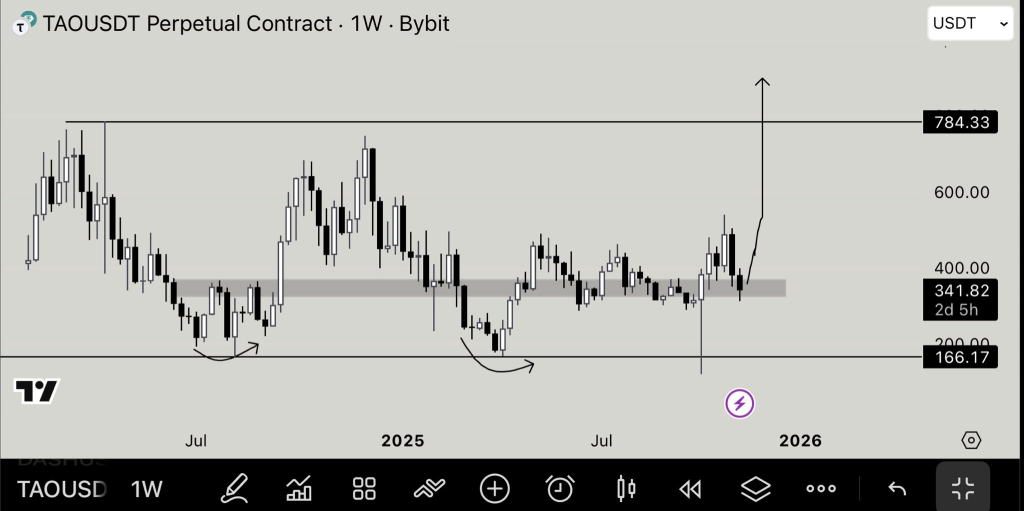

TAO Chart Analysis by Nihilus

Analysis provided by chartist Nihilus indicates that TAO is currently forming a significant multi-year accumulation range. The chart highlights consistent higher lows established at a horizontal base near $166. This support zone has repeatedly demonstrated its strength, acting as a floor for the price since early 2024. Nihilus identifies a mid-range area, marked in gray on the chart, between $320 and $360, which TAO is currently striving to reclaim. A confirmed weekly close above this region would signal a return of buyer interest in anticipation of the halving event.

A key indicator within Nihilus's chart is the projected breakout target situated near $784, representing the upper boundary of the accumulation range. A sustained move beyond this level would technically validate a multi-year reversal pattern. Nihilus illustrates this potential with an arrow, suggesting a vertical breakout is likely once TAO surpasses this price point. Such patterns are frequently observed following extended consolidation periods in assets with limited supply.

This chart setup provides a technical basis for the belief among some analysts that TAO could initiate a significant upward price trend in 2025–2026. If the supply dynamics tighten considerably post-halving and ecosystem demand continues to grow, a retest and subsequent break above the $700–$800 range becomes a plausible scenario from a purely structural perspective.

Assessing the Realism of $3,000–$5,000 TAO Price Targets

Achieving price targets of $3,000 to $5,000 for TAO would necessitate substantial growth within Bittensor's ecosystem, increased utility across its subnets, and favorable overall market conditions. At a price of $5,000, TAO would command a valuation in the tens of billions of dollars. While not an insurmountable figure, such a valuation would likely depend on AI-focused crypto assets becoming a dominant multi-year narrative within the broader market.

The upcoming halving is a recognized catalyst, and TAO's inherently limited supply supports a positive long-term outlook. However, reaching the most aggressive price predictions would likely require the confluence of several factors. These include a robust Bitcoin cycle, rapid adoption of decentralized AI markets, and increased liquidity from institutional investors entering the AI crypto sector.

The current chart analysis suggests that TAO is building momentum for a significant breakout. The halving event is poised to further bolster this narrative. Nevertheless, the realization of the most ambitious price targets remains contingent on sustained market strength throughout 2026.