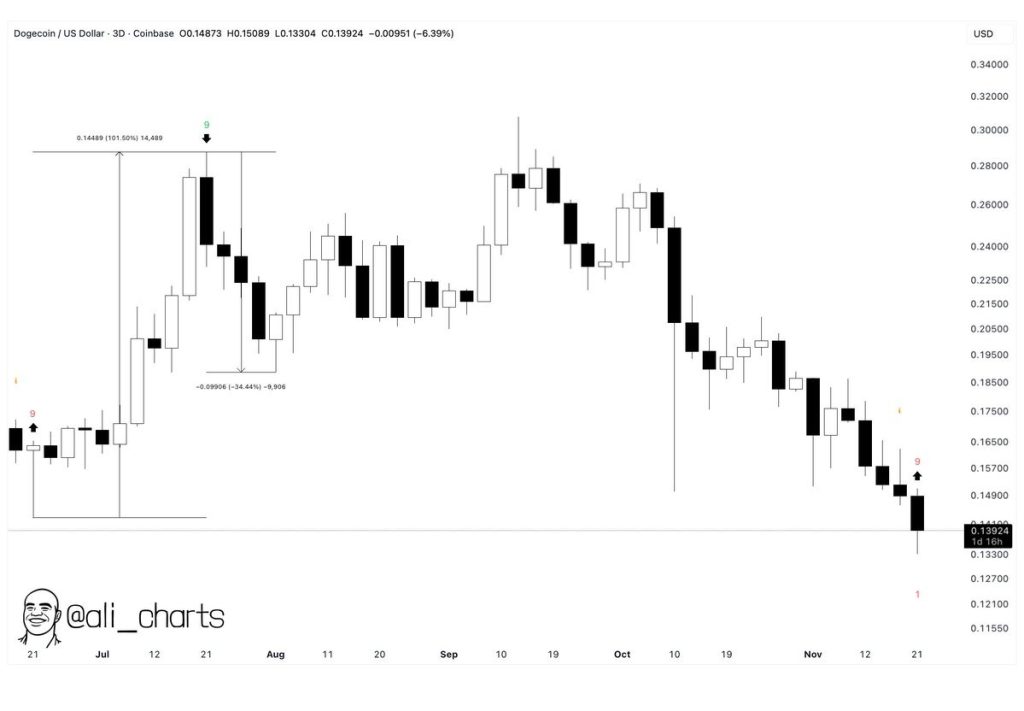

Dogecoin has received a bullish spark, with analyst Ali Martinez noting that the TD Sequential indicator has issued a new buy signal on the 3-day chart. Historically, the last occurrence of this signal led to a DOGE price surge of over 101%. This development is particularly noteworthy given the current shaky sentiment across the broader market.

The DOGE price is currently trading near $0.14, following weeks of consistent downward movement. This new signal emerges precisely as the price approaches a familiar support level.

DOGE Receives a Timely TD Buy Signal

The TD Sequential indicator is designed to identify trend exhaustion, suggesting that sellers might be losing momentum. Ali Martinez highlighted that the previous identical signal resulted in a significant reversal, propelling the DOGE price upwards rapidly.

While this signal does not guarantee another breakout, its timing is significant. After a period of gradual decline, momentum appears to be stabilizing, and the TD setup suggests a potential turning point.

Dogecoin Continues to Defend Weekly Support Zone

The broader market context also plays a crucial role. Analyst Lyvo points out that DOGE continues to respect a robust weekly support trendline that has remained intact for years. On each occasion that Dogecoin has revisited this zone, buyers have consistently stepped in to defend it.

This support level is currently situated around $0.13. This means DOGE is not only exhibiting a technical indicator signal but is also positioned at a level from which previous rallies have initiated. Lyvo believes this configuration could lead to a meaningful bounce in the coming days or weeks, provided the level continues to hold.

It is important to acknowledge that no outcome is guaranteed, and Lyvo emphasizes this point. Should the DOGE price fall below $0.13 and fail to reclaim it, the price could potentially decline towards $0.09, the next significant support area on the chart. Such a move would not necessarily destroy the long-term structure but would likely delay any bullish momentum. Therefore, the primary question remains whether $0.13 can continue to serve as a floor.

Trader Focus Shifts to Next Market Movements

Dogecoin does not require a massive breakout to initiate a shift in sentiment. A bounce from support, a move back above $0.16, and increased trading volume would all indicate a return of buyer interest. A clear trendline break on lower timeframes would further confirm this trend.

Until then, Dogecoin is in a phase of observation. However, the technical conditions for a reversal are clearly present. The combination of a TD buy signal, strong support, and increasing trader interest is a rare alignment.

If the $0.13 level holds, the DOGE price may be poised for another unexpected upward move, mirroring its previous performance.