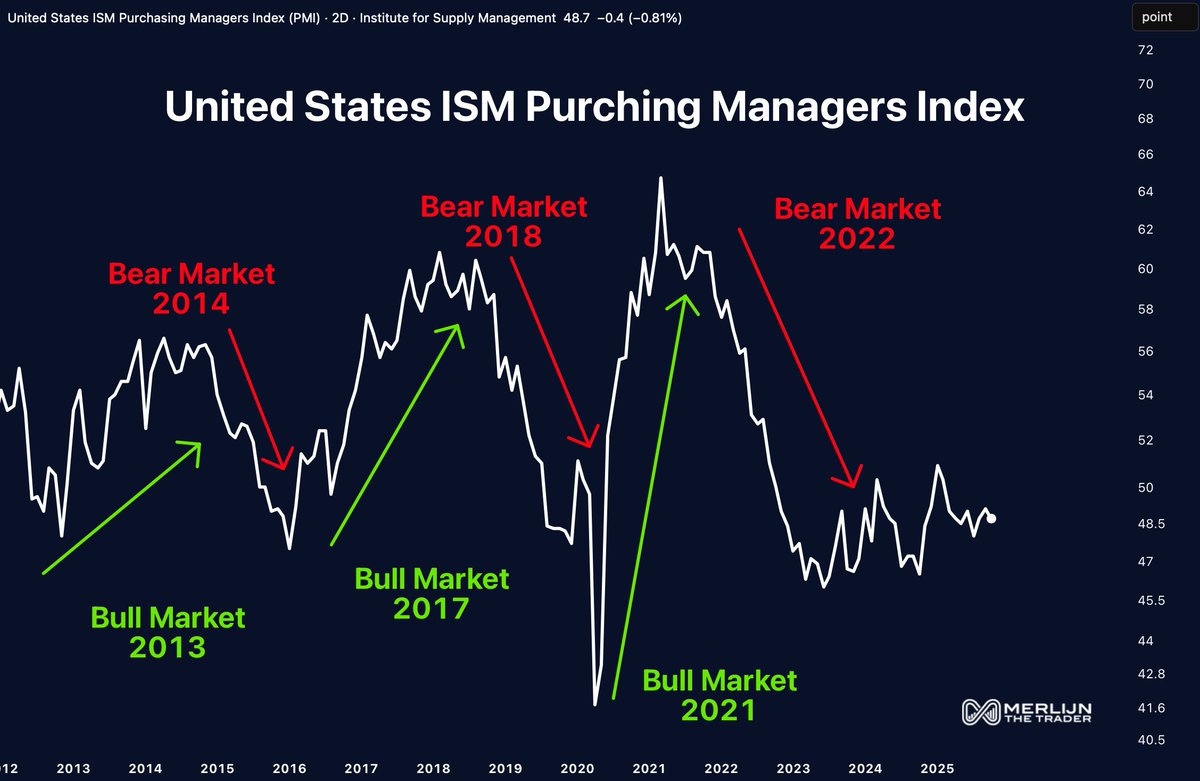

The U.S. manufacturing sector is still sitting in contraction territory, but one key component is now quietly showing signs of life, and seasoned traders believe this could mark the early stages of a market reversal. According to Merlijn The Trader, New Orders within the ISM Purchasing Managers Index are beginning to climb again, a pattern that has historically aligned with the start of every major bull market over the last decade.

Investors typically focus on the headline ISM number, but New Orders have long been the “tell” that institutional money tracks before the broader market reacts. While the ISM remains below 50, signaling economic contraction, the New Orders rebound suggests underlying demand is improving faster than sentiment reflects. If this trend holds, the shift could feed into risk assets sooner than expected.

A Familiar Pattern Before Every Major Bull Market

Historical ISM cycles show the same recurring sequence: New Orders bottom, climb steadily, and then broader market momentum accelerates months later. This script played out ahead of the bull markets of 2013, 2017, and 2021. Notably, it also preceded major equity and crypto rallies during periods when retail sentiment was overwhelmingly bearish.

Today’s ISM chart mirrors those past inflection points, with New Orders turning up from deeply depressed levels. That early-stage improvement is happening while most investors focus on recession fears, creating the type of stealth transition that often catches retail off guard.

Why December Could Deliver a Surprise

Merlijn suggests that this recovery could “flip fast,” and the timing aligns with seasonally strong months for U.S. equities and crypto markets. December has historically delivered outsized returns during periods when macro data begins to improve from cycle lows. If New Orders continue to rise into year-end, it could trigger a broader shift in risk appetite.

Institutional traders tend to accumulate during times of pessimism, especially when macro indicators show forward-looking improvement. Retail traders, however, often wait for confirmation long after a trend has changed. That gap in behavior is why early-cycle signals like ISM New Orders matter.

Smart Money Is Watching – Retail Isn’t

The overarching message is simple: recoveries rarely begin when everyone feels confident. They begin when the data turns before sentiment does. Today’s ISM chart shows a setup that has historically preceded major rallies, even though markets remain cautious and headlines still lean bearish.

If the ISM upturn accelerates, the coming months, especially December, may look very different from the prevailing mood today.